In this article, we will delve into the intricacies of life insurance approvals in relation to prostate cancer. We will explore the factors that insurers consider, the potential hurdles faced by individuals with prostate cancer, and strategies to improve the chances of securing life insurance coverage. By gaining a deeper understanding of this topic, individuals can navigate the life insurance application process more effectively and make informed decisions about their financial future.

Understanding Prostate Cancer

Prostate cancer is a complex disease that affects the prostate gland, a part of the male reproductive system. Here, we will explore the causes, stages, PSA values, symptoms, treatment options, and the worst-case scenario associated with prostate cancer.

Causes:

The exact cause of prostate cancer is unknown, but several factors contribute to its development. Age is the most significant risk factor, with the likelihood of developing prostate cancer increasing with age. Family history and genetics also play a role, as men with close relatives who have had prostate cancer are at a higher risk. Hormonal imbalances, certain genetic mutations, and lifestyle factors such as diet and exercise may also influence the risk of developing prostate cancer.

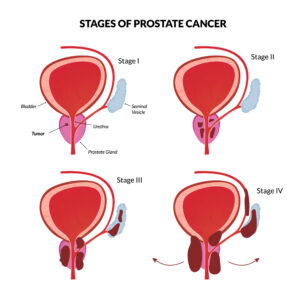

Stages of Prostate Cancer:

Prostate cancer is typically classified into four stages, which help determine the extent of the disease and guide treatment decisions. These stages are commonly referred to as T1, T2, T3, and T4, based on the TNM staging system. Let’s explore each stage:

- Stage T1: This stage indicates that the prostate cancer is not palpable or visible during a digital rectal exam (DRE) or imaging tests. It is often referred to as early or localized prostate cancer. At this stage, the cancer is usually confined to the prostate gland and has not spread to nearby tissues or lymph nodes.

- Stage T2: In this stage, the cancer is still localized within the prostate gland but can be detected during a DRE or imaging tests. Stage T2 is further divided into two sub-stages:

- T2a: The cancer is confined to one-half or less of one side (lobe) of the prostate.

- T2b: The cancer has spread to more than one-half of one side (lobe) but is still within the prostate.

- Stage T3: At this stage, the cancer has advanced beyond the confines of the prostate gland and may have invaded nearby tissues or structures. Stage T3 is further divided into two sub-stages:

- T3a: The cancer has spread outside the prostate, potentially into the seminal vesicles (small glands that produce semen).

- T3b: The cancer has spread to the tissues surrounding the prostate, such as the bladder neck or rectum.

- Stage T4: This is the most advanced stage of prostate cancer. In stage T4, the cancer has spread beyond the prostate and invaded nearby organs or structures, such as the bladder, rectum, pelvic wall, or lymph nodes.

In addition to the T staging, the TNM system also considers the involvement of lymph nodes (N) and the presence of distant metastasis (M) to further classify the stage of prostate cancer. These additional factors are denoted by numbers and letters, such as N0, N1, M0, or M1.

PSA Levels:

PSA (prostate-specific antigen) is a blood test commonly used as a screening tool for prostate cancer. However, it is important to note that PSA levels alone cannot definitively diagnose prostate cancer. Instead, elevated PSA levels may indicate the need for further diagnostic tests to confirm the presence of cancer. Here is a general guideline for interpreting PSA values:

- Normal PSA Levels: Generally, a PSA level below 4 nanograms per milliliter (ng/mL) is considered normal. However, the risk of prostate cancer can still exist even with PSA levels below 4 ng/mL.

- Elevated PSA Levels: PSA levels between 4 ng/mL and 10 ng/mL are considered moderately elevated. Levels above 10 ng/mL are considered significantly elevated. Higher PSA levels indicate a higher probability of prostate cancer, but they can also be caused by non-cancerous conditions such as prostate enlargement (benign prostatic hyperplasia) or inflammation (prostatitis).

- Rate of PSA Increase: In addition to absolute PSA values, the rate at which PSA levels increase over time, known as PSA velocity, can provide valuable information. A significant and rapid increase in PSA levels may raise suspicion for the presence of prostate cancer.

- Age-Specific PSA Ranges: PSA levels can vary based on age. As men age, the prostate gland naturally tends to produce more PSA. Therefore, higher PSA levels may be considered normal for older individuals.

It’s important to emphasize that PSA levels are just one aspect of prostate cancer screening and diagnosis. If PSA levels are elevated, further diagnostic tests such as a digital rectal exam (DRE) and prostate biopsy may be recommended to confirm the presence of cancer.

Ultimately, the interpretation of PSA values should be done in consultation with a healthcare professional who can evaluate the individual’s overall health, medical history, symptoms, and additional risk factors for prostate cancer.

Symptoms:

In the early stages, prostate cancer often does not cause noticeable symptoms. However, as the disease progresses, symptoms may include difficulty urinating, weak urine flow, blood in the urine or semen, erectile dysfunction, pain in the pelvic area, and bone pain if the cancer has metastasized.

Treatment:

Treatment options for prostate cancer depend on the stage, aggressiveness of the cancer, overall health, and patient preferences. Options may include active surveillance (regular monitoring), surgery (prostatectomy), radiation therapy, hormone therapy, chemotherapy, immunotherapy, and targeted therapy. Treatment decisions are made through a collaborative effort between the patient and the healthcare team.

Worst-Case Scenario:

In advanced cases of prostate cancer, if the disease has spread extensively and becomes resistant to treatment, it is considered a worst-case scenario. This stage is known as metastatic castration-resistant prostate cancer (mCRPC), where the cancer continues to grow despite hormonal therapy. In such cases, treatment options become limited, and palliative care focuses on managing symptoms and improving quality of life.

Impact on One’s Life Insurance Application:

When it comes to life insurance applications for individuals with a history of prostate cancer, several factors can impact the approval process and the rates offered. Here is a general overview of how different scenarios may affect the application:

- Early Diagnosis and Minimum 1-Year Full Remission: Individuals who have had an early diagnosis of prostate cancer and have achieved at least one year of full remission may have a higher likelihood of qualifying for a standard rate. This is particularly true if their PSA values are within the normal range or have shown a significant decline.

- Currently Treating or Less Than 1-Year Full Remission: If an individual is currently undergoing treatment for prostate cancer or has not reached the minimum requirement of one year of full remission, their life insurance application may be denied or postponed. Insurance providers typically prefer to assess the stability and long-term outlook of the disease before approving coverage.

- Beyond Stage 1 or 2: For individuals with prostate cancer that has progressed beyond stage 1 or 2, life insurance companies typically review applications on an individual basis. Factors such as the specific stage, treatment history, PSA values, and overall health will be considered to assess the level of risk. In these cases, individuals may receive customized offers, have their premiums adjusted, or be required to provide additional medical information.

It is essential to note that the underwriting process for life insurance is specific to each insurance company. Each company has its own guidelines and risk assessment criteria when evaluating applications from individuals with a history of prostate cancer. Working with an experienced insurance agent or broker who understands the complexities of underwriting can help navigate the application process and increase the chances of finding suitable coverage at the best possible rates.

Factors that will determine eligibility:

When assessing life insurance applications from individuals with a history of prostate cancer, insurance companies typically consider several factors to determine the insurability and premium rates. These factors may include:

- Stage and Grade of Prostate Cancer: The specific stage and grade of prostate cancer play a significant role in underwriting decisions. Early-stage cancers (such as stage 1 or 2) with low-grade tumors generally have a better prognosis and may be viewed more favorably by insurance providers.

- Treatment History: The type of treatments received and the response to treatment are important considerations. Insurance companies will assess whether the individual has undergone surgery, radiation therapy, hormone therapy, chemotherapy, or other forms of treatment. The length of time since treatment completion or remission will also be taken into account.

- PSA (Prostate-Specific Antigen) Levels: PSA levels before and after treatment, as well as the trend in PSA values, are examined. Lower PSA values and stable or declining trends indicate a more favorable outlook.

- Time Since Diagnosis and Remission: The length of time since diagnosis and achieving full remission is an important factor. Insurance providers often require a minimum period of remission (e.g., one year) before considering coverage.

- Follow-up and Surveillance: Adherence to follow-up appointments, regular monitoring, and ongoing surveillance for prostate cancer are indications of proactive management and can positively influence underwriting decisions.

- Overall Health: Insurers will assess the individual’s overall health, including medical history, comorbidities, lifestyle factors (e.g., smoking, obesity), and any other pre-existing health conditions that may impact mortality risk.

- Age: Age is a significant consideration in life insurance underwriting. Younger individuals with a history of prostate cancer may have a better chance of obtaining coverage compared to older individuals.

- Other Risk Factors: Insurance companies may consider additional risk factors such as family history of prostate cancer, other cancer diagnoses, or any complications or recurrence associated with prostate cancer.

Improving Chances of Life Insurance Approval

Securing life insurance coverage after a history of prostate cancer can be a challenging endeavor, but with careful considerations and proactive measures, it is possible to improve the chances of approval. Here are a few tips which could increase your chances:

- Timelines and Waiting Periods After Treatment: One way to enhance the chances of life insurance approval after prostate cancer treatment is to adhere to the specified timelines and waiting periods. Insurance companies often require a certain period of time, typically one year or more, since the completion of treatment or achieving full remission. By ensuring that the required waiting period has passed, individuals can demonstrate stability in their health and increase their chances of securing life insurance coverage.

- Maintaining Good Health and Lifestyle Choices: Maintaining good overall health and making positive lifestyle choices can positively impact the underwriting process for life insurance applications. This includes regular exercise, a balanced diet, and avoiding tobacco and excessive alcohol consumption. By demonstrating a commitment to a healthy lifestyle, individuals can showcase their dedication to minimizing risk factors and improving their long-term health outlook, which may be favorably considered by insurance providers.

- Seeking Professional Guidance and Assistance: Navigating the life insurance application process can be complex, especially for individuals with a history of prostate cancer. Seeking professional guidance and assistance from insurance agents or brokers experienced in handling cases involving prostate cancer can greatly improve the chances of approval. These professionals have in-depth knowledge of different insurance companies underwriting guidelines and can help individuals identify insurers that specialize in providing coverage for those with a history of prostate cancer. They can guide applicants through the process, ensure all necessary documentation is in order, and help present their case in the most favorable light.

Furthermore, consulting with healthcare professionals, including oncologists or urologists, can provide valuable insights and documentation regarding the individual’s medical history, treatment course, and prognosis. This information can be instrumental in reinforcing the applicant’s case and providing a comprehensive understanding of their health status to insurance underwriters.

Final thoughts…

While obtaining life insurance coverage after a history of prostate cancer may present certain challenges, there are steps individuals can take to enhance their chances of approval. Adhering to waiting periods, maintaining a healthy lifestyle, and seeking professional guidance can all contribute to a more favorable underwriting outcome. It is important to work closely with insurance professionals and healthcare providers who understand the intricacies of prostate cancer underwriting and can provide the necessary support and expertise throughout the application process.

By taking proactive measures and advocating for oneself, individuals can protect their financial future and provide peace of mind for themselves and their loved ones. Remember, each case is unique, and with the right approach, it is possible to secure life insurance coverage even after a history of prostate cancer.