Guillain-Barré Syndrome (GBS) can be a debilitating condition, and as such, it can raise concerns about the ability to obtain life insurance coverage. However, individuals with GBS can still qualify for life insurance coverage under certain circumstances.

In this article, we will discuss what GBS is, how it affects life insurance approval, and what steps you can take to obtain coverage.

Understanding Guillain-Barré Syndrome (GBS)

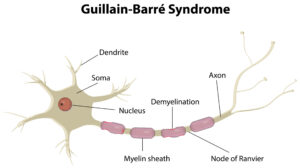

Guillain-Barré Syndrome (GBS) is a rare autoimmune disorder that affects the peripheral nervous system, which consists of the nerves outside the brain and spinal cord. It occurs when the immune system mistakenly attacks the body’s own nerve cells, resulting in muscle weakness or paralysis, tingling or numbness in the arms and legs, and difficulty breathing.

Causes:

The exact cause of GBS is not yet fully understood, but it is believed to be triggered by an infection or vaccination. The most common infections associated with GBS are respiratory or gastrointestinal infections caused by Campylobacter jejuni, a type of bacteria. Other viral and bacterial infections, such as Zika virus and cytomegalovirus, have also been linked to GBS. Vaccines, such as the flu vaccine, have been associated with a slightly increased risk of GBS, but the risk is still very low.

Symptoms:

The symptoms of GBS can vary from person to person, but they typically include muscle weakness or paralysis, tingling or numbness in the arms and legs, difficulty breathing, and even temporary vision loss. Symptoms can progress rapidly, often peaking within two to four weeks. The recovery period can last anywhere from a few weeks to several years, and it may involve rehabilitation and physical therapy. In some cases, GBS can be life-threatening if it affects the muscles responsible for breathing.

Treatment options:

There is currently no cure for GBS, but treatments are available to help manage symptoms and improve recovery. One of the most common treatments for GBS is intravenous immunoglobulin (IVIG), which involves infusing a high dose of antibodies into the bloodstream to help fight the immune system’s attack on nerve cells. Plasma exchange is another treatment option, which involves removing a portion of the patient’s blood and replacing it with donor plasma. Other treatments may include medications to manage pain and inflammation and physical therapy to help regain strength and mobility.

In severe cases of GBS, patients may require hospitalization and mechanical ventilation to help with breathing. In some cases, patients may also experience long-term effects of GBS, such as chronic pain or weakness.

Worst-case scenario:

The worst-case scenario for GBS is when the muscle weakness and paralysis affect the muscles responsible for breathing. This can result in the need for mechanical ventilation and may require intensive care unit (ICU) treatment. In rare cases, GBS can also result in death, although this is extremely rare.

Overall, GBS is a rare condition, and while it can be a severe and potentially life-threatening condition, the majority of patients do recover with appropriate treatment. If you are experiencing symptoms of GBS, it is important to seek medical attention immediately to receive a proper diagnosis and treatment plan.

How GBS Affects Life Insurance Approval

When applying for life insurance coverage, insurance companies consider a variety of factors, including an individual’s health history and current medical conditions. GBS can be a red flag for insurance companies because it is a severe medical condition that can impact an individual’s longevity.

Insurance companies will often ask detailed questions about an applicant’s medical history and request medical records to assess their risk level. For individuals with GBS, insurance companies will want to know when the condition was diagnosed, what symptoms were experienced, what treatment was received, and whether any long-term effects remain.

The type and severity of the GBS symptoms will also play a role in the insurance company’s decision-making process. For example, if an individual experienced temporary weakness but has since fully recovered, they may be able to obtain coverage without any issues. In fact, many may even be able to qualify for a preferred rate!

However, if an individual experienced long-term weakness or paralysis, the insurance company may classify them as a higher risk and charge higher premiums or even decline coverage.

Steps to Obtain Life Insurance Coverage with GBS

If you have GBS and are looking to obtain life insurance coverage, there are steps you can take to increase your chances of approval.

Work with an experienced insurance agent

The first step is to work with an experienced insurance agent who has experience with high-risk cases. An agent can help you navigate the insurance process, including answering your questions, identifying the best insurance companies for your situation, and helping you complete the application.

Gather all medical records

It is crucial to gather all medical records related to your GBS diagnosis and treatment. Insurance companies will want to review your medical history to assess your risk level accurately. The more detailed and comprehensive your medical records, the better your chances of obtaining coverage.

Be honest about your medical history

When completing your life insurance application, it is essential to be honest about your medical history. Insurance companies will verify your medical records, and if they discover that you were not truthful, it can result in your coverage being canceled or denied.

Consider a guaranteed issue life insurance policy

If you are unable to qualify for traditional life insurance due to your GBS diagnosis, you may want to consider a guaranteed issue life insurance policy. This type of policy does not require a medical exam, and coverage is guaranteed regardless of your health status. However, premiums for these policies tend to be higher, and coverage amounts are usually limited.

Improve your overall health

While GBS can be a challenging condition, taking steps to improve your overall health can increase your chances of obtaining life insurance coverage. This includes following your treatment plan, managing any other health conditions you may have, and making healthy lifestyle choices such as eating a balanced diet, exercising regularly, and avoiding tobacco products.

Conclusion…

While GBS can be a severe condition, it is possible to obtain life insurance coverage with the right approach. By working with an experienced insurance agent, gathering all medical records, being honest about your medical history, considering a guaranteed issue policy, and improving your overall health, you can increase your chances of obtaining coverage. Remember that each insurance company has its underwriting guidelines and that your specific case will be evaluated individually. Therefore, it is essential to be patient and work closely with your insurance agent to find the right coverage for your needs.

If you have GBS and are looking for life insurance coverage, reach out to an experienced insurance agent today to discuss your options. With the right approach, you can obtain the coverage you need to protect your loved ones and give yourself peace of mind.

Frequently Asked Questions

Can I get life insurance if I have Guillain-Barré Syndrome (GBS)?

Yes, it is possible to obtain life insurance coverage with a history of GBS, but it may be more challenging to qualify for traditional life insurance. However, you may be able to obtain a guaranteed issue life insurance policy, which does not require a medical exam and provides guaranteed coverage regardless of your health status.

Will having GBS affect my life insurance premiums?

Yes, having a history of GBS may result in higher life insurance premiums due to the potential for long-term effects of the condition. However, the extent of the impact on your premiums will depend on the severity of your condition and how well you have recovered.

Should I disclose my GBS diagnosis when applying for life insurance?

Yes, it is important to disclose your GBS diagnosis when applying for life insurance. Failure to do so could result in the denial of your claim if your insurance company discovers that you had a pre-existing condition that was not disclosed during the application process.

What information do I need to provide when applying for life insurance with a history of GBS?

When applying for life insurance with a history of GBS, you will need to provide detailed medical records, including any hospitalizations, medications taken, and treatments received. You may also be required to provide a statement from your treating physician regarding your current health status and any potential long-term effects of GBS.

How can I increase my chances of obtaining life insurance coverage with a history of GBS?

To increase your chances of obtaining life insurance coverage with a history of GBS, it is important to work with an experienced insurance agent who specializes in high-risk cases. You should also gather all medical records, be honest about your medical history, consider a guaranteed issue policy, and take steps to improve your overall health.

How long do I have to wait after being diagnosed with GBS before applying for life insurance?

The length of time you need to wait before applying for life insurance after being diagnosed with GBS will vary depending on the insurance company’s underwriting guidelines and the severity of your condition. In general, you may need to wait anywhere from six months to two years after being diagnosed before applying for coverage.

Can I purchase life insurance with GBS if I am currently experiencing symptoms?

It may be more challenging to obtain life insurance coverage if you are currently experiencing symptoms of GBS. Insurance companies typically require applicants to be in good health at the time of application, and having active symptoms may be a red flag for underwriters. However, you may still be able to obtain coverage with a guaranteed issue policy.

What if I am denied life insurance coverage due to my GBS diagnosis?

If you are denied life insurance coverage due to your GBS diagnosis, you may want to consider working with an insurance agent who specializes in high-risk cases. They may be able to help you find alternative coverage options, such as a guaranteed issue policy or a policy with a higher premium.