In this article, we will explore the challenges faced by those with Addison’s disease when seeking life insurance, offer tips for navigating the application process, and highlight resources for finding coverage.

Addison’s Disease

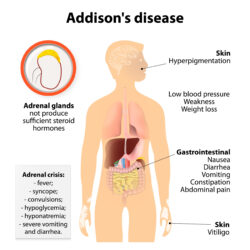

Addison’s disease, also known as primary adrenal insufficiency, is a rare but serious medical condition that occurs when the adrenal glands do not produce enough hormones. This results in a range of symptoms, including fatigue, weakness, weight loss, low blood pressure, and darkening of the skin. The disease is caused by damage to the adrenal glands, which can occur due to autoimmune disorders, infections, cancer, or other factors.

Diagnosis

Diagnosis of Addison’s disease involves a combination of blood tests and imaging studies to assess the function and structure of the adrenal glands. Treatment typically involves hormone replacement therapy, which aims to replace the missing hormones and manage symptoms. In addition to medication, lifestyle changes such as a healthy diet and stress management may also be recommended.

Individuals with Addison’s disease are at risk for complications such as adrenal crisis, a life-threatening condition that occurs when the body is under stress and does not have enough cortisol.

Risk factors for complications include illness, injury, surgery, and emotional or physical stress. As a result, it is crucial for individuals with Addison’s disease to monitor their health closely and work with their healthcare provider to develop a management plan. In the context of life insurance, these risk factors may be considered by insurers when assessing an applicant’s eligibility and rates.

Challenges of Getting Life Insurance with Addison’s Disease

Individuals with Addison’s disease may face challenges during the underwriting process due to their medical condition. Some common challenges include a history of hospitalization, medication use, and the risk of complications such as an adrenal crisis. As a result, insurers may view applicants with Addison’s disease as higher risk and may offer higher rates or decline coverage altogether.

Other factors that can affect insurance rates include the severity of the disease, the frequency of symptoms, and the age and overall health of the applicant. Additionally, insurers may consider any co-occurring medical conditions or lifestyle factors such as smoking or a history of substance abuse.

Despite these challenges, it is important for individuals with Addison’s disease to explore all available options for life insurance coverage. By working with a knowledgeable insurance broker or agency, individuals can identify insurers that specialize in high-risk cases and develop strategies for improving their chances of approval. This may include providing detailed medical records, maintaining good control of the disease, and demonstrating a healthy lifestyle.

Tips for Getting Life Insurance with Addison’s Disease

When applying for life insurance with Addison’s disease, there are several tips that can help increase the chances of approval:

First, it is important to gather all relevant medical records and ensure that they accurately reflect the current state of the disease. This can help insurers understand the severity of the condition and any steps taken to manage it.

Next, applicants should be prepared to answer detailed questions about their medical history and lifestyle factors. This may include questions about medication use, hospitalizations, and any co-occurring medical conditions.

To improve the chances of approval, applicants can also focus on maintaining good control of the disease through regular check-ups with their healthcare provider, adherence to medication regimens, and a healthy lifestyle.

Navigating the medical underwriting process can be challenging, but working with an experienced insurance broker or agency can help. These professionals can provide guidance on how to present the medical information in the best light and identify insurers that are more likely to approve coverage for individuals with Addison’s disease.

For those who are declined or unable to get traditional life insurance, there are alternative options such as guaranteed issue or simplified issue policies. These policies may have higher rates or lower coverage amounts, but can still provide valuable protection for individuals with Addison’s disease. It is important to explore all available options and work with a trusted insurance professional to find the right coverage.

Despite any challenges…

One may face, it’s important to keep in mind that securing life insurance coverage can be an important step for individuals with Addison’s disease to protect their financial future and provide peace of mind for themselves and their loved ones. While there may be challenges in obtaining coverage, it is important for individuals with Addison’s disease to be proactive in exploring all available options and working with trusted insurance professionals.

By taking steps to manage the disease, maintain good health, and present their medical information in the best light, individuals with Addison’s disease can increase their chances of obtaining life insurance coverage. Additionally, resources such as support organizations, insurance brokers, and government programs can provide valuable guidance and support throughout the process.

Looking to the future, there is hope for improved access to life insurance coverage for individuals with Addison’s disease as insurers continue to evaluate and adjust their underwriting practices. In the meantime, it is important for individuals with Addison’s disease to take control of their financial future and explore all available options for life insurance coverage.

Frequently asked questions

Is it possible to qualify for life insurance after being diagnosed with Addison’s disease?

Yes, it is possible to qualify for life insurance after being diagnosed with Addison’s disease. However, individuals with Addison’s disease may face challenges in obtaining coverage, and may need to work with insurance professionals who specialize in high-risk cases. Insurance companies will evaluate each application on a case-by-case basis and consider factors such as the severity of the disease, current health status, and overall risk. It is important to be honest and upfront about the diagnosis and provide all required medical documentation to the insurance company.

Will having Addison’s disease affect my ability to obtain life insurance coverage?

Having Addison’s disease can affect your ability to obtain life insurance coverage. Insurance companies evaluate each applicant’s risk level, and individuals with medical conditions such as Addison’s disease are considered higher risk. However, obtaining coverage is still possible, and there are insurance companies and brokers who specialize in high-risk cases. Factors such as the severity of the disease, current health status, and overall risk will be taken into consideration when evaluating the application. It is important to be upfront and honest about the diagnosis and provide all required medical documentation to the insurance company.

What factors will insurance companies consider when evaluating my application for life insurance with Addison’s disease?

When evaluating an application for life insurance with Addison’s disease, insurance companies will consider several factors including:

- Age at the time of diagnosis

- Severity of the disease

- Medications and treatment being used

- History of hospitalizations related to the disease

- Current health status and overall health history

- Other medical conditions or risk factors

- Lifestyle factors such as smoking, alcohol use, and occupation

- Family history of medical conditions

All of these factors will be considered in the underwriting process when determining the applicant’s risk level and premium rates for life insurance coverage.

Will I be required to disclose my Addison’s disease diagnosis on my life insurance application?

Yes, you will be required to disclose your Addison’s disease diagnosis on your life insurance application. It is important to provide complete and accurate information on your application to avoid any issues with your coverage in the future. If you fail to disclose your Addison’s disease diagnosis and the insurance company later discovers the omission, they could potentially deny the claim or even cancel the policy. It is always best to be upfront and honest about your medical history to ensure that you receive the coverage you need.

What documentation will I need to provide to the insurance company when applying for life insurance with Addison’s disease?

When applying for life insurance with Addison’s disease, you will be required to provide the insurance company with several types of documentation, including:

- Medical records: The insurance company will require copies of your medical records to evaluate your health status and the severity of your Addison’s disease.

- Lab results: You may be required to provide lab results such as blood tests or urine tests to evaluate your overall health and any related medical conditions.

- Medication history: The insurance company may ask for a detailed history of the medications you are currently taking to manage your Addison’s disease.

- Physician’s statement: Your physician may be required to provide a statement detailing your diagnosis, treatment, and prognosis.

- Personal statement: You may be asked to provide a personal statement outlining your overall health status, lifestyle factors, and any other relevant information.

Providing complete and accurate documentation is important to ensure that the insurance company can evaluate your application properly and offer you appropriate coverage.

How can I improve my chances of being approved for life insurance with Addison’s disease?

To improve your chances of being approved for life insurance with Addison’s disease, there are several steps you can take:

- Work with a high-risk life insurance specialist: Insurance brokers who specialize in high-risk cases can help you find insurance companies that are more likely to offer coverage to individuals with Addison’s disease.

- Provide complete and accurate medical records: Be sure to provide all requested medical records to the insurance company, including detailed information about your diagnosis, treatment, and overall health status.

- Maintain good control of your Addison’s disease: Demonstrating good control of your Addison’s disease through regular doctor visits, proper medication management, and healthy lifestyle choices can help show the insurance company that you are taking steps to manage your health.

- Be honest and upfront about your condition: Failing to disclose your Addison’s disease diagnosis could result in a denied claim or policy cancellation. It is important to be honest and upfront about your medical history to ensure that you receive the coverage you need.

- Consider a guaranteed issue life insurance policy: If you are unable to obtain traditional life insurance, you may want to consider a guaranteed issue life insurance policy, which does not require a medical exam and is designed for individuals who are unable to obtain coverage elsewhere.

Will my premiums be higher if I have Addison’s disease?

It is possible that your premiums may be higher if you have Addison’s disease. Insurance companies typically charge higher premiums for individuals who have certain medical conditions, including Addison’s disease, as they are considered to be higher risk. The exact amount of the premium increase will depend on several factors, including the severity of your condition, your age, your overall health, and your lifestyle habits. It is important to keep in mind that even with higher premiums, life insurance coverage can still provide valuable financial protection for you and your loved ones.

What are my options if I am declined coverage for life insurance due to Addison’s disease?

If you are declined coverage for life insurance due to Addison’s disease, there are still several options available to you:

- Appeal the decision: If you believe that the insurance company’s decision was based on inaccurate information or a misunderstanding of your medical condition, you can appeal the decision and provide additional information to support your case.

- Look for a different insurance company: Some insurance companies are more willing to offer coverage to individuals with pre-existing medical conditions like Addison’s disease. Working with an insurance broker who specializes in high-risk cases can help you find a company that is more likely to offer coverage.

- Consider a guaranteed issue life insurance policy: Guaranteed issue life insurance policies are designed for individuals who are unable to obtain traditional coverage due to pre-existing medical conditions or other factors. These policies do not require a medical exam and are typically easier to obtain.

- Explore government programs: Some government programs, such as Social Security Disability Insurance, may provide some financial protection in the event of your death.

Can a life insurance policy be canceled or denied based on a later diagnosis of Addison’s disease?

It is unlikely that a life insurance policy can be canceled or denied based on a later diagnosis of Addison’s disease if the policy was issued prior to the diagnosis. This is because life insurance policies are typically issued based on the insured’s health and medical history at the time of application. If you were diagnosed with Addison’s disease after the policy was issued, the insurance company cannot retroactively cancel or deny coverage based on the new diagnosis.

However, it is important to note that if you fail to disclose a pre-existing medical condition like Addison’s disease on your life insurance application, the insurance company may have grounds to cancel the policy. It is important to be honest and upfront about your medical history when applying for life insurance to avoid any potential issues down the line.