Ankylosing spondylitis or Bechterew’s Disease is a serious medical condition that can make it difficult to qualify for life insurance. While it can be a daunting task, it is essential to protect your loved ones with a good life insurance policy. At JBM, we understand that navigating the world of life insurance can be overwhelming, especially when you have a pre-existing medical condition.

To help you get started, we have compiled a list of some of the most common questions people with ankylosing spondylitis frequently ask when applying for life insurance.

By reading this article, we hope to provide you with the knowledge and tools necessary to make informed decisions about your life insurance policy and qualify for the best coverage possible.

Frequently Asked Questions

What is ankylosing spondylitis?

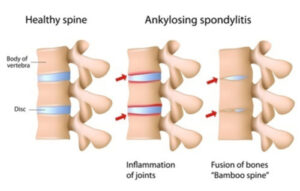

Ankylosing spondylitis (AS) is a chronic inflammatory disease that primarily affects the spine and other joints in the body. It causes pain, stiffness, and inflammation in the affected areas, which can lead to difficulty in movement and function. The disease is a type of arthritis and is more common in men than women. The symptoms of AS often develop gradually and can be confused with other types of back pain, making it difficult to diagnose. There is no cure for AS, but treatment options are available to manage symptoms and slow down the progression of the disease.

Can I qualify for life insurance after being diagnosed with ankylosing spondylitis?

Yes, it is possible to qualify for life insurance after being diagnosed with ankylosing spondylitis, although it may be more challenging than for someone without the condition. The ability to qualify for life insurance will depend on various factors, including the severity of the disease, age of onset, treatment history, and overall health. In some cases, ankylosing spondylitis may result in higher premiums or exclusions in the policy.

What information do I need to provide to the insurance company when applying for life insurance with ankylosing spondylitis?

When applying for life insurance with ankylosing spondylitis, you will likely need to provide detailed information about your medical history, including the diagnosis, age of onset, and any treatments you have received. The insurance company may also request copies of your medical records, including test results, doctor’s notes, and treatment plans. You may also be asked about your lifestyle habits, such as smoking or drinking, as these factors can impact your overall health and risk level.

Will my premiums be higher due to my ankylosing spondylitis diagnosis?

It is possible that your premiums may be higher due to your ankylosing spondylitis diagnosis, as insurance companies typically assess the risk of insuring an individual based on various factors, including their health history. The severity of your condition and age of onset can impact the cost of your premiums. However, the specific impact on your premiums will depend on the insurance company’s underwriting guidelines and the details of your individual case.

Can I still get life insurance if I have a history of ankylosing spondylitis in my family?

Yes, you can still get life insurance if you have a history of ankylosing spondylitis in your family. However, the presence of a family history of the disease may impact your ability to qualify for certain policies or affect your premiums. Insurance companies take various factors into account when assessing an individual’s risk level, and a family history of ankylosing spondylitis can indicate a higher likelihood of developing the condition in the future.

Are there any specific life insurance policies for people with ankylosing spondylitis?

There are no specific life insurance policies for people with ankylosing spondylitis. However, some insurance companies may offer policies with more flexible underwriting guidelines that can accommodate individuals with pre-existing medical conditions, such as ankylosing spondylitis. These policies may include graded death benefit policies or guaranteed issue policies. However, these policies may come with higher premiums or lower coverage amounts than traditional life insurance policies. It is essential to work with an experienced insurance agent who can help you find the best.

What types of medical tests may be required before I can qualify for life insurance with ankylosing spondylitis?

The types of medical tests required to qualify for life insurance with ankylosing spondylitis will depend on the insurance company’s underwriting guidelines and the details of your individual case. However, some common medical tests that may be required include:

- Blood tests: Blood tests can help assess your overall health, including cholesterol levels, blood sugar levels, and liver function.

- Urine tests: Urine tests can help assess kidney function and detect any underlying health issues.

- Medical exams: A medical exam may include a physical exam, blood pressure check, and other assessments to determine your overall health.

- Imaging tests: Imaging tests, such as x-rays or MRI scans, may be required to assess the extent of your ankylosing spondylitis and any related damage.

- Other tests: Depending on your individual case, other medical tests, such as pulmonary function tests or electrocardiograms (ECG), may also be required.

Can I apply for life insurance if I am currently receiving treatment for ankylosing spondylitis?

Yes, you can apply for life insurance if you are currently receiving treatment for ankylosing spondylitis. The insurance company will consider various factors, including the severity of your condition and the effectiveness of your treatment, when assessing your eligibility for coverage. The specific impact of your treatment on your ability to qualify for life insurance will depend on the insurance company’s underwriting guidelines and the details of your individual case.

What factors do life insurance companies consider when determining whether to insure someone with ankylosing spondylitis?

Life insurance companies consider various factors when determining whether to insure someone with ankylosing spondylitis. These factors include:

- Age of onset: The age at which an individual was diagnosed with ankylosing spondylitis can impact the severity of their condition and the associated risk level.

- Severity of symptoms: The severity of an individual’s symptoms can affect their overall health and risk level. Insurance companies may consider the number and frequency of flares, as well as the extent of spinal damage.

- Treatment history: Insurance companies may consider an individual’s treatment history, including the effectiveness of their treatments and any side effects or complications experienced.

- Lifestyle habits: Insurance companies may consider an individual’s lifestyle habits, such as smoking, drinking, or physical activity levels, as these factors can impact overall health and risk level.

- Family medical history: A family history of ankylosing spondylitis or other related conditions can indicate a higher likelihood of developing the condition in the future.

Can I still get life insurance if my ankylosing spondylitis is severe or if I have other medical conditions?

It is possible to obtain life insurance coverage even if you have severe ankylosing spondylitis or other medical conditions. However, the availability and cost of coverage may vary depending on the severity of your condition and the insurance company’s underwriting guidelines. Insurance companies may consider factors such as the age of onset, severity of symptoms, treatment history, and other medical conditions when assessing an individual’s eligibility for coverage.

If an individual has severe ankylosing spondylitis or other medical conditions, they may be considered a higher risk for life insurance coverage. This could result in higher premiums or reduced coverage amounts compared to individuals without these conditions. However, there are still options available, such as graded death benefit policies or guaranteed issue policies, which may be more accessible to individuals with pre-existing medical conditions.

Can I still get life insurance if I have had surgery related to my ankylosing spondylitis?

If you have had surgery related to your ankylosing spondylitis, you may still be able to qualify for life insurance coverage. However, the availability and cost of coverage may depend on the type of surgery, the outcome of the surgery, and your overall health status.

Insurance companies may consider factors such as the age of onset, severity of symptoms, treatment history, and other medical conditions when assessing an individual’s eligibility for coverage. If you have had surgery related to your ankylosing spondylitis, the insurance company may request medical records and additional information about the surgery and your overall health status.

If the surgery was successful and you are managing your condition well, you may be able to qualify for traditional life insurance coverage. However, if the surgery was recent or you are still experiencing symptoms related to your condition, the insurance company may consider you a higher risk and may offer coverage with higher premiums or lower death benefits.

How long after being diagnosed with ankylosing spondylitis do I need to wait before applying for life insurance?

There is no specific waiting period after being diagnosed with ankylosing spondylitis before you can apply for life insurance. You can apply for life insurance as soon as you are diagnosed with the condition.

However, it is important to note that insurance companies may consider the severity and duration of your condition, as well as your treatment history, when assessing your eligibility for coverage. If your condition is severe or you have a history of complications, you may face higher premiums or may not be able to qualify for coverage.