Life Insurance with Ventricular Septal Defect: Securing financial protection is a vital consideration for individuals with Ventricular Septal Defect (VSD), a congenital heart condition affecting the normal functioning of the heart. Despite the challenges associated with obtaining life insurance when living with VSD, it is not an impossible feat.

In this article, we delve into the world of life insurance for individuals with VSD, exploring the intricacies of the condition, addressing common concerns, and providing a comprehensive guide on how to navigate the insurance landscape successfully. By understanding the unique aspects of securing life insurance with VSD, individuals and their loved ones can gain the confidence to protect their financial well-being in the face of this medical condition.

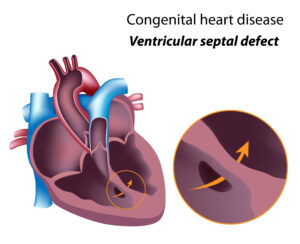

Understanding Ventricular Septal Defect

Ventricular Septal Defect (VSD) is a congenital heart defect characterized by an abnormal opening or hole in the wall that separates the lower chambers (ventricles) of the heart. This condition occurs during fetal development when the septum fails to fully form, resulting in a communication between the left and right ventricles. VSD is one of the most common heart defects, affecting approximately 1 in every 500 live births.

Causes:

The exact cause of VSD is often unknown. However, certain risk factors and genetic factors can contribute to its development. Some of the factors associated with VSD include genetic abnormalities (such as Down syndrome), maternal alcohol or drug abuse during pregnancy, maternal infections (such as rubella), and certain medications taken during pregnancy.

Symptoms:

The symptoms of VSD can vary depending on the size of the defect and its impact on the heart’s functioning. In some cases, small VSDs may not cause noticeable symptoms and may close on their own over time. However, larger VSDs can lead to symptoms such as:

- Difficulty breathing or rapid breathing

- Poor weight gain and growth in infants

- Fatigue and easy tiring during physical activity

- Rapid or irregular heartbeat

- Sweating, especially during feeding

- Recurrent respiratory infections

Treatments:

The treatment approach for VSD depends on various factors, including the size and location of the defect, the presence of symptoms, and the overall health of the individual. In many cases, small VSDs may not require any treatment and may close spontaneously. However, larger VSDs and those causing significant symptoms may necessitate medical intervention. Treatment options include:

- Medications: Medications may be prescribed to manage symptoms and improve heart function, such as diuretics to reduce fluid buildup or medications to control irregular heartbeat.

- Surgery: Surgical repair is often recommended for moderate to large VSDs or those causing severe symptoms. The procedure involves closing the hole in the septum using sutures or a patch.

- Catheter-based procedures: In certain cases, a minimally invasive procedure called cardiac catheterization may be performed. This involves inserting a catheter through a blood vessel and using it to place a device or plug to close the VSD.

Worst-Case Scenario:

While the majority of individuals with VSD lead normal and healthy lives, there are potential complications associated with this condition. In rare cases or when left untreated, VSD can lead to severe complications, including:

- Pulmonary hypertension: If the VSD is large and left untreated, it can lead to increased blood flow to the lungs, causing high blood pressure in the pulmonary arteries.

- Heart failure: In some instances, untreated VSD can result in heart failure, where the heart is unable to pump blood effectively to meet the body’s needs.

- Endocarditis: Individuals with VSD are at an increased risk of developing infective endocarditis, an infection of the inner lining of the heart and heart valves.

- Eisenmenger syndrome: In rare cases, untreated VSD can lead to a condition called Eisenmenger syndrome, where the blood flow reverses direction due to increased pressure in the lungs. This can lead to cyanosis (bluish discoloration of the skin) and severe complications.

It is important to note that with appropriate medical care, early diagnosis, and timely intervention, the prognosis for individuals with VSD is generally favorable, and the risk of developing severe complications can be significantly reduced.

Impact on One’s Life Insurance Application

When applying for life insurance with Ventricular Septal Defect (VSD), the severity of the condition plays a significant role in the insurance underwriting process and the resulting premium rates. Insurance companies assess the risk associated with an individual’s health condition to determine the appropriate rating class or coverage eligibility. Here’s an overview of how VSD severity may impact life insurance applications:

- Mild VSD: Individuals with mild VSD, particularly those with small defects that don’t cause significant symptoms or require intervention, may have a higher chance of qualifying for a preferred rating. A preferred rating implies that the individual is considered low risk and may be eligible for lower premium rates compared to individuals with more severe forms of VSD.

- Surgically Repaired VSD: If an individual has undergone successful surgical repair for their VSD, it can positively impact their life insurance application. With a documented history of treatment and recovery, individuals who have had their VSD repaired may also qualify for a preferred rating, depending on other factors like overall health and lifestyle.

- Moderate VSD: Individuals with moderate VSD, which generally refers to larger defects or those causing mild to moderate symptoms, may still qualify for life insurance coverage, but typically at a standard rating. Standard rating implies that the individual is considered an average risk, and premium rates may be slightly higher compared to preferred rates.

- Severe VSD: Individuals with severe VSD, such as larger defects that cause significant symptoms or complications, may face challenges in obtaining traditional life insurance coverage. Insurance companies may view severe VSD as a higher risk due to potential complications and may deny coverage through traditional channels.

It’s important to note that each insurance company has its own underwriting guidelines and may assess VSD differently. Factors such as age, overall health, treatment history, and the presence of any associated health conditions may also influence the underwriting decision and resulting premium rates.

In cases where traditional coverage is not available or affordable, individuals with severe VSD may explore alternative options such as guaranteed issue life insurance or accidental death policies. These types of policies typically have less stringent underwriting requirements and may provide coverage even for individuals with pre-existing conditions.

Factors that will be considered

When assessing a life insurance application for an individual with Ventricular Septal Defect (VSD), insurance companies consider several factors to determine the applicant’s risk level and eligibility for coverage. These factors may include:

- VSD Severity: The size, location, and impact of the VSD on the individual’s overall health will be evaluated. Larger defects or those causing significant symptoms may be perceived as higher risk.

- Treatment History: The insurance company will review the individual’s medical records and treatment history, including any surgical interventions or other medical procedures related to the VSD.

- Current Health Condition: The applicant’s overall health, including any additional medical conditions or complications associated with VSD, will be taken into account. Factors such as blood pressure, cholesterol levels, and cardiac function will be assessed.

- Medications and Treatment Compliance: Adherence to prescribed medications and treatment plans is important. Demonstrating consistent compliance with medications and regular follow-up appointments with healthcare providers can positively impact the underwriting decision.

- Stability and Prognosis: The stability of the VSD, including whether it has shown signs of closure or improvement over time, will be considered. A positive prognosis with a low likelihood of complications can increase the chances of obtaining coverage.

- Lifestyle Factors: Certain lifestyle choices, such as smoking, excessive alcohol consumption, or engagement in high-risk activities, can affect the underwriting decision. Adopting a healthy lifestyle and managing associated risk factors may improve eligibility for coverage.

- Age and Gender: Age and gender play a role in the underwriting process. Younger individuals and females may be viewed more favorably due to potentially lower risk profiles.

- Underwriting Guidelines: Each insurance company has its own underwriting guidelines and risk tolerance. These guidelines may vary, leading to differences in how VSD is assessed and the resulting rating class or coverage eligibility.

It’s essential to note that these factors are general considerations, and the underwriting process can be complex and highly individualized. Working with an experienced insurance agent or broker who understands the nuances of underwriting for VSD and has access to a wide range of insurance providers can help individuals navigate the process and find the most suitable coverage options.

Tips to improve One’s chances of being approved

While obtaining life insurance with Ventricular Septal Defect (VSD) can pose challenges, there are steps individuals can take to enhance their chances of being approved. Here are some tips to improve your likelihood of obtaining life insurance coverage:

- Maintain Regular Follow-Up with Healthcare Providers: It’s important to stay proactive about your health and attend regular check-ups with your cardiologist or healthcare team. Consistent medical monitoring and documentation of your condition can demonstrate responsible management of your VSD.

- Comply with Treatment Plans and Medication Regimens: Adhering to prescribed treatment plans, including taking medications as directed, is crucial. Consistent compliance demonstrates a commitment to managing your VSD and can positively influence the underwriting decision.

- Adopt a Healthy Lifestyle: Embracing a healthy lifestyle can have a positive impact on your overall health and may improve your eligibility for life insurance coverage. This includes maintaining a balanced diet, engaging in regular exercise as permitted by your healthcare provider, and avoiding tobacco use.

- Manage Associated Risk Factors: Take proactive steps to manage any risk factors associated with VSD. For example, controlling blood pressure, cholesterol levels, and other cardiovascular risk factors can demonstrate a commitment to maintaining good health.

- Demonstrate Long-Term Stability: If your VSD has shown signs of closure, improvement, or stability over time, provide medical records and documentation to support this. Showing long-term stability and a favorable prognosis can strengthen your case during the underwriting process.

- Work with an Experienced Insurance Agent or Broker: Seek the assistance of an insurance professional who specializes in high-risk cases or medical conditions like VSD. They can guide you through the application process, help you gather the necessary documentation, and navigate the insurance landscape to find suitable coverage options.

- Consider Alternative Options: If traditional coverage is not available or affordable, explore alternative options such as guaranteed issue life insurance or simplified issue policies. These types of policies often have less stringent underwriting requirements and may be more accessible for individuals with pre-existing conditions.

Remember that each insurance company has its own underwriting guidelines and risk assessments. It’s essential to disclose your VSD and provide accurate and thorough information during the application process. By taking proactive steps to manage your condition, demonstrating stability, and working with experienced professionals, you can improve your chances of obtaining life insurance coverage despite having a Ventricular Septal Defect.

Final thoughts…

Obtaining life insurance with Ventricular Septal Defect (VSD) may require additional effort and consideration, but it is certainly possible. By understanding the factors that insurance companies evaluate, such as the severity of VSD, treatment history, overall health, and lifestyle choices, individuals can take proactive steps to improve their chances of being approved for coverage.

It is crucial to work closely with experienced insurance professionals who specialize in high-risk cases to navigate the underwriting process and explore alternative options if traditional coverage is not readily available.

Remember, protecting your financial well-being through life insurance is an essential step towards providing security for yourself and your loved ones, even in the face of medical conditions like VSD.