Life insurance is an essential investment that provides financial security for your loved ones in the event of your unexpected death. However, obtaining life insurance coverage can be challenging if you have a pre-existing medical condition like arrhythmia.

In this article, we will explore the difficulties faced by individuals with arrhythmia in obtaining life insurance coverage, the impact of arrhythmia on life insurance approvals, and strategies that can help you improve your chances of getting life insurance coverage. We will also provide real-life case studies to help you understand how life insurance approvals with arrhythmia work in practice.

By the end of this article, you will have a better understanding of how to navigate the life insurance approval process with arrhythmia and ensure that you and your loved ones have the financial security you need.

Understanding Arrhythmias

Arrhythmia is a medical condition that affects the heart’s electrical system, causing an irregular heartbeat. It can cause the heart to beat too fast, too slow, or irregularly. This can affect the heart’s ability to pump blood effectively, leading to complications.

Types of Arrhythmias

There are several types of arrhythmias, including:

Atrial fibrillation (AFib): Atrial fibrillation (AFib) is a type of arrhythmia where the heart’s upper chambers (atria) beat irregularly and out of sync with the lower chambers (ventricles). Instead of a regular heartbeat, the atria quiver or fibrillate, causing the heart to beat too fast and irregularly. This can affect the heart’s ability to pump blood effectively, leading to complications such as blood clots, stroke, and heart failure.Ventricular fibrillation: A life-threatening arrhythmia where the heart’s lower chambers quiver instead of pumping blood effectively.

Supraventricular tachycardia: Supraventricular tachycardia (SVT) is a type of arrhythmia that originates in the heart’s upper chambers (atria) or the atrioventricular (AV) node, which regulates the electrical signals between the atria and the ventricles. In SVT, the heart beats abnormally fast, usually at a rate of more than 100 beats per minute.

Bradycardia: Bradycardia is a type of arrhythmia characterized by a slow heart rate, usually less than 60 beats per minute. Bradycardia can occur in people of all ages, but it is more common in older adults..

Premature ventricular contractions: Premature ventricular contractions (PVCs) are a type of arrhythmia that originates in the heart’s lower chambers (ventricles). In PVCs, the heart beats irregularly, with an extra beat occurring earlier than expected, which can disrupt the heart’s normal rhythm.

Symptoms of an Arrhythmia

The symptoms of arrhythmia can vary depending on the type of arrhythmia and the underlying cause. Some people may not experience any symptoms at all, while others may have significant symptoms that can affect their daily life.

Common symptoms of arrhythmia can include:

- Palpitations – a feeling that your heart is skipping a beat, fluttering or racing.

- Chest discomfort or pain.

- Shortness of breath or difficulty breathing.

- Fatigue or weakness.

- Dizziness or lightheadedness.

- Fainting or near-fainting.

In some cases, arrhythmia can be asymptomatic and only detected during a routine medical examination.

Potential causes of an Arrhythmia

The causes of arrhythmia can vary, and in many cases, the exact cause is unknown. However, some common causes and risk factors for arrhythmia include:

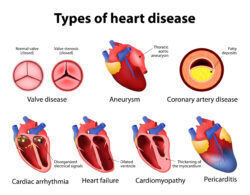

Heart disease: Conditions such as coronary artery disease, heart valve disease, and heart failure can increase the risk of developing arrhythmia.

Electrolyte imbalances: An imbalance in the levels of minerals such as potassium, sodium, calcium, and magnesium in the body can affect the heart’s electrical activity and trigger arrhythmia.

Medications: Some medications, such as certain blood pressure medications, asthma medications, and antidepressants, can cause arrhythmia as a side effect.

Substance abuse: Alcohol, caffeine, nicotine, and illegal drugs can trigger arrhythmia.

Genetics: Some arrhythmias can be inherited, such as Long QT syndrome, which is a genetic disorder that affects the heart’s electrical activity.

Age: As people age, the risk of developing arrhythmia increases.

Other factors: Other factors that can increase the risk of arrhythmia include stress, sleep apnea, obesity, and other underlying medical conditions such as thyroid disease or diabetes.

Life insurance and arrhythmia

Life insurance is a contract between an individual and an insurance company in which the individual pays regular premiums, and in return, the insurance company pays a death benefit to the individual’s beneficiaries if they die during the policy term. Life insurance provides financial protection for loved ones in the event of an individual’s unexpected death.

Why arrhythmia can impact life insurance:

Arrhythmia can impact life insurance because it can increase the risk of an individual dying prematurely. Life insurance companies use a variety of factors, including an individual’s health status, to determine the premiums they charge for life insurance policies. Individuals with pre- existing medical conditions such as arrhythmia may be deemed higher risk, and as a result, they may have to pay higher premiums for life insurance coverage.

How underwriters assess risk:

Life insurance underwriters assess the risk associated with insuring an individual based on a variety of factors, including age, health status, lifestyle habits, and family history. Underwriters evaluate the risk associated with insuring an individual by reviewing their medical history, including any pre-existing conditions such as arrhythmia. Underwriters use this information to determine the likelihood of the individual dying during the policy term and set the premium rates accordingly.

Factors that impact life insurance approval with arrhythmia:

When assessing an individual with arrhythmia for life insurance approval, underwriters will consider several factors, including:

Type of arrhythmia: Some types of arrhythmia may be deemed less severe than others and may have a lower impact on life insurance approval.

Severity of the arrhythmia: Underwriters will evaluate the frequency and duration of the arrhythmia, as well as any associated symptoms or complications.

Treatment plan: If the individual is undergoing treatment for arrhythmia, underwriters will evaluate the effectiveness of the treatment plan and any potential side effects of the medication.

Age: Underwriters will consider the individual’s age, as arrhythmia is more common in older adults.

Overall health status: Underwriters will consider the individual’s overall health status, including any other pre-existing medical conditions, lifestyle habits, and family history.

Based on these factors, underwriters will determine the individual’s risk profile and decide whether to approve their application for life insurance coverage and set the premium rates accordingly.

Strategies to Improve Life Insurance Approval with Arrhythmia

When applying for life insurance with arrhythmia, it is important to gather all relevant medical information, including medical records and test results, to provide to the insurance underwriter. This information will help the underwriter evaluate the individual’s overall health status and determine their risk profile.

Working with an experienced life insurance agent:

Working with an experienced life insurance agent can be beneficial in navigating the life insurance application process with arrhythmia. An experienced agent can help the individual gather the necessary medical information and navigate the underwriting process to help increase their chances of approval.

Obtaining a cardiologist’s report:

Obtaining a cardiologist’s report can be helpful in providing additional information to the insurance underwriter regarding the individual’s arrhythmia and treatment plan. The report should include details on the individual’s arrhythmia diagnosis, treatment plan, and any associated complications.

Making lifestyle changes:

Making lifestyle changes such as quitting smoking, reducing alcohol and caffeine consumption, and engaging in regular exercise can help improve overall health and reduce the risk associated with arrhythmia. These lifestyle changes may also help improve the individual’s chances of approval for life insurance coverage.

Applying for the right type of life insurance policy:

Individuals with arrhythmia may have more success obtaining coverage through a simplified issue or guaranteed issue life insurance policy, which typically do not require a medical exam. These policies may have higher premiums than traditional life insurance policies but may be easier to obtain for individuals with pre-existing medical conditions.

In summary, improving life insurance approval with arrhythmia involves gathering relevant medical information, working with an experienced agent, obtaining a cardiologist’s report, making lifestyle changes, and applying for the right type of life insurance policy. By taking these steps, individuals with arrhythmia can increase their chances of obtaining life insurance coverage at an affordable rate.

At the end of the day…

It’s fair to say that Arrhythmia is a common heart condition that can impact an individual’s ability to obtain life insurance coverage. However, with the right strategies, individuals with arrhythmia can increase their chances of approval. These strategies include gathering relevant medical information, working with an experienced agent, obtaining a cardiologist’s report, making lifestyle changes, and applying for the right type of life insurance policy.

Frequently asked questions

What is an arrhythmia?

Arrhythmia is a heart condition characterized by an irregular heartbeat, which can be too slow, too fast, or irregular.

Can I get life insurance with an arrhythmia?

Yes, it is possible to get life insurance with arrhythmia, but the approval and pricing of the policy may be impacted by the severity of the condition and the treatment plan.

What factors impact life insurance approval with arrhythmia?

Factors that can impact life insurance approval with arrhythmia include the type and severity of the arrhythmia, the frequency of episodes, the individual’s age and overall health, and the treatment plan.

What type of life insurance policy is best for someone with arrhythmia?

The best type of life insurance policy for someone with arrhythmia may vary depending on their individual circumstances. It is important to consult with an experienced life insurance agent to determine the most appropriate policy.

What information do I need to provide to the insurance company when applying for life insurance with arrhythmia?

When applying for life insurance with arrhythmia, you will need to provide relevant medical information, including your diagnosis, treatment plan, and any medications you are taking. The insurance company may also request additional information from your healthcare provider.

How do underwriters assess risk for individuals with arrhythmia?

Underwriters assess risk for individuals with arrhythmia based on factors such as the type and severity of the arrhythmia, the frequency of episodes, the individual’s age and overall health, and the treatment plan. They may also consider other factors such as family history and lifestyle.

What can I do to improve my chances of getting approved for life insurance with arrhythmia?

To improve your chances of getting approved for life insurance with arrhythmia, you can take steps to improve your overall health, work with an experienced life insurance agent, obtain a cardiologist’s report, and apply for the right type of policy.

Can I apply for life insurance if I have a pacemaker?

Yes, it is possible to apply for life insurance if you have a pacemaker. The approval and pricing of the policy may be impacted by the presence of the pacemaker and any associated medical conditions.

Will I have to pay higher premiums if I have arrhythmia?

It is possible that you may have to pay higher premiums if you have arrhythmia, depending on the severity of the condition and the treatment plan. However, with the right approach, it is still possible to obtain affordable life insurance coverage.

What should I do if I am denied coverage for life insurance with arrhythmia?

If you are denied coverage for life insurance with arrhythmia, you should explore all options for obtaining coverage, including simplified issue or guaranteed issue policies, and work with experienced professionals who can help navigate the application process.