Glaucoma is a serious eye condition that affects millions of people around the world. It is a leading cause of blindness and can cause significant damage to the optic nerve if left untreated. If you have been diagnosed with glaucoma, you may be wondering if you can still qualify for life insurance coverage. The answer is yes, but there are some things you should know about getting approved for life insurance with glaucoma.

What is Glaucoma?

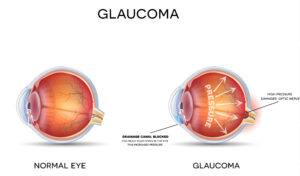

Glaucoma is a group of eye diseases that cause damage to the optic nerve, which is responsible for transmitting visual information from the eye to the brain. This damage is often caused by increased pressure within the eye, known as intraocular pressure. Glaucoma is a leading cause of blindness worldwide, but with early detection and treatment, vision loss can often be prevented or slowed.

Causes:

The exact cause of glaucoma is not fully understood, but it is believed to be related to a buildup of fluid in the eye that increases the intraocular pressure. There are several factors that can increase your risk of developing glaucoma, including:

- Age: The risk of developing glaucoma increases as you get older.

- Genetics: Glaucoma can run in families, suggesting that there may be a genetic component to the disease.

- Ethnicity: People of African, Hispanic, and Asian descent are at a higher risk of developing glaucoma.

- Medical conditions: Certain medical conditions, such as diabetes and high blood pressure, can increase your risk of developing glaucoma.

Symptoms:

In the early stages, glaucoma often has no noticeable symptoms, which is why regular eye exams are so important. As the disease progresses, symptoms may include:

- Blurred vision

- Loss of peripheral vision

- Halos around lights

- Eye pain

- Redness in the eye

Treatment:

The goal of glaucoma treatment is to lower the intraocular pressure to prevent further damage to the optic nerve. There are several treatment options available, including:

- Eye drops: Medication in the form of eye drops can help to reduce intraocular pressure.

- Oral medications: In some cases, oral medications may be prescribed to help lower intraocular pressure.

- Laser surgery: Laser surgery can be used to increase the drainage of fluid from the eye or decrease the production of fluid to lower intraocular pressure.

- Conventional surgery: In more severe cases, conventional surgery may be necessary to create a new channel for fluid to drain from the eye.

Worst Case Scenario:

If glaucoma is left untreated or not effectively managed, it can lead to permanent vision loss and blindness. In fact, glaucoma is one of the leading causes of blindness worldwide. This is why early detection and treatment are so important in preventing vision loss. In some cases, even with treatment, glaucoma can still progress and lead to vision loss, but with regular eye exams and proper treatment, the progression of the disease can often be slowed or halted.

How Does Glaucoma Affect Life Insurance Approval?

When you apply for life insurance, the insurance company will ask you a series of questions about your medical history, including any eye conditions you may have. If you have been diagnosed with glaucoma, the insurance company will want to know more about the severity of your condition and what treatments you have received.

The insurance company will also want to know if you have any other medical conditions that may be related to glaucoma, such as diabetes or high blood pressure. These conditions can increase your risk of complications from glaucoma and may affect your overall insurability.

Can You Get Life Insurance with Glaucoma?

The short answer is yes, you can get life insurance with glaucoma. However, the type of coverage you can get and the cost of that coverage will depend on several factors, including the severity of your glaucoma and any other medical conditions you may have.

If you have mild to moderate glaucoma and it is well-controlled with medication, you may be able to qualify for preferred or preferred plus rate. However, if your glaucoma is severe or has caused significant damage to your optic nerve, you may need to apply for a higher-risk life insurance policy.

In general, the insurance company will want to see that you are receiving regular medical care for your glaucoma and that you are following your doctor’s recommended treatment plan. This may include taking medication, having regular eye exams, and making lifestyle changes to manage any related medical conditions.

What Types of Life Insurance Coverage are Available?

There are several types of life insurance coverage available, and the type of coverage you choose will depend on your individual needs and circumstances.

Term life insurance is the most common type of coverage and provides coverage for a set period of time, typically 10, 20, or 30 years. This type of coverage is generally the most affordable and may be a good option if you only need coverage for a specific period of time, such as until your children are grown or your mortgage is paid off.

Permanent life insurance provides coverage for your entire life and includes a savings component that can build cash value over time. There are two main types of permanent life insurance: whole life insurance and universal life insurance. Whole life insurance provides a fixed death benefit and a guaranteed cash value, while universal life insurance offers more flexibility in terms of premium payments and death benefits.

No matter what type of life insurance coverage you choose, it is important to work with an experienced life insurance agent who can help you find the right coverage for your needs and budget.

Tips for Getting Approved for Life Insurance with Glaucoma

If you have been diagnosed with glaucoma and are applying for life insurance, there are some tips that can help increase your chances of getting approved for coverage:

Get regular eye exams. The insurance company will want to see that you are receiving regular medical care for your glaucoma and that you are following your doctor’s recommended treatment plan. This includes having regular eye exams to monitor the progression of your glaucoma and ensure that your treatment plan is working effectively.

Follow your doctor’s treatment plan. If you have been prescribed medication or other treatments for your glaucoma, it is important to follow your doctor’s instructions carefully. This can help to prevent further damage to your optic nerve and improve your overall health.

Manage any related medical conditions. If you have other medical conditions that may be related to glaucoma, such as diabetes or high blood pressure, it is important to manage these conditions as well. This can help to reduce your risk of complications from glaucoma and improve your overall health.

Work with an experienced life insurance agent. Life insurance underwriting can be complex, especially if you have a medical condition like glaucoma. Working with an experienced life insurance agent can help ensure that you find the right coverage at the best possible price.

Consider a medical exam. Depending on the severity of your glaucoma and any other medical conditions you may have, the insurance company may require a medical exam as part of the underwriting process. While this can be an additional step in the process, it can also help to demonstrate that you are managing your condition effectively and increase your chances of getting approved for coverage.

Final Thoughts…

If you have been diagnosed with glaucoma, it is important to understand that you can still qualify for life insurance coverage. While the type of coverage you can get and the cost of that coverage may depend on several factors, including the severity of your glaucoma and any related medical conditions, there are still options available to you.

Working with an experienced life insurance agent can help you navigate the underwriting process and find the right coverage for your needs and budget. By following your doctor’s recommended treatment plan, managing any related medical conditions, and staying proactive about your health, you can increase your chances of getting approved for life insurance coverage with glaucoma.

Frequently Asked Questions

Can I get life insurance with glaucoma?

Yes, you can still qualify for life insurance coverage even if you have been diagnosed with glaucoma. However, the type of coverage you can get and the cost of that coverage may depend on several factors, including the severity of your glaucoma and any related medical conditions.

Will I have to pay higher premiums for life insurance if I have glaucoma?

It is possible that you may have to pay higher premiums for life insurance if you have glaucoma. This is because glaucoma is considered a high-risk condition, and insurance companies may view you as a higher risk for potential claims. However, the exact cost of your premiums will depend on several factors, including the severity of your glaucoma and any related medical conditions.

Will I have to undergo a medical exam to get life insurance if I have glaucoma?

Depending on the severity of your glaucoma and any related medical conditions you may have, the insurance company may require a medical exam as part of the underwriting process. While this can be an additional step in the process, it can also help to demonstrate that you are managing your condition effectively and increase your chances of getting approved for coverage.

Will the insurance company consider my glaucoma a pre-existing condition?

Yes, glaucoma will typically be considered a pre-existing condition by the insurance company. This means that any coverage you get for glaucoma-related conditions may be subject to certain limitations or exclusions.

Can I get life insurance if I have already lost vision due to glaucoma?

If you have already lost vision due to glaucoma, it may be more difficult to get approved for traditional life insurance coverage. However, there are still options available, such as guaranteed issue life insurance, which is a type of coverage that does not require a medical exam and typically has lower coverage limits and higher premiums.

What can I do to increase my chances of getting approved for life insurance with glaucoma?

To increase your chances of getting approved for life insurance coverage with glaucoma, it is important to work with an experienced life insurance agent who can help you navigate the underwriting process. You should also follow your doctor’s recommended treatment plan, manage any related medical conditions, and stay proactive about your health. Additionally, getting regular eye exams and providing detailed medical records to the insurance company can help to demonstrate that you are managing your condition effectively.

What types of life insurance coverage are available if I have glaucoma?

There are several types of life insurance coverage available, including term life insurance, whole life insurance, and universal life insurance. However, the type of coverage you can get and the cost of that coverage may depend on several factors, including the severity of your glaucoma and any related medical conditions.

Can I get life insurance if I have already been declined coverage due to my glaucoma?

If you have already been declined coverage due to your glaucoma, it can be more difficult to get approved for traditional life insurance coverage. However, there are still options available, such as guaranteed issue life insurance, which is a type of coverage that does not require a medical exam and typically has lower coverage limits and higher premiums.

What information do I need to provide when applying for life insurance with glaucoma?

When applying for life insurance with glaucoma, you will typically be required to provide detailed information about your medical history, including any medications you are taking, any related medical conditions, and any treatments you have undergone. You may also be required to undergo a medical exam or provide medical records to the insurance company.

How can I find the best life insurance coverage if I have glaucoma?

To find the best life insurance coverage if you have glaucoma, it is important to work with an experienced life insurance agent who understands the underwriting process and can help you find the best coverage options for your needs. Additionally, it is important to compare multiple quotes from different insurance companies to find the most affordable coverage that meets your needs.