If you have been diagnosed with claudication, you may be wondering if it will affect your ability to get life insurance coverage. The short answer is yes, it can impact your life insurance application. However, it is still possible to get approved for coverage even with this condition.

In this article, we will discuss what claudication is, how it can affect your life insurance application, and what steps you can take to increase your chances of getting approved for coverage.

What is Claudication?

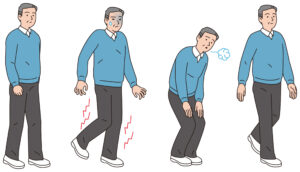

Claudication is a medical condition characterized by pain, cramping, or discomfort in the legs, buttocks, or hips that typically occurs during physical activity. The condition is caused by a narrowing or blockage in the arteries that supply blood to the affected area.

Types of Caludication

There are two types of claudication:

- Intermittent claudication: It is the most common type and is characterized by pain or cramping in the legs during physical activity such as walking, climbing stairs, or exercising. The pain usually goes away after a few minutes of rest.

- Rest pain: This is a more severe form of claudication, and the pain occurs even while at rest. It can be constant or intermittent and may worsen at night.

The most common cause of claudication is peripheral artery disease (PAD), which occurs when the arteries that supply blood to the legs become narrowed or blocked due to a buildup of plaque. Other causes of claudication may include blood clots, inflammation of the arteries, or trauma to the affected area.

Symptoms

Symptoms of claudication include:

- Pain, cramping, or discomfort in the legs, buttocks, or hips during physical activity

- Numbness or tingling in the affected area

- Weakness in the affected leg(s)

- Coldness or a pale appearance in the affected leg(s)

- Slow-healing sores or wounds in the affected area

Treatment

Treatment for claudication typically involves lifestyle modifications, such as quitting smoking, exercising regularly, and maintaining a healthy diet. Medications such as aspirin, cholesterol-lowering drugs, and blood thinners may also be prescribed to help manage symptoms and prevent further complications.

In some cases, surgical interventions may be necessary to improve blood flow to the affected area. Procedures such as angioplasty, stenting, or bypass surgery may be recommended to open up blocked or narrowed arteries.

If left untreated, claudication can lead to more serious complications such as limb ischemia, which occurs when there is a severe lack of blood flow to the affected area. This can result in tissue damage, infections, and in severe cases, amputation of the affected limb.

How Does Claudication Affect Life Insurance?

Individuals who have been diagnosed with claudication may be able to qualify for a traditional life insurance policy, but they may be rated substandard due to their increased risk of cardiovascular disease and other health complications. This means that they will likely pay a higher premium for their coverage compared to someone who does not have claudication or other health concerns.

A substandard rating, also known as a table rating, is a classification assigned by the insurance company that reflects an individual’s increased risk of mortality. The rating is usually assigned on a scale of 1 to 10, with 1 being the best rating and 10 being the worst.

Individuals who have been diagnosed with claudication will likely be rated as a higher risk due to their increased risk of developing more serious cardiovascular disease or other related health complications. In some cases, the insurance company may require additional medical underwriting or a medical exam to determine the severity of the individual’s condition and their overall health status.

It is important for individuals with claudication who are seeking life insurance coverage to work with an experienced insurance agent who can help them navigate the underwriting process and find the best coverage at the most affordable price. The agent can also provide guidance on how to improve their overall health and reduce their risk of developing more serious health complications associated with claudication.

Overall, while it may be more challenging for individuals with claudication to qualify for a traditional life insurance policy, it is not impossible. By working with an experienced agent and being proactive about managing their health, individuals with claudication can still find the coverage they need to protect their loved ones financially in the event of their death.

Tips for Getting Approved for Life Insurance with Claudication

While getting approved for life insurance with claudication may be more difficult, there are steps you can take to increase your chances of getting coverage.

Work with an Experienced Agent

One of the most important things you can do when applying for life insurance with claudication is to work with an experienced agent who understands your condition and the insurance industry. An experienced agent can help you find insurance companies that are more likely to approve your application and can help you navigate the application process.

Be Honest About Your Condition

When applying for life insurance, it is important to be honest about your condition and any underlying health conditions you may have. Failing to disclose your condition can result in your application being denied or your coverage being canceled.

Maintain Good Health Habits

Maintaining good health habits such as eating a healthy diet, exercising regularly, and managing your blood pressure and cholesterol levels can help improve your overall health and reduce the risk of more serious health complications.

Provide Detailed Medical Records

Providing detailed medical records that show you are managing your condition and any underlying health conditions can help demonstrate to the insurance company that you are a low-risk applicant.

Shop Around for Coverage

Shopping around for coverage is important when applying for life insurance with claudication. Not all insurance companies have the same underwriting guidelines, so it is important to compare quotes from multiple companies to find the best coverage at the most affordable price.

Consider Guaranteed Issue Life Insurance

Guaranteed issue life insurance policies are a type of life insurance policy that is designed to provide coverage to individuals who may have difficulty obtaining traditional life insurance coverage due to their age, health status, or other factors. As with any type of insurance policy, there are pros and cons to consider when deciding whether a guaranteed issue life insurance policy is right for you.

Pros of Guaranteed Issue Life Insurance Policy:

- Guaranteed Approval: One of the biggest advantages of a guaranteed issue life insurance policy is that it provides guaranteed approval, regardless of your health status or other risk factors. This can be a huge relief for individuals who have been turned down for traditional life insurance coverage in the past.

- No Medical Exam Required: Another benefit of a guaranteed issue life insurance policy is that there is no medical exam required to qualify for coverage. This can be a major advantage for individuals who have health conditions that may make it difficult to obtain coverage through traditional underwriting.

- Cash Value: Some guaranteed issue life insurance policies also offer cash value accumulation, which can be used as a source of savings or investment.

- Death Benefit: Guaranteed issue life insurance policies also provide a death benefit, which can help provide financial support to your loved ones in the event of your death.

Cons of Guaranteed Issue Life Insurance Policy:

- Higher Premiums: Guaranteed issue life insurance policies typically have higher premiums compared to traditional life insurance policies due to the higher risk associated with insuring individuals without medical underwriting.

- Lower Death Benefit: Guaranteed issue life insurance policies also tend to have lower death benefits compared to traditional life insurance policies, which can make them less appealing for individuals who are looking to provide significant financial support to their loved ones.

- Waiting Period: Some guaranteed issue life insurance policies also have a waiting period before the death benefit is paid out. This waiting period can range from two to three years, and if the policyholder dies during this period, their beneficiaries may not receive the full death benefit.

- Limited Coverage: Guaranteed issue life insurance policies may also have limitations on coverage amounts, which can make it difficult for individuals with significant financial responsibilities to obtain the coverage they need.

In conclusion, guaranteed issue life insurance policies can be a good option for individuals who have difficulty obtaining traditional life insurance coverage due to their health status or other factors. However, they come with higher premiums, lower death benefits, waiting periods, and limited coverage amounts. Before purchasing a guaranteed issue life insurance policy, it is important to weigh the pros and cons and determine whether it is the right choice for your specific needs and circumstances.

Final thoughts…

Getting approved for life insurance with claudication may be more challenging, but it is not impossible. By working with an experienced agent, being honest about your condition, maintaining good health habits, providing detailed medical records, considering guaranteed issue life insurance, shopping around for coverage, and considering term life insurance, you can increase your chances of getting approved for coverage and protecting your loved ones financially in the event of your death.

Remember to be patient and persistent during the application process, and don’t hesitate to ask questions or seek guidance from your insurance agent or healthcare provider. With the right approach and a little bit of effort, you can find the life insurance coverage that meets your needs and gives you peace of mind.