When it comes to obtaining life insurance coverage, the presence of certain health conditions can make the process more challenging. One such condition is a goiter, specifically Grave’s disease. This article will explore the impact of Grave’s disease on life insurance approval, and provide tips for individuals seeking coverage.

What is Goiter and Grave’s Disease?

Grave’s disease is an autoimmune disorder that causes the thyroid gland to produce too much thyroid hormone. This overproduction of hormones, known as hyperthyroidism, can cause a range of symptoms and lead to serious health complications if left untreated.

Causes of Grave’s Disease

The exact cause of Grave’s disease is unknown, but it is believed to be a combination of genetic and environmental factors. It is more common in women than men and often occurs in people between the ages of 30 and 50.

Symptoms of Grave’s Disease

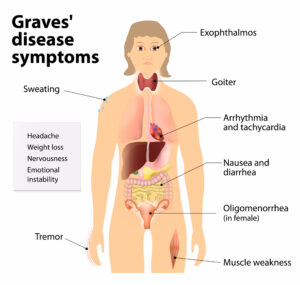

The symptoms of Grave’s disease can vary widely and may include:

- Weight loss despite increased appetite

- Rapid or irregular heartbeat

- Anxiety, irritability, and nervousness

- Tremors or shaking

- Heat intolerance and increased sweating

- Difficulty sleeping

- Increased bowel movements

- Muscle weakness or fatigue

- Eye problems such as bulging, redness, or vision changes

- Swelling in the neck due to an enlarged thyroid gland

These symptoms can range in severity and may develop slowly over time or occur suddenly.

Treatment for Grave’s Disease

Treatment for Grave’s disease is aimed at reducing the production of thyroid hormones and managing symptoms. Treatment options may include:

- Medications: Antithyroid medications such as methimazole or propylthiouracil (PTU) may be prescribed to block the production of thyroid hormones. Beta-blockers may also be used to manage symptoms such as rapid heartbeat and tremors.

- Radioactive iodine therapy: This involves taking a pill or liquid that contains radioactive iodine, which is absorbed by the thyroid gland and destroys some of the cells that produce thyroid hormones.

- Surgery: In some cases, surgery may be recommended to remove part or all of the thyroid gland.

Worst Case Scenario

If left untreated, Grave’s disease can lead to serious health complications such as:

- Thyroid storm: This is a rare but life-threatening complication of Grave’s disease that can cause high fever, rapid heartbeat, and confusion.

- Heart problems: The overproduction of thyroid hormones can cause rapid heartbeat, high blood pressure, and heart failure.

- Osteoporosis: Over time, hyperthyroidism can lead to weakened bones and an increased risk of fractures.

- Eye problems: In severe cases, Grave’s disease can cause eye problems such as double vision, loss of vision, or even blindness.

- Pregnancy complications: Grave’s disease can increase the risk of complications during pregnancy, including preterm birth, miscarriage, or stillbirth.

It is important for individuals with Grave’s disease to work closely with their healthcare provider to manage the condition and prevent these serious complications from occurring.

How does Grave’s Disease impact life insurance approval?

When applying for life insurance, an underwriter will evaluate an individual’s health status to determine their risk level and determine if they are eligible for coverage. In the case of Grave’s disease, underwriters will take into account the severity of the condition and its impact on overall health.

Individuals with mild or well-managed Grave’s disease may be able to obtain coverage at preferred rates. However, those with more severe cases of the disease or complications such as heart disease may face higher premiums or be denied coverage altogether.

Factors that underwriters will consider when evaluating an application for life insurance coverage with Grave’s disease may include:

- Age at Diagnosis: The age at which Grave’s disease was diagnosed can impact the severity of the disease and its impact on overall health. Individuals diagnosed at a younger age may face more scrutiny from underwriters.

- Treatment Plan: The type of treatment and management plan in place for Grave’s disease can also impact underwriter’s decision. Underwriters may consider whether an individual is on medication, undergoing radiation therapy, or has undergone surgery to remove the thyroid gland.

- Overall Health: Underwriters will also take into account an individual’s overall health status, including factors such as weight, blood pressure, and cholesterol levels. Individuals with co-existing health conditions such as heart disease may face higher premiums or be denied coverage.

Tips for Obtaining Life Insurance Coverage with Grave’s Disease

If you have Grave’s disease and are seeking life insurance coverage, there are steps you can take to increase your chances of approval and secure more affordable premiums:

- Provide Detailed Health History: When applying for life insurance, be sure to provide a detailed health history that includes information about your diagnosis, treatment plan, and overall health. This information will help underwriters evaluate your risk level and determine if you are eligible for coverage.

- Work with an Independent Agent: Working with an independent insurance agent who specializes in high-risk cases can be beneficial for individuals with Grave’s disease. These agents have access to a range of insurance carriers and can help find the best coverage options and rates.

- Improve Overall Health: Taking steps to improve your overall health can also increase your chances of approval and secure more affordable premiums. This can include maintaining a healthy weight, quitting smoking, and managing co-existing health conditions such as high blood pressure.

- Consider Alternative Coverage Options: If you are unable to obtain traditional life insurance coverage, there may be alternative options available such as guaranteed issue life insurance or accidental death and dismemberment insurance. These policies may have higher premiums and lower coverage limits, but can provide peace of mind and financial protection for loved ones.

Conclusion…

Obtaining life insurance coverage with Grave’s disease can be challenging, but it is not impossible. By understanding how Grave’s disease impacts underwriting decisions and taking steps to improve overall health, individuals can increase their chances of approval and secure more affordable premiums.

It is important to work with an independent insurance agent who specializes in high-risk cases and to provide detailed information about your health history when applying for coverage. Additionally, considering alternative coverage options such as guaranteed issue life insurance or accidental death and dismemberment insurance may be worth exploring.

Ultimately, the key to obtaining life insurance coverage with Grave’s disease is to be proactive and diligent in the application process. By taking steps to manage the condition and improve overall health, individuals can provide underwriters with the information they need to make an informed decision and secure the coverage they need to protect their loved ones.

Frequently Asked Questions

Can I get life insurance with Grave’s disease?

Yes, it is possible to get life insurance with Grave’s disease, but it may be more challenging and more expensive than getting coverage without the condition.

Will my premiums be higher if I have Grave’s disease?

It is likely that your premiums will be higher if you have Grave’s disease due to the increased risk of health complications associated with the condition.

What information do I need to provide when applying for life insurance with Grave’s disease?

When applying for life insurance with Grave’s disease, you will need to provide detailed information about your health history, including the date of diagnosis, treatment received, current medications, and any symptoms or complications experienced.

Should I work with an independent insurance agent when buying life insurance with Grave’s disease?

Yes, it is recommended to work with an independent insurance agent who specializes in high-risk cases. They can help you navigate the application process, find the best policy for your needs, and secure more affordable premiums.

Will I need to undergo a medical exam to get life insurance with Grave’s disease?

It depends on the type of policy you are applying for. Traditional life insurance policies typically require a medical exam, while guaranteed issue life insurance policies do not. However, guaranteed issue policies may have higher premiums and lower coverage amounts.

What are my options if I am unable to qualify for traditional life insurance with Grave’s disease?

If you are unable to qualify for traditional life insurance with Grave’s disease, you may want to consider alternative coverage options such as guaranteed issue life insurance or accidental death and dismemberment insurance.

Can I improve my chances of getting approved for life insurance with Grave’s disease?

Yes, you can improve your chances of getting approved for life insurance with Grave’s disease by taking steps to manage the condition and improve your overall health. This may include following a healthy diet, getting regular exercise, and taking medications as prescribed by your healthcare provider.

Will my coverage be limited if I have Grave’s disease?

It is possible that your coverage may be limited if you have Grave’s disease, depending on the severity of the condition and any associated complications. However, working with an independent insurance agent can help you find the best policy for your needs.