Cerebrospinal meningitis, also known as meningococcal meningitis, is a bacterial infection that affects the protective membranes that surround the brain and spinal cord. This condition can be life-threatening, and it is essential to take measures to protect yourself and your family against it.

If you have been diagnosed with cerebrospinal meningitis, you may be concerned about how this will affect your ability to obtain life insurance. In this article, we will explore the life insurance approval process for individuals with cerebrospinal meningitis and provide tips to help you secure coverage.

What is cerebrospinal meningitis?

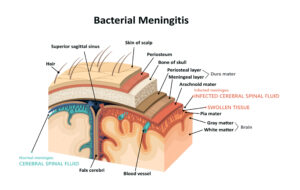

Cerebrospinal meningitis is a serious bacterial infection that affects the meninges, which are the protective membranes that surround the brain and spinal cord. This condition is caused by the Neisseria meningitidis bacteria and is highly contagious.

Causes:

Cerebrospinal meningitis is spread through contact with respiratory or throat secretions, such as saliva, coughing, or sneezing. It can also be spread through close contact with an infected person, such as kissing or sharing utensils.

Symptoms:

The symptoms of cerebrospinal meningitis can be similar to those of the flu or a cold, making it difficult to diagnose. The initial symptoms may include fever, headache, nausea, vomiting, and a stiff neck. As the infection progresses, other symptoms may develop, such as sensitivity to light, confusion, seizures, and loss of consciousness. In severe cases, the infection can lead to sepsis, organ failure, and even death.

Treatment:

Cerebrospinal meningitis is a medical emergency that requires immediate treatment. Antibiotics are typically used to treat the infection and reduce the risk of complications. In some cases, hospitalization may be necessary to monitor the patient’s condition and provide supportive care.

Worst case scenario:

The worst-case scenario for cerebrospinal meningitis is when the infection progresses to sepsis, which is a life-threatening condition that occurs when the infection spreads throughout the body. Sepsis can lead to organ failure, septic shock, and even death. In severe cases, the infection can also cause neurological damage or brain swelling, which can result in long-term complications such as cognitive impairment, hearing loss, or seizures.

Prevention:

Preventing cerebrospinal meningitis involves taking measures to reduce the risk of infection. These measures include maintaining good hygiene, avoiding close contact with infected individuals, and getting vaccinated. The meningococcal vaccine is highly effective at preventing meningococcal meningitis and is recommended for individuals who are at increased risk of infection, such as college students living in dormitories, military personnel, and individuals with weakened immune systems.

In conclusion, cerebrospinal meningitis is a serious bacterial infection that can have life-threatening complications. Early diagnosis and treatment are essential for a positive outcome. Prevention measures such as vaccination and good hygiene practices can help reduce the risk of infection.

How does cerebrospinal meningitis affect life insurance approval?

If an applicant has fully recovered from cerebrospinal meningitis and there are no lingering effects or complications, chances are, having suffered from cerebrospinal meningitis won’t play a role in the outcome of one’s life insurance application. That said, however, If an applicant is actively receiving treatment for cerebrospinal meningitis, it is highly unlikely that they will be able to obtain life insurance coverage until they have fully recovered. Insurance companies view active infections as a significant health risk and may be unwilling to take on that risk.

Factors that may impact life insurance approval with cerebrospinal meningitis

When assessing your application, insurance companies will consider various factors, including:

- The severity of your condition: The severity of your cerebrospinal meningitis will be a significant factor in the underwriting decision. If you have had severe symptoms or complications, such as neurological damage or prolonged hospitalization, this may increase the risk you pose to the insurer and result in higher premiums or a denial of coverage.

- The length of time since your diagnosis: The length of time since your diagnosis can also impact your life insurance application. If you were diagnosed with cerebrospinal meningitis recently, this may raise concerns about the stability of your condition and the likelihood of future complications. However, if you have been in remission for a significant period, this may indicate that your condition is under control and may result in more favorable underwriting terms.

- Your age: Your age will also be a factor in the underwriting decision. Generally, younger individuals are considered lower risk than older individuals, and may, therefore, have more favorable underwriting terms.

- Your overall health status: Your overall health status, including any other pre-existing medical conditions, will also be considered in the underwriting decision. If you have other medical conditions that increase your risk, this may further impact the underwriting decision.

Tips for securing life insurance coverage with cerebrospinal meningitis

If you have been diagnosed with cerebrospinal meningitis and are concerned about securing life insurance coverage, there are several steps you can take to increase your chances of approval.

- Shop around: Different insurance companies have different underwriting guidelines, so it is essential to shop around and compare quotes from multiple insurers. Working with an independent insurance agent who specializes in high-risk cases can help you find insurers that are more likely to approve your application and offer more favorable underwriting terms.

- Be upfront about your medical history: When applying for life insurance, it is essential to be honest and upfront about your medical history. Failing to disclose your cerebrospinal meningitis diagnosis can result in a denial of coverage or the cancellation of your policy.

- Provide detailed medical records: Providing detailed medical records and documentation can help insurance companies assess your condition more accurately. This can include medical reports, lab results, and notes from your healthcare provider.

- Follow your treatment plan: Following your treatment plan and attending regular follow-up appointments can help demonstrate that your condition is under control and reduce concerns about future complications.

- Consider a graded or guaranteed issue policy: If you are unable to qualify for traditional life insurance coverage, you may want to consider a graded or guaranteed issue policy. These policies are typically more expensive and offer lower coverage amounts, but they may be a viable option if you are unable to obtain traditional coverage.

In conclusion, securing life insurance coverage with cerebrospinal meningitis can be challenging, but it is possible. The key is to shop around, be upfront about your medical history, provide detailed medical records, follow your treatment plan, and consider alternative coverage options. By taking these steps, you can increase your chances of obtaining life insurance coverage that provides financial security for you and your loved ones.

Frequently Asked Questions

What is cerebrospinal meningitis?

Cerebrospinal meningitis, also known as meningococcal meningitis, is a bacterial infection that affects the protective membranes surrounding the brain and spinal cord.

Can cerebrospinal meningitis affect life insurance approval?

Yes, cerebrospinal meningitis can affect life insurance approval, especially if the applicant has a current or recent history of the infection.

Can I get life insurance if I have had cerebrospinal meningitis in the past?

It may be possible to obtain life insurance coverage if you have fully recovered from cerebrospinal meningitis and there are no lingering effects or complications. However, you may need to provide detailed medical records and documentation to support your application.

Will I have to pay a higher premium if I have a history of cerebrospinal meningitis?

It is possible that you may have to pay a higher premium or be subject to more restrictive policy terms if you have a history of cerebrospinal meningitis. This is because insurance companies view the infection as a significant health risk.

Can I get life insurance if I am currently receiving treatment for cerebrospinal meningitis?

It is highly unlikely that you will be able to obtain life insurance coverage if you are actively receiving treatment for cerebrospinal meningitis. Insurance companies view active infections as a significant health risk and may be unwilling to take on that risk.

Do I need to disclose my history of cerebrospinal meningitis when applying for life insurance?

Yes, you should always disclose your medical history when applying for life insurance, including any history of cerebrospinal meningitis. Failure to disclose your medical history can result in your policy being voided in the event of a claim.

Can I still get life insurance if I have a pre-existing condition like cerebrospinal meningitis?

It is possible to obtain life insurance coverage if you have a pre-existing condition like cerebrospinal meningitis, but you may need to provide additional medical information and may be subject to more restrictive policy terms.