Acid reflux is a common health condition that affects millions of people worldwide. While it may not be life-threatening in itself, acid reflux can increase the risk of more serious health problems. As such, it is crucial to manage acid reflux properly to ensure a long and healthy life. One important aspect of this management is obtaining life insurance coverage, which can provide peace of mind for both the individual and their loved ones.

However, getting life insurance approval can be difficult for those with acid reflux. In this article, we will explore the challenges acid reflux patients face when trying to obtain life insurance and provide tips on how to improve their chances of approval. We will also discuss some of the companies that specialize in approving acid reflux patients and their policies.

What is acid reflux?

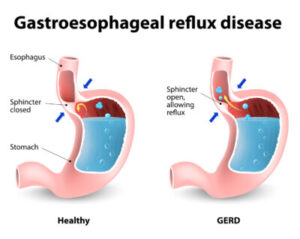

Acid reflux, also known as gastroesophageal reflux disease (GERD), is a condition where stomach acid and other contents flow back up into the esophagus. The esophagus is the tube that connects the throat to the stomach, and when acid reflux occurs, it can cause discomfort and damage to the lining of the esophagus.

The primary cause of acid reflux is a weak or malfunctioning lower esophageal sphincter (LES), which is the muscle at the bottom of the esophagus that normally closes off the stomach. When the LES doesn’t function properly, stomach acid can flow back into the esophagus, causing acid reflux.

Other factors that can contribute to acid reflux include:

- Obesity or excess weight

- Pregnancy

- Smoking

- Certain medications, such as antihistamines and calcium channel blockers

- Eating large meals or lying down after eating

- Eating spicy, acidic, or fatty foods

- Hiatal hernia

Symptoms of acid reflux can include:

- Heartburn or chest pain

- Regurgitation of food or sour liquid

- Difficulty swallowing

- Hoarseness or sore throat

- Chronic cough

- Asthma or asthma-like symptoms

- Dental problems

Potential difficulty of obtaining life insurance for acid reflux patients

Obtaining life insurance for acid reflux patients can be difficult because of the increased risk of health complications associated with the condition. This is because Insurance companies use a risk-based approach to underwriting, meaning they assess an individual’s risk of mortality or morbidity based on various factors, including their health status. And since acid reflux can affect life insurance approval because it can increase the risk of more serious health problems, such as esophageal cancer, Barrett’s esophagus, and respiratory problems.

Some insurance companies may view acid reflux as a pre-existing condition, which could result in higher premiums or exclusions on the policy. Additionally, if an individual has a history of acid reflux-related complications or treatments, such as surgery or medication, it could further impact their ability to obtain life insurance.

How to improve chances of life insurance approval for acid reflux patients

If you have acid reflux and are looking to obtain life insurance coverage, there are several steps you can take to improve your chances of approval including:

Managing acid reflux symptoms:

Managing acid reflux symptoms is essential for improving the chances of life insurance approval. Some tips for managing acid reflux symptoms include:

- Eating smaller, more frequent meals

- Avoiding trigger foods, such as spicy, fatty, or acidic foods

- Not lying down immediately after eating

- Elevating the head of the bed while sleeping

- Maintaining a healthy weight

- Quitting smoking

- Managing stress

Regular doctor visits:

Regular doctor visits are also crucial for acid reflux patients to improve their chances of life insurance approval. Regular check-ups with a doctor can help monitor the condition and identify any potential complications or related health problems. It also shows the insurance company that the individual is taking the necessary steps to manage their health.

Choosing the right policy/company

Choosing the right life insurance company/policy is important for acid reflux patients to improve their chances of approval. Some insurance companies specialize in providing coverage for individuals with pre-existing conditions, including acid reflux. It may also be helpful to work with an independent insurance agent who can shop around for policies from multiple insurance companies to find the best coverage and rates. It is important to read the policy carefully and understand any exclusions or limitations related to acid reflux or other pre-existing conditions.

Life insurance companies that approve acid reflux patients

Some life insurance companies specialize in approving coverage for individuals with pre-existing conditions, including acid reflux. These companies understand the unique health risks associated with acid reflux and offer policies that provide coverage and protection for these individuals.

When comparing policies and prices, it’s important to consider the coverage options, premiums, and any exclusions related to acid reflux or other pre-existing conditions. Some of the top companies that approve acid reflux patients include AIG, Prudential, Mutual of Omaha, and Transamerica. That said, it’s important to understand that each company has its own underwriting guidelines and may offer different coverage options and premiums and that suffering from acid reflux is just one of many factors that may determine the outcome of your life insurance application.

Lastly, we should remind everyone that applying for life insurance typically involves completing an application, undergoing a medical exam, and providing information about your medical history and any pre-existing conditions, including acid reflux. It is important, to be honest, and accurate when providing this information, as any discrepancies could impact the approval process.

In summary…

If you have acid reflux and are looking for life insurance coverage, there are steps you can take to improve your chances of approval. These include managing your symptoms, seeking regular medical care, and working with an independent insurance agent to find the right policy for your needs. With the right approach, you can obtain the coverage you need to protect your loved ones and secure your financial future.

Frequently asked questions

Can I get life insurance if I have acid reflux?

Yes, you can get life insurance if you have acid reflux, but the approval process may be more challenging due to the increased health risks associated with the condition.

Will having acid reflux impact my life insurance rates?

It is possible that having acid reflux could impact your life insurance rates, as insurance companies assess risk based on various factors, including health status and pre-existing conditions.

How can I improve my chances of getting approved for life insurance with acid reflux?

Managing your acid reflux symptoms, seeking regular medical care, and working with an independent insurance agent can all improve your chances of getting approved for life insurance coverage.

What types of life insurance policies are available for acid reflux patients?

Acid reflux patients may be able to qualify for several types of life insurance policies, including term life insurance, whole life insurance, and guaranteed issue life insurance. However, the availability of each type of policy and the cost will depend on your specific health history and other factors.

Will my acid reflux medications impact my life insurance application?

Your acid reflux medications may impact your life insurance application as insurance companies typically consider all aspects of your health when assessing risk. However, whether your medications impact your application depends on the specific type and dosage of medication you are taking, as well as other factors such as your overall health, age, and lifestyle habits. It is important to be honest and transparent about your medication use on your application.

Do I need to disclose my acid reflux on my life insurance application?

Yes, it is important to disclose your acid reflux on your life insurance application. Insurance companies require applicants to provide accurate and complete information about their medical history and health status, including any pre-existing conditions such as acid reflux. Failing to disclose your acid reflux could result in a denied claim or even the cancellation of your policy if the insurance company discovers the condition after the fact. It’s always best to be honest and transparent about your health history on your application.

Can I still get life insurance if I have a history of acid reflux-related surgeries?

Yes, you may still be able to get life insurance if you have a history of acid reflux-related surgeries. However, whether you can get approved for coverage, and at what cost, will depend on a variety of factors, including the severity and frequency of your acid reflux symptoms, the type and frequency of surgeries you have undergone, and other factors such as your overall health, age, and lifestyle habits. You should be prepared to provide detailed medical records and other documentation related to your surgeries when applying for life insurance.

How long does the life insurance approval process take for acid reflux patients?

The life insurance approval process can vary depending on a variety of factors, including the insurance company you apply to, the type of policy you are seeking, and your individual health history. In general, it can take anywhere from several days to several weeks to receive approval for a life insurance policy. Acid reflux patients may experience a longer approval process, as insurance companies may want to review your medical records and assess your risk based on your specific symptoms and treatment history. It’s important to be patient and thorough when applying for life insurance to ensure that you receive the best possible coverage at a fair price.

How much life insurance coverage do I need as an acid reflux patient?

The amount of life insurance coverage you need as an acid reflux patient depends on a variety of factors, including your current health status, age, lifestyle habits, and financial obligations. You should aim to purchase enough life insurance coverage to ensure that your loved ones are financially secure if you were to pass away unexpectedly. A common rule of thumb is to purchase coverage that is equal to 10 to 12 times your annual income. However, you may need more or less coverage depending on your individual circumstances. It is important to speak with a financial advisor or insurance agent to determine the appropriate level of coverage for your needs.