As men age, they may experience an enlarged prostate, a common condition that can cause discomfort and interfere with daily life. For those seeking life insurance, an enlarged prostate can pose a challenge when it comes to underwriting and approval. However, with proper management and documentation, it is still possible to obtain life insurance coverage.

In this article, we will explore what an enlarged prostate is, how it can affect life insurance approvals, and what steps you can take to increase your chances of getting approved.

What is an Enlarged Prostate?

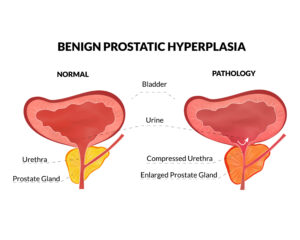

The prostate gland is a small organ located beneath the bladder in men. As men age, it is common for the prostate to enlarge. This condition is known as benign prostatic hyperplasia (BPH) and affects approximately 50% of men over the age of 50 and up to 90% of men over the age of 80.

Symptoms of an enlarged prostate can include frequent urination, difficulty urinating, weak urine flow, and the need to urinate urgently. While BPH is not typically life-threatening, it can significantly impact a man’s quality of life.

Enlarged Prostate should not be confused with Prostate Cancer

While prostate cancer and an enlarged prostate share some symptoms, they are two distinct conditions. Prostate cancer occurs when abnormal cells grow and divide uncontrollably in the prostate gland, forming a tumor. Unlike BPH, prostate cancer can spread to other parts of the body and is potentially life-threatening if left untreated.

It is important to differentiate between these two conditions, as the diagnosis and treatment options for each are different. If you are experiencing symptoms such as difficulty urinating, frequent urination, or blood in the urine, it is important to see a healthcare provider to determine the underlying cause and receive appropriate treatment.

When it comes to life insurance, insurance companies may view a history of prostate cancer as a potential risk factor and may require additional medical documentation or higher premium rates. However, having an enlarged prostate without a history of prostate cancer may not have as significant an impact on life insurance approval or rates.

How an Enlarged Prostate Affects Life Insurance Approvals

When applying for life insurance, underwriters consider a variety of factors to determine your eligibility for coverage and your premium rates. One of the factors they consider is your medical history and current health status.

For individuals with an enlarged prostate, underwriters may view this condition as a potential risk factor. This is because an enlarged prostate can sometimes be a precursor to prostate cancer, a more serious condition that can be life-threatening.

As such, underwriters may request additional medical documentation or tests to assess the severity of the enlarged prostate and rule out the presence of cancer. They may also take into account any medications or treatments that the applicant is currently receiving to manage their condition.

In some cases, an enlarged prostate may result in higher premium rates or even a declination of coverage, particularly if there are additional health concerns or risk factors present.

Additional health concerns linked to an Enlarged Prostate

While an enlarged prostate may be a concern for insurance companies, there are additional health concerns or risk factors that may be more closely tied to the condition. These may include:

- Prostate Cancer: Enlargement of the prostate gland can be a risk factor for prostate cancer, which is the second most common cancer among men in the United States. Insurance companies may view a history of prostate cancer or elevated PSA levels as a potential risk factor and may require additional medical documentation or higher premium rates.

- Urinary Tract Infections: Men with an enlarged prostate may be at an increased risk for urinary tract infections (UTIs). Repeated or severe UTIs may signal a more serious underlying condition, such as kidney or bladder damage, and may be viewed as a potential risk factor by insurance companies.

- Erectile Dysfunction: An enlarged prostate can cause pressure on the urethra, which may lead to erectile dysfunction (ED). Insurance companies may view ED as a potential risk factor for other health conditions and may request additional medical documentation or tests to assess your overall health.

- Age: Enlarged prostate is more common in men over the age of 50, and age itself may be viewed as a potential risk factor by insurance companies. As men get older, they are more likely to develop other health conditions that may impact life insurance approval or rates.

- Medications: Medications used to treat an enlarged prostate, such as alpha-blockers or 5-alpha-reductase inhibitors, may have side effects or interactions with other medications that could impact overall health. Insurance companies may view the use of these medications as a potential risk factor and may require additional medical documentation or tests to assess your overall health.

Life Insurance Options

If you have an enlarged prostate, you may be concerned about your ability to get life insurance coverage, or about the cost of coverage due to your health condition. However, there are still options available for obtaining life insurance coverage, even with an enlarged prostate.

- Guaranteed Issue Life Insurance: Guaranteed issue life insurance policies are designed for individuals who may have difficulty obtaining coverage due to health conditions or other factors. These policies typically require no medical exam or health questions, and acceptance is guaranteed regardless of your health status. However, these policies may have lower coverage amounts and higher premiums than other types of life insurance policies.

- Simplified Issue Life Insurance: Simplified issue life insurance policies may require some basic medical information, but generally do not require a medical exam. These policies typically have higher coverage amounts and lower premiums than guaranteed issue policies, but may still be an option for those with an enlarged prostate.

- Fully Underwritten Life Insurance: Fully underwritten life insurance policies require a comprehensive medical exam and detailed health history, and are generally the most affordable option for obtaining life insurance coverage. While an enlarged prostate may impact the underwriting process, it may not necessarily disqualify you from coverage. Insurance companies will take into account factors such as the severity of your condition, any treatments you have undergone, and your overall health status.

When shopping for life insurance coverage with an enlarged prostate, it is important to work with an experienced life insurance agent who can help you navigate the underwriting process and find the best coverage options for your unique situation.

Tips for Getting Life Insurance Approval with an Enlarged Prostate

If you have an enlarged prostate and are seeking life insurance coverage, there are several steps you can take to increase your chances of getting approved:

- Get Regular Check-Ups: Regular check-ups with your doctor can help ensure that your prostate is being monitored and any potential issues are being addressed promptly. This can help provide underwriters with the documentation they need to assess your health status.

- Follow Your Doctor’s Recommendations: If you are currently receiving treatment or taking medication for your enlarged prostate, it is important to follow your doctor’s recommendations and keep up with your treatment plan. This can help demonstrate to underwriters that you are actively managing your condition and taking steps to maintain your health.

- Provide Detailed Medical Information: When applying for life insurance coverage, be sure to provide detailed information about your medical history and current health status. This can include information about any medications or treatments you are currently receiving, as well as any relevant lab results or imaging studies.

- Consider a Medical Exam: Some life insurance policies require a medical exam as part of the underwriting process. While this can be an added expense and inconvenience, it can also provide underwriters with a more detailed assessment of your health status and potentially improve your chances of getting approved.

- Work with an Experienced Agent: An experienced life insurance agent can help guide you through the application process and work with underwriters on your behalf to address any concerns or questions they may have. They can also help you compare policy options and premium rates from multiple insurers to find the best coverage for your needs.

Synopsis:

While an enlarged prostate can pose a challenge when it comes to life insurance approvals, it is not an automatic disqualification. By staying proactive about managing your condition and providing thorough medical documentation, you can increase your chances of getting approved for life insurance coverage.

It is important to note that every insurance company has different underwriting guidelines and criteria, so the approval process may vary depending on the insurer. Working with an experienced life insurance agent can help you navigate the process and find the best coverage options for your unique situation.

In addition to the tips outlined above, there are other lifestyle factors that can impact your overall health and potentially improve your chances of getting approved for life insurance coverage. These include maintaining a healthy diet and exercise routine, avoiding tobacco and excessive alcohol consumption, and managing stress.

Ultimately, getting life insurance coverage with an enlarged prostate may require a bit of extra effort, but it is still possible. By staying proactive about your health and working with an experienced agent, you can find the coverage you need to protect yourself and your loved ones.Top of Form

Frequently Asked Questions

Can I still get life insurance with an enlarged prostate?

Yes, there are options available for obtaining life insurance coverage, even with an enlarged prostate. Guaranteed issue, simplified issue, and fully underwritten policies may all be options to consider, depending on your unique situation.

Will an enlarged prostate impact my life insurance rates?

It may impact your rates, depending on the severity of your condition and other factors. However, having an enlarged prostate without a history of prostate cancer may not have as significant an impact on life insurance approval or rates.

Do I need to disclose my enlarged prostate when applying for life insurance?

Yes, it is important to provide accurate and complete information when applying for life insurance coverage. Failing to disclose a pre-existing condition such as an enlarged prostate could potentially result in a denied claim in the future.

What information will the insurance company need about my enlarged prostate?

The insurance company may request information about the severity of your condition, any treatments you have undergone, and your overall health status. This information will be used to determine your risk level and any potential impact on your life insurance rates.

Will having a history of prostate cancer impact my ability to get life insurance coverage?

A history of prostate cancer may be viewed as a potential risk factor by insurance companies and may impact your ability to obtain coverage or result in higher premiums. However, there are still options available for obtaining coverage, and an experienced life insurance agent can help you find the best options for your unique situation.

How can I find the best life insurance coverage with an enlarged prostate?

Working with an experienced life insurance agent can help you navigate the underwriting process and find the best coverage options for your unique situation. An agent can help you understand the different types of policies available, as well as the coverage amounts and premiums associated with each.