In this article, we will discuss the challenges of getting life insurance with cerebral sclerosis, the types of coverage available, and the steps you can take to increase your chances of getting approved for life insurance.

Understanding Cerebral Sclerosis

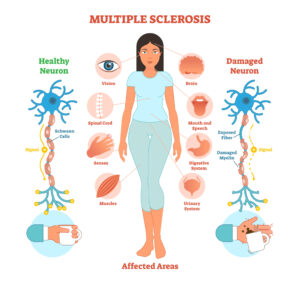

Cerebral sclerosis, also known as multiple sclerosis (MS), is a chronic autoimmune disease that affects the central nervous system. It causes the body’s immune system to attack and damage the myelin sheath, a protective covering that surrounds nerve fibers in the brain and spinal cord. This damage disrupts the normal flow of electrical impulses in the central nervous system, which can lead to a wide range of symptoms.

Causes:

The exact cause of cerebral sclerosis is unknown, but it is believed to be a combination of genetic and environmental factors. Some possible triggers include viral infections, vitamin D deficiency, smoking, and exposure to certain toxins.

Symptoms:

The symptoms of cerebral sclerosis can vary widely depending on the location and extent of the damage in the central nervous system. Some common symptoms include:

- Fatigue

- Difficulty with coordination and mobility

- Muscle weakness

- Numbness or tingling in the limbs

- Vision problems

- Bladder or bowel dysfunction

- Cognitive impairment

- Depression and anxiety

Treatment:

There is no cure for cerebral sclerosis, but there are treatments available that can help manage symptoms and slow the progression of the disease. Some common treatments include:

- Medications – Medications like corticosteroids, immunosuppressants, and disease-modifying therapies can help reduce inflammation and slow the progression of the disease.

- Physical Therapy – Physical therapy can help improve mobility, balance, and coordination.

- Occupational Therapy – Occupational therapy can help individuals with cerebral sclerosis learn new ways to perform everyday tasks and improve their quality of life.

- Speech Therapy – Speech therapy can help individuals with cerebral sclerosis improve their communication skills and manage swallowing difficulties.

Worst Case Scenario:

In rare cases, cerebral sclerosis can lead to severe disability or even death. The worst case scenario for cerebral sclerosis would be a rapid and aggressive progression of the disease, leading to significant loss of mobility, cognitive impairment, and other complications.

However, with proper medical care and management, many individuals with cerebral sclerosis are able to lead full and active lives. It is important to work with a healthcare team and develop a treatment plan that meets individual needs and goals.

Challenges of Getting Life Insurance with Cerebral Sclerosis

Individuals who have been diagnosed with cerebral sclerosis, will most likely be denied when trying to obtain traditional life insurance coverage due to the progressive nature of the disease. For this reason, applicants will need to seek out alternative life insurance options that may be available to them. Options such as group life insurance, guaranteed issue life insurance and/or accidental death insurance.

Group Life Insurance

Group life insurance is a type of life insurance policy that is offered by an employer or organization to a group of individuals. The policy provides coverage for a specified amount of time and pays out a death benefit to the beneficiary in the event of the insured’s death. Here are some of the pros and cons of group life insurance:

Pros:

- No Medical Exam: One of the biggest advantages of group life insurance is that it usually does not require a medical exam or underwriting. This means that individuals with pre-existing medical conditions, such as cerebral sclerosis, may still be able to obtain coverage through their employer or organization.

- Lower Premiums: Group life insurance policies are typically less expensive than individual life insurance policies because the premiums are spread out among a large group of people. This can make it more affordable for individuals who may not be able to afford an individual policy.

- Convenience: Group life insurance is often offered as part of an employer’s benefits package, which means that individuals can enroll in the policy without having to do much work on their own. The premiums may also be deducted from an individual’s paycheck, making it easy to pay for coverage.

- Immediate Coverage: With group life insurance, coverage usually begins as soon as an individual enrolls in the policy. This means that there is no waiting period for coverage to start.

Cons:

- Limited Coverage: Group life insurance policies typically provide a set amount of coverage, which may not be sufficient for everyone’s needs. Individuals may need to purchase additional coverage through an individual policy to ensure that their loved ones are adequately protected.

- Limited Portability: Group life insurance policies are often tied to an individual’s employment or membership in an organization. This means that if an individual leaves their job or organization, they may lose their coverage. However, some policies may offer the option to convert to an individual policy, which can provide ongoing coverage.

- Limited Customization: Group life insurance policies are typically one-size-fits-all, which means that individuals may not have the option to customize their coverage to meet their specific needs. This can be a disadvantage for individuals who need more coverage or have specific concerns related to their health status.

- Lack of Control: With group life insurance, the employer or organization controls the policy and may have the ability to change or cancel the policy at any time. This lack of control can be a disadvantage for individuals who want more say in their coverage.

Summation:

Group life insurance can be a good option for individuals who want to obtain life insurance coverage through their employer or organization. However, it is important to carefully consider the pros and cons of group life insurance before enrolling in a policy. While group life insurance may be more affordable and convenient, it may also come with limited coverage, limited portability, and limited customization options. Individuals should also explore other life insurance options, such as individual policies, to ensure that they have the coverage they need to protect their loved ones in the event of an unexpected death.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of life insurance policy that is typically offered to individuals who are unable to qualify for traditional life insurance policies due to their health or other risk factors. Here are some of the pros and cons of guaranteed issue life insurance:

Pros:

- No Medical Exam: Guaranteed issue life insurance does not require a medical exam or underwriting. This means that individuals with pre-existing medical conditions, such as cerebral sclerosis, can still obtain coverage.

- Guaranteed Approval: As the name suggests, guaranteed issue life insurance policies guarantee approval for coverage. As long as an individual meets the eligibility criteria, they will be approved for coverage.

- Immediate Coverage: Guaranteed issue life insurance policies typically provide immediate coverage. This means that there is no waiting period for coverage to begin.

- Simple Application Process: The application process for guaranteed issue life insurance is usually very simple and straightforward. Individuals only need to answer a few basic questions to apply for coverage.

Cons:

- High Premiums: Guaranteed issue life insurance policies are typically more expensive than traditional life insurance policies. This is because the insurance company is taking on more risk by insuring individuals who are considered high-risk.

- Limited Coverage: Guaranteed issue life insurance policies usually provide a limited amount of coverage. The death benefit may be as low as a few thousand dollars, which may not be enough to cover an individual’s final expenses or provide for their loved ones after their death.

- Limited Benefits: Guaranteed issue life insurance policies may also have limited benefits, such as no cash value accumulation or limited riders and options.

- Limited Eligibility: Not everyone is eligible for guaranteed issue life insurance. Eligibility criteria may vary by insurer, but typically, individuals must be within a certain age range and may not be able to obtain coverage after a certain age.

- Graded death benefits

Summation:

Guaranteed issue life insurance can be a good option for individuals who are unable to qualify for traditional life insurance policies due to their health or other risk factors. However, it is important to carefully consider the pros and cons of guaranteed issue life insurance before enrolling in a policy. While guaranteed issue life insurance may guarantee approval for coverage and provide immediate coverage, it may also come with high premiums, limited coverage, and limited benefits. Individuals should also explore other life insurance options, such as group or individual policies, to ensure that they have the coverage they need to protect their loved ones in the event of an unexpected death.

Accidental Death Insurance

Accidental death insurance, also known as accidental death and dismemberment insurance (AD&D), is a type of life insurance policy that provides coverage in the event of death or dismemberment resulting from an accident. Here are some of the pros and cons of accidental death insurance:

Pros:

- Affordable: Accidental death insurance policies are typically more affordable than traditional life insurance policies, making them an accessible option for individuals who may not have the means to pay for more expensive policies.

- Additional Coverage: Accidental death insurance can provide additional coverage in the event of an accidental death. This can be beneficial for individuals who have a higher risk of accidental death, such as those who work in high-risk jobs or participate in extreme sports.

- Easy to Obtain: Accidental death insurance policies are usually easy to obtain and may not require a medical exam or extensive underwriting. This can be beneficial for individuals who have pre-existing health conditions that may make it difficult for them to obtain traditional life insurance coverage.

- Fast Payout: Accidental death insurance policies typically pay out quickly after the policyholder’s death, providing financial support for the policyholder’s beneficiaries.

Cons:

- Limited Coverage: Accidental death insurance policies only provide coverage in the event of an accidental death or dismemberment. They do not provide coverage for death resulting from natural causes or illness.

- Limited Benefits: Accidental death insurance policies may also have limited benefits. For example, they may not cover certain types of accidents or may have limited coverage for certain types of injuries.

- Exclusions: Accidental death insurance policies may have exclusions for certain activities or behaviors. For example, if the policyholder dies as a result of participating in an activity that is excluded from the policy, the policy may not pay out.

- Not a Substitute for Traditional Life Insurance: Accidental death insurance policies are not a substitute for traditional life insurance. They only provide coverage in the event of accidental death or dismemberment and may not provide enough coverage for the policyholder’s beneficiaries.

Summation:

Accidental death insurance can provide additional coverage and financial support for the policyholder’s beneficiaries in the event of an accidental death or dismemberment. However, it is important to carefully consider the pros and cons of accidental death insurance before enrolling in a policy. While accidental death insurance may be affordable and easy to obtain, it may have limited coverage and benefits, and may not be a substitute for traditional life insurance. Individuals should also explore other life insurance options, such as group or individual policies, to ensure that they have the coverage they need to protect their loved ones in the event of an unexpected death.

Final thoughts…

Getting life insurance for cerebral sclerosis can be challenging, but it is not impossible. Being honest about your condition, working with an experienced insurance agent, and providing as much medical information as possible, will significantly increase your chances at finding coverage that you can both qualify and afford. The good news is that we can help, you just need to give us a call!