In this article, we will discuss the steps you can take to qualify for life insurance after an aneurysm and explore the high-risk insurance options available to you. We will also discuss the importance of working with an experienced agent to help you navigate the process and find the right coverage for your unique needs.

Life Insurance After an Aneurysm

An aneurysm can impact your ability to qualify for life insurance in several ways. For example, if you have suffered from an aneurysm, you may be considered a higher risk for future health complications, such as stroke or heart disease. You may also have residual effects from the aneurysm, such as cognitive or physical impairments, that could impact your ability to qualify for coverage.

Factors that will determine your eligibility for life insurance after an aneurysm may include the severity of the aneurysm, the treatment you received, and the amount of time that has passed since the aneurysm occurred. Your age, gender, and overall health will also be taken into account.

Medical Requirements when applying for traditional coverage

When applying for life insurance after an aneurysm, you will be required to provide detailed medical information. This may include medical exams, medical records, and information about your medication management.

Medical exams are often required as part of the underwriting process. These exams may include a physical exam, blood tests, and other tests to evaluate your overall health and assess your risk for future health complications. Your medical records will also be reviewed to provide additional information about your medical history and the treatment you received for your aneurysm.

Current treatment

Medication management is another important factor to consider when applying for life insurance after an aneurysm. If you are taking medication to manage your aneurysm or other health conditions, insurers will want to know what medications you are taking and how well you are managing your condition.

It’s important to be upfront and honest about your medical history and current health status when applying for life insurance. Providing accurate and detailed information can help ensure that you are accurately assessed for risk and that you receive the appropriate coverage for your needs.

Lifestyle Considerations

In addition to medical requirements, insurers may also take into account any lifestyle changes you have made since your aneurysm. This can include changes to your diet and exercise habits, stress management techniques, and follow-up care.

Diet and exercise can play an important role in managing your overall health and reducing your risk of future health complications. Insurers may ask about your current diet and exercise habits, as well as any changes you have made since your aneurysm. Making healthy lifestyle choices can help demonstrate to insurers that you are taking proactive steps to manage your health and reduce your risk of future complications.

Stress management is another important factor to consider when applying for life insurance after an aneurysm. Chronic stress can have negative impacts on your overall health, and insurers may view individuals with high levels of stress as higher risk. Providing information about how you manage stress, such as through mindfulness practices or therapy, can help demonstrate that you are taking steps to manage your overall health and reduce your risk of future complications.

Finally, insurers may also want to know about your follow-up care since your aneurysm. This can include information about any ongoing treatment, such as follow-up appointments with your doctor, imaging tests, or other medical interventions. Demonstrating that you are actively managing your health and following your doctor’s recommendations can help reassure insurers that you are taking proactive steps to manage your health and reduce your risk of future complications.

High-Risk Insurance Options

If you have been diagnosed with an aneurysm, you may find that traditional life insurance policies are not available to you. In this case, there are several high-risk insurance options to consider.

Guaranteed-issue life insurance is one option for individuals who have been diagnosed with an aneurysm. This type of insurance does not require a medical exam, and coverage is guaranteed as long as you meet the policy’s eligibility requirements. However, premiums for guaranteed issue policies tend to be higher than traditional policies, and coverage limits are often lower.

Accidental death insurance is a third option to consider. This type of policy provides coverage in the event of accidental death, but does not typically cover death resulting from natural causes such as an aneurysm. While accidental death policies tend to have lower premiums than other types of policies, they may not provide the comprehensive coverage that many individuals need.

It’s important to carefully consider your options when selecting high-risk insurance policies. While these policies may be more expensive or provide less comprehensive coverage than traditional policies, they can still provide important financial protection for you and your loved ones.

Frequently asked questions

Can I get life insurance after being diagnosed with an aneurysm?

Yes, it is possible to obtain life insurance after being diagnosed with an aneurysm. However, the process may be more complicated than for individuals without a history of medical issues, and your options may be limited. The eligibility for life insurance after an aneurysm will depend on several factors, such as the size and location of the aneurysm, your overall health status, and any treatment received.

Will my medical history impact my ability to get life insurance?

Yes, your medical history will likely impact your ability to obtain life insurance. Insurance companies evaluate applicants based on their health status, medical history, and other risk factors to determine the likelihood of paying out a death benefit. A history of medical issues, such as an aneurysm, may be considered a high risk by insurers, and as a result, may lead to higher premiums or potential denial of coverage. However, it is essential to remember that each insurance company has different underwriting guidelines, and some may be more lenient than others. It’s best to work with an experienced agent or broker to navigate the underwriting process and find the best options for your specific situation.

What factors impact my eligibility for life insurance after an aneurysm?

Several factors can impact your eligibility for life insurance after an aneurysm, including:

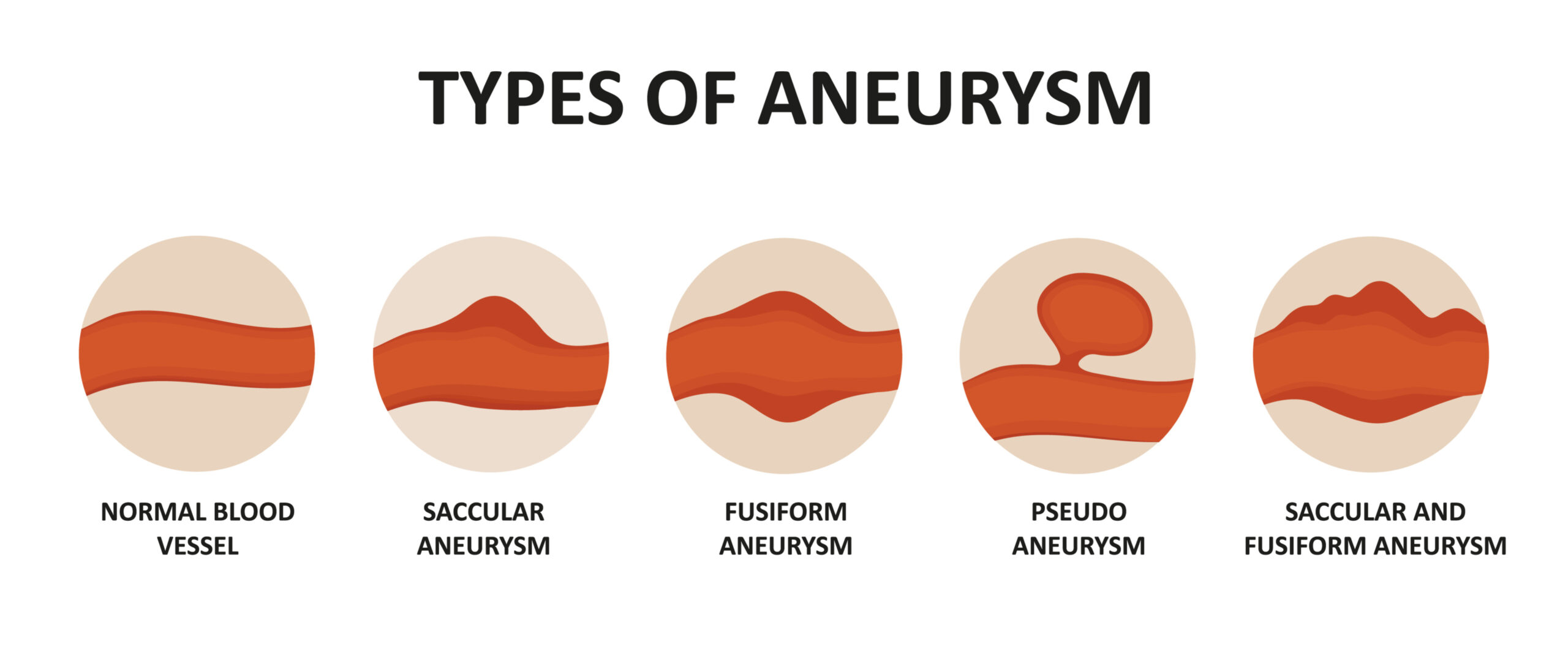

- Type of aneurysm: The location, size, and type of aneurysm can affect your eligibility for life insurance. For instance, a small aneurysm that is treated and managed may be viewed more favorably than a large aneurysm that has not been treated.

- Health status: Insurance companies will evaluate your overall health, including any other medical conditions or illnesses you may have. They may consider factors such as your age, height and weight, blood pressure, cholesterol levels, and whether you smoke.

- Treatment received: If you have received treatment for your aneurysm, such as surgery or medication, this may impact your eligibility for life insurance. Insurance companies will want to see evidence of follow-up care and medication management to ensure that you are managing your condition effectively.

- Time elapsed since diagnosis: The amount of time that has passed since your aneurysm diagnosis can also be a factor in determining your eligibility for life insurance. Generally, the longer the time elapsed, the better your chances of obtaining coverage.

- Family history: Your family history of aneurysms or other medical conditions may also be considered when determining your eligibility for life insurance.

What medical requirements do I need to meet to qualify for life insurance after an aneurysm?

To qualify for life insurance after an aneurysm, you will typically need to undergo a medical exam, submit your medical records, and demonstrate that you are effectively managing any prescribed medications. The medical exam will typically include blood tests, urine tests, and measurements of vital signs such as blood pressure and heart rate. Your medical records will be reviewed to assess the severity of your aneurysm, any treatment you have undergone, and your overall health history. It is important to note that the specific medical requirements for life insurance eligibility can vary depending on the insurer and your individual circumstances.

Can I improve my eligibility for life insurance after an aneurysm?

Yes, you may be able to improve your eligibility for life insurance after an aneurysm by making certain lifestyle changes and following up with your healthcare provider. Adopting a healthy diet and exercise routine, managing stress, and taking prescribed medications as directed can all help to demonstrate that you are taking steps to manage your health and reduce the risk of complications related to your aneurysm. Additionally, following up with your healthcare provider for regular check-ups and imaging scans can help to demonstrate that you are actively monitoring your condition and taking the necessary steps to manage any potential risks.

What high-risk insurance options are available to me?

If you are having difficulty qualifying for traditional life insurance after an aneurysm, there are several high-risk insurance options available that may be more accessible.

Guaranteed issue life insurance is a type of policy that does not require a medical exam or health questionnaire, so you are guaranteed to be approved as long as you meet the age requirements. However, these policies often come with lower coverage amounts and higher premiums.

Accidental death insurance policies provide coverage in the event of accidental death but do not typically cover death related to illness or natural causes. These policies may be easier to qualify for but may have limited coverage.

Can I still get life insurance if I have a family history of aneurysms?

Yes, it’s still possible to qualify for life insurance even if you have a family history of aneurysms. However, it may depend on the specifics of your family history and your personal medical history, so it’s important to discuss your options with a licensed insurance professional.

How long after an aneurysm do I have to wait before applying for life insurance?

The waiting period after an aneurysm before you can apply for life insurance varies depending on the insurance company and the severity of your condition. In general, most insurance companies require a waiting period of at least six months to a year after treatment or surgery before considering an application.

During this time, you will need to provide medical records and demonstrate that you are receiving appropriate follow-up care. It is important to note that the waiting period may be longer for more severe cases, and some insurance companies may require a longer waiting period even for milder cases. It is best to consult with an insurance professional to determine the specific waiting period and requirements for your situation.

What if I have other health issues in addition to my aneurysm?

If you have other health issues in addition to your aneurysm, it may impact your ability to qualify for traditional life insurance. However, there are high-risk insurance options that may still be available to you, such as guaranteed issue or simplified issue life insurance.

Will my premiums be higher if I have an aneurysm?

It’s possible that your premiums may be higher if you have an aneurysm, particularly if it’s a recent diagnosis. However, the amount of the premium increase will depend on the severity of your aneurysm, your overall health, and other factors.

What if I was previously declined for life insurance due to my aneurysm?

If you were previously declined for life insurance due to your aneurysm, it doesn’t necessarily mean that you are ineligible for coverage altogether. It’s important to remember that not all life insurance companies use the same underwriting guidelines, and some may be more willing to insure individuals with a history of aneurysms than others. It’s also possible that there may have been specific factors in your case that led to the decline, such as not meeting certain medical requirements or having other health conditions that increase your overall risk. In any case, it may be worthwhile to seek guidance from an experienced insurance agent or broker who can help you navigate the process and find a company that is more likely to approve your application. They can also help you gather the necessary medical documentation and present your case in the best possible light to the insurer.