Life insurance is an important financial safety net that can provide your loved ones with financial security in the event of your unexpected death. However if you have a history of an eating disorder, you may have concerns about whether you can qualify for life insurance and how much it will cost.

In this article, we’ve compiled some of the most common questions that people with eating disorders often have about life insurance, and we’ve provided answers to help you better understand the process.

Our goal is to help you become better prepared to qualify for the best life insurance policy possible, so you can have peace of mind knowing that your loved ones will be taken care of.

Now, before we get started, we should note that not all eating disorders are the same, however, most (if not all) will be treated quite similarly by most insurance companies when applying for a traditional life insurance policy. For this reason, when we use the term “eating disorder” just assume that we’re talking about any one of the following:

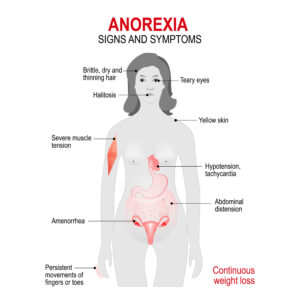

- Anorexia Nervosa: This is a disorder characterized by a severe restriction of food intake, leading to significant weight loss and an intense fear of gaining weight.

- Bulimia Nervosa: This is a disorder characterized by binge eating (consuming large amounts of food in a short period of time) followed by purging (such as vomiting, using laxatives, or excessive exercise).

- Binge Eating Disorder: This is a disorder characterized by recurring episodes of eating large amounts of food, often feeling out of control during these episodes.

- Avoidant/Restrictive Food Intake Disorder (ARFID): This is a disorder where an individual avoids certain foods or food groups due to sensory issues or fear of adverse reactions, which can lead to weight loss and malnutrition.

- Orthorexia Nervosa: This is a disorder characterized by an unhealthy obsession with healthy eating and a rigid adherence to strict dietary rules, leading to malnutrition and other health problems.

It’s important to note that eating disorders are serious mental health conditions that require professional help and treatment. If you or someone you know is struggling with an eating disorder, it’s important to seek help from a healthcare professional.

Frequently asked questions

Can I qualify for life insurance if I have a history of an eating disorder?

Yes, it’s possible to qualify for life insurance if you have a history of an eating disorder. However, it may depend on the severity of your condition, your current health status, and the type of policy you’re applying for.

Will my life insurance premiums be higher if I have a history of an eating disorder?

It’s possible that your life insurance premiums may be higher if you have a history of an eating disorder. This is because insurance companies view individuals with a history of an eating disorder as having a higher risk of developing future health complications. The specific amount of the premium increase will depend on the severity of the disorder, the length of time in recovery, and other factors related to your health and medical history.

What information will I need to provide about my eating disorder when applying for life insurance?

When applying for life insurance with a history of an eating disorder, you will likely be asked to provide detailed information about your condition. This may include information about the type of eating disorder you were diagnosed with, the date of diagnosis, the severity of your condition, any hospitalizations you may have had related to the disorder, and any medications or treatments you have received. You may also be asked to provide information about your current health status and your overall medical history. It’s important to be honest and accurate when providing this information to ensure that your policy is issued correctly and that your coverage is adequate.

How long do I need to be in recovery before I can apply for life insurance?

There’s no set time that you need to be in recovery before you can apply for life insurance with a history of an eating disorder. However, insurance companies may require that you be in recovery for a certain length of time before you can be considered for coverage. This is because the insurance company wants to see that you have successfully managed your disorder and are less likely to experience a relapse in the future. The length of time required for recovery will vary depending on the individual and the severity of their eating disorder. It’s best to speak with an experienced life insurance agent who can guide you through the process and help you determine if you’re eligible for coverage.

Will I need to undergo a medical exam when applying for life insurance?

Whether or not you will need to undergo a medical exam when applying for life insurance with a history of an eating disorder will depend on several factors. Insurance companies may require a medical exam as part of their underwriting process, but this will depend on the specific policy you’re applying for, the severity of your disorder, and other factors related to your health and medical history. In some cases, a medical exam may be required to assess your overall health and determine the appropriate premium rate for your policy. However, in other cases, the insurance company may waive the medical exam requirement or use alternative underwriting methods to assess your risk.

Can I get life insurance if I’m currently in treatment for an eating disorder?

It may be difficult to get life insurance if you’re currently in treatment for an eating disorder. Insurance companies typically view individuals who are actively receiving treatment for a medical condition as a higher risk. However, it’s not impossible to get coverage. The specific policy and the severity of your condition will impact your eligibility. We should also point out that the “type” of care that you are receiving may play a role in your eligibility. This is because many eating disorders may require long-term care, without necessarily an “end date”.

Will I need to provide medical records when applying for life insurance with a history of an eating disorder?

When applying for life insurance with a history of an eating disorder, you will likely need to provide medical records to the insurance company. These records will be used to assess your overall health and to determine your eligibility for coverage. The specific records required will depend on the policy you’re applying for, the severity of your disorder, and other factors related to your health and medical history. In some cases, the insurance company may also request additional information or require you to undergo a medical exam as part of the underwriting process. It’s important to be honest and accurate when providing medical records to ensure that your policy is issued correctly and that your coverage is adequate.

Can I get life insurance if I’ve been hospitalized for my eating disorder?

It may be possible to get life insurance if you’ve been hospitalized for your eating disorder, but it will depend on several factors. Insurance companies may view individuals who have been hospitalized for an eating disorder as a higher risk, and as a result, may require more information about your condition and treatment history. The specific policy you’re applying for, the length of time since your hospitalization, and the severity of your condition will also impact your eligibility.

Will I need to disclose my history of an eating disorder on my life insurance application?

Yes, you will need to disclose your history of an eating disorder on your life insurance application. Insurance companies require full disclosure of your medical history to accurately assess your risk and determine the appropriate premium rate for your policy. Failing to disclose a history of an eating disorder could result in your policy being cancelled or your beneficiaries not receiving the death benefit in the event of your passing.

Will my life insurance application be denied if I have a history of an eating disorder?

Not necessarily. Having a history of an eating disorder does not automatically disqualify you from getting life insurance. However, it may impact your eligibility and the cost of your premiums. Insurance companies consider a variety of factors when underwriting policies, including the severity of your eating disorder, the length of time since your last episode, and your overall health and medical history. If the insurance company determines that you are a higher risk, they may offer coverage with a higher premium or exclude coverage for certain conditions related to your eating disorder.

Can I get life insurance if I have a current mental health diagnosis?

It may be possible to get life insurance if you have a current mental health diagnosis, but it will depend on several factors. Insurance companies typically view individuals with a current mental health diagnosis as a higher risk, and as a result, may require more information about your condition and treatment history. The specific policy you’re applying for, the severity of your condition, and the type of diagnosis will also impact your eligibility. In some cases, the insurance company may offer coverage with a higher premium or exclude coverage for certain conditions related to your mental health diagnosis.

How can I improve my chances of getting approved for life insurance with a history of an eating disorder?

There are several things you can do to improve your chances of getting approved for life insurance with a history of an eating disorder:

- Be honest and accurate: Provide complete and accurate information about your medical history, including your history of an eating disorder. Failing to disclose this information could result in your policy being cancelled or your beneficiaries not receiving the death benefit in the event of your passing.

- Get treatment and follow your doctor’s advice: If you’re currently receiving treatment for your eating disorder, it’s important to follow your doctor’s advice and continue with your treatment plan. This can demonstrate to the insurance company that you’re taking steps to manage your condition and improve your health.

- Wait until you’re in stable recovery: If possible, it’s best to wait until you’re in stable recovery from your eating disorder before applying for life insurance. This can improve your eligibility and may result in lower premiums.

- Work with an experienced life insurance agent: An experienced life insurance agent can help guide you through the process and help you find the best policy for your needs. They can also help you understand your options and work with the insurance company to improve your chances of getting approved.

- Consider multiple insurance companies: Not all insurance companies have the same underwriting guidelines, so it’s worth considering multiple options to find the best coverage and premium rates for your situation.

Can I get life insurance if I’m overweight due to my eating disorder?

Yes, you may be able to get life insurance if you’re overweight due to your eating disorder, but it will depend on several factors. Insurance companies typically consider a variety of factors when underwriting policies, including your overall health, medical history, and lifestyle. If your eating disorder has resulted in a higher body mass index (BMI), the insurance company may view you as a higher risk and offer coverage with a higher premium. However, it’s important to be honest and accurate about your weight and your eating disorder when applying for life insurance, as failing to disclose this information could result in your policy being cancelled or your beneficiaries not receiving the death benefit in the event of your passing.

Will the insurance company consider my age and gender when evaluating my life insurance application with a history of an eating disorder?

Yes, the insurance company will consider your age and gender when evaluating your life insurance application with a history of an eating disorder. Age and gender are two of the most important factors in determining life insurance premiums, as they can impact overall life expectancy. Women are more likely than men to develop eating disorders, and young people are also at a higher risk. As a result, the insurance company may view younger women with a history of an eating disorder as a higher risk and may offer coverage with a higher premium. However, the specific policy you’re applying for, the severity of your condition, and your overall health will also impact your eligibility and premium rates

Should I work with an experienced life insurance agent when applying for coverage with a history of an eating disorder?

In our opinion, it’s highly recommended that you work with an experienced life insurance agent when applying for coverage with a history of an eating disorder. An experienced agent can help guide you through the process, explain the underwriting guidelines of different insurance companies, and help you find the best policy for your needs. They can also help you understand the types of information you’ll need to provide on your application and how to accurately disclose your history of an eating disorder to the insurance company. An agent can also help you explore different policy options, such as term or permanent life insurance, and help you understand the potential costs and benefits of each. Overall, an experienced life insurance agent can be a valuable resource to help you navigate the complex process of applying for life insurance with a history of an eating disorder.