Gout is a common form of arthritis that can be a challenge for life insurance applicants. As a result, many people with gout have concerns about whether or not they can qualify for life insurance coverage. In this article, we will discuss life insurance approvals with gout and provide some tips to help those with gout navigate the application process.

What is Gout?

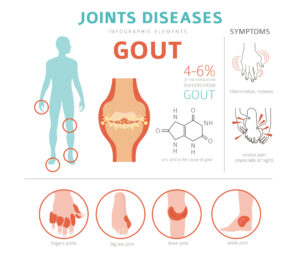

Gout is a type of arthritis that occurs when uric acid crystals build up in the joints, leading to inflammation, pain, and discomfort. It can be a chronic condition that impacts a person’s daily life and can lead to other health problems if left untreated.

Causes:

Gout is caused by high levels of uric acid in the blood, which can occur due to a variety of factors, including:

- Genetics: Some people may be genetically predisposed to gout and may be more likely to develop the condition if it runs in their family.

- Diet: Eating a diet high in purines, which are found in red meat, seafood, and alcohol, can increase uric acid levels and trigger gout attacks.

- Obesity: Being overweight or obese can increase the risk of gout by increasing uric acid production in the body.

- Medical conditions: Certain medical conditions, such as high blood pressure, kidney disease, and diabetes, can increase the risk of developing gout.

Symptoms:

The symptoms of gout can vary from person to person but often include:

- Sudden, intense joint pain: The pain is often described as sharp, stabbing, or throbbing and can occur in the big toe, ankle, knee, wrist, elbow, or fingers.

- Swelling and redness: The affected joint may become swollen, tender, and warm to the touch.

- Limited range of motion: The joint may become stiff and difficult to move.

- Fever: In some cases, a gout attack may be accompanied by a low-grade fever.

Treatment:

Gout can be treated with a combination of medications and lifestyle changes. The goals of treatment are to reduce pain and inflammation during an attack and prevent future attacks from occurring. Some common treatments for gout include:

- Nonsteroidal anti-inflammatory drugs (NSAIDs): These medications can help reduce pain and inflammation during a gout attack.

- Colchicine: This medication can be used to treat acute gout attacks and prevent future attacks.

- Corticosteroids: These medications can be taken orally or injected into the affected joint to reduce pain and inflammation.

- Lifestyle changes: Making dietary changes, losing weight, and limiting alcohol consumption can help reduce the risk of future gout attacks.

Worst Case Scenario:

In some cases, gout can lead to complications if left untreated. These complications may include:

- Chronic gout: When gout attacks occur frequently or are left untreated, it can lead to chronic gout, which can cause joint damage and deformity.

- Kidney stones: High levels of uric acid in the blood can lead to the formation of kidney stones, which can cause pain and other complications.

- Tophi: Tophi are deposits of uric acid crystals that can form under the skin or in the joints, causing pain and inflammation.

- Joint damage: Repeated gout attacks can damage the joints, leading to chronic pain and limited mobility.

In rare cases, gout can also lead to other health problems, such as high blood pressure, heart disease, and stroke.

Summation:

Gout is a common form of arthritis that can cause intense joint pain, swelling, and other symptoms. While it can be a chronic condition, it can be managed with medications and lifestyle changes. It’s important to seek medical attention if you experience symptoms of gout to prevent complications and improve your quality of life. With proper treatment and management, people with gout can live healthy and active lives.

How does Gout Affect Life Insurance Approvals?

Gout can have an impact on life insurance approvals because it is a chronic medical condition that can affect life expectancy. Life insurance companies use medical underwriting to assess the risk of insuring an individual. This includes a review of the applicant’s medical history, lifestyle, and other risk factors.

When an applicant has a medical condition like gout, the underwriter will consider the severity of the condition, the frequency of flare-ups, and the treatment being used to manage the condition. The underwriter may also consider the applicant’s age, overall health, and other risk factors that could impact life expectancy.

In general, life insurance companies are more likely to approve applicants with well-managed gout than those with uncontrolled or severe gout. Applicants like these will likely be considered eligible for preferred rates, whereas applicants who have a history of frequent flare-ups, joint damage, or other complications may be considered higher risk and may face higher premiums or be denied coverage altogether.

Tips for Getting Life Insurance with Gout

If you have gout and are applying for life insurance, there are several things you can do to improve your chances of approval and get the best possible rates.

Get Your Gout Under Control

The first step in getting life insurance with gout is to get your condition under control. This may involve making lifestyle changes, such as avoiding trigger foods and losing weight, and taking medications to manage the symptoms of gout.

By working with your healthcare provider to manage your gout, you can show the life insurance company that you are taking steps to minimize the impact of your condition on your health and life expectancy.

Shop Around for the Best Rates

Not all life insurance companies treat gout the same way, so it’s important to shop around for the best rates. Some companies may have more lenient underwriting guidelines for gout, while others may consider it a higher-risk condition.

Working with an independent insurance agent who specializes in high-risk life insurance can help you find the best rates and coverage options for your specific situation.

Be Honest on Your Application

It’s important to be honest on your life insurance application, even if you have a medical condition like gout. Lying on your application or omitting information about your medical history could result in the denial of your claim later on.

If you are honest about your gout and provide complete and accurate information on your application, the underwriter can make a more informed decision about your risk level and may be more likely to approve your application.

Consider Guaranteed Issue Life Insurance

If you have been denied traditional life insurance coverage because of your gout, you may want to consider guaranteed issue life insurance. This type of policy is designed for individuals who are unable to qualify for traditional coverage due to health conditions or other risk factors.

Guaranteed issue life insurance policies typically do not require a medical exam or medical underwriting, so they can be a good option for people with gout or other high-risk conditions. However, guaranteed issue policies may have higher premiums and lower coverage amounts than traditional policies, so it’s important to compare options and understand the terms of the policy before making a decision.

Consider a Group Life Insurance Policy

If you are employed, your employer may offer group life insurance as a benefit. Group life insurance policies often have less stringent underwriting requirements than individual policies, so you may be able to qualify for coverage even if you have gout.

Group life insurance policies typically provide coverage amounts based on a multiple of your salary, so they may not provide as much coverage as an individual policy. However, group policies are often more affordable and can be a good option for those who are unable to qualify for traditional individual life insurance coverage.

Conclusion…

Getting life insurance with gout may require some extra effort and research, but it is possible. By taking steps to manage your condition, shopping around for the best rates, being honest on your application, and considering alternative options like guaranteed issue or group life insurance, you can get the coverage you need to protect your loved ones.

If you have gout or another high-risk medical condition, it’s important to work with an experienced insurance agent who can help you navigate the application process and find the best possible coverage for your unique situation. With the right guidance and preparation, you can get the life insurance coverage you need to protect your family’s financial future.

Frequently Asked Questions

Will having gout affect my ability to get life insurance?

Having gout may impact your ability to get traditional life insurance coverage, but it doesn’t necessarily mean you won’t be able to get coverage. It’s important to be upfront and honest about your condition when applying for life insurance and to work with an experienced insurance agent who can help you navigate the application process and find the best coverage options for your unique situation.

Can I get life insurance with gout if I take medication for it?

Taking medication for gout is a common treatment and shouldn’t impact your ability to get life insurance coverage. However, it’s important to disclose any medications you are taking when applying for life insurance so the insurance company can accurately assess your risk.

Will I have to pay higher premiums for life insurance if I have gout?

It’s possible that you may have to pay higher premiums for life insurance if you have gout, especially if you are applying for traditional coverage. However, there are alternative options, such as guaranteed issue policies or group life insurance, that may be more affordable and accessible.

How do I know if I should apply for guaranteed issue life insurance?

Guaranteed issue life insurance policies are typically designed for people who may have difficulty qualifying for traditional life insurance coverage, such as those with high-risk medical conditions like gout. If you have been denied coverage in the past or have a chronic medical condition, guaranteed issue policies may be a good option to consider.

Can I still get life insurance if I have a history of gout attacks?

Having a history of gout attacks may impact your ability to get traditional life insurance coverage, but it doesn’t necessarily mean you won’t be able to get coverage. It’s important to disclose any past medical history when applying for life insurance and to work with an experienced insurance agent who can help you find the best coverage options for your unique situation.

What information do I need to provide when applying for life insurance with gout?

When applying for life insurance with gout, you will likely need to provide information about your medical history, including any past gout attacks, as well as information about your current treatment and medications. You may also need to provide information about your lifestyle, such as whether you smoke or drink alcohol.

How long does the life insurance application process take?

The life insurance application process can vary depending on the insurance company and the type of coverage you are applying for. Generally, the process can take anywhere from a few weeks to a few months. It’s important to be patient and to provide any information or documentation requested by the insurance company in a timely manner to help speed up the process.