Cirrhosis of the liver is a serious health condition that affects millions of people worldwide. It is a chronic condition that can lead to various complications, including liver failure, cancer, and death.

Unfortunately, people with cirrhosis of the liver often have a difficult time getting approved for life insurance. This is because the condition is considered high-risk by insurance companies. In this article, we will discuss how to get life insurance approvals with cirrhosis of the liver.

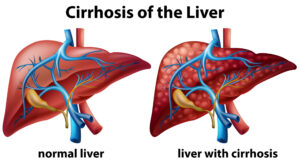

What is Cirrhosis of the Liver?

Cirrhosis of the liver is a chronic liver disease that occurs when the liver is damaged and scarred over time, leading to the loss of its normal structure and function. As the liver becomes increasingly damaged, it loses the ability to perform essential functions such as detoxifying the body, producing bile, and storing glucose.

Causes:

The most common causes of cirrhosis of the liver are long-term excessive alcohol consumption and chronic viral hepatitis B or C. Other causes can include non-alcoholic fatty liver disease, autoimmune hepatitis, primary biliary cirrhosis, and inherited metabolic disorders such as Wilson’s disease and hemochromatosis.

Symptoms:

In the early stages of cirrhosis, there may be no symptoms. As the disease progresses, the following symptoms may appear:

- Fatigue and weakness

- Loss of appetite and weight loss

- Nausea and vomiting

- Abdominal pain and swelling

- Jaundice (yellowing of the skin and eyes)

- Itching

- Dark urine and pale stools

- Spider-like blood vessels on the skin

- Mental confusion and difficulty concentrating

Treatment:

Treatment for cirrhosis of the liver focuses on managing its complications and preventing further damage to the liver. Treatment may include:

- Lifestyle changes, such as stopping alcohol consumption, losing weight, and exercising regularly

- Medications to treat underlying causes, such as antiviral drugs for hepatitis B or C, and medications to manage symptoms such as itching and fatigue

- Nutritional support, including a diet low in salt and high in protein and supplements as needed

- Procedures to drain fluid buildup in the abdomen (ascites) and reduce blood pressure in the liver (portal hypertension)

- Liver transplantation, in severe cases where the liver is no longer functioning properly.

Worst Case Scenario: If left untreated, cirrhosis of the liver can progress to liver failure, which is a life-threatening condition. Complications of cirrhosis can also include internal bleeding, kidney failure, and an increased risk of liver cancer. In some cases, the only treatment option may be a liver transplant, which is a major surgery with significant risks and complications. It is essential to seek medical attention if you experience any symptoms of cirrhosis or have risk factors for the disease.

Why is Cirrhosis of the Liver Considered High-Risk for Life Insurance?

Cirrhosis of the liver is considered high-risk for life insurance because it is a chronic condition that can lead to serious complications, including liver failure, bleeding, and an increased risk of liver cancer. Life insurance companies view individuals with cirrhosis of the liver as a higher risk for mortality, which means that they are more likely to die prematurely than someone without the condition. As a result, life insurance companies may be hesitant to offer coverage or may charge higher premiums to offset the increased risk.

When assessing an application for life insurance, underwriters evaluate a variety of factors to determine the applicant’s risk level. These factors include age, gender, lifestyle habits, family medical history, and current health status. For individuals with cirrhosis of the liver, underwriters will closely examine the severity and stage of the condition, the underlying cause, and any complications that have occurred as a result of the disease.

Life insurance companies use actuarial tables and statistical models to estimate an applicant’s life expectancy based on their risk factors. If an individual has cirrhosis of the liver, the insurance company may consider their life expectancy to be significantly lower than someone without the condition. As a result, most (if not all) life insurance companies will immediately reject any traditional application from someone who has been diagnosed with cirrhosis of the liver.

Therefore, anyone wishing to purchase a life insurance policy after they have been diagnosed will need to consider an alternative option such as a guaranteed issue life insurance policy, or an accidental death policy.

Alternative options for those unable to qualify for traditional coverage

For individuals who are unable to qualify for traditional life insurance coverage due to their medical condition, there are alternative options available, such as guaranteed issue life insurance policies and accidental death policies. Both options offer coverage to those who may have difficulty obtaining traditional coverage due to their health status, but there are important differences to consider.

Guaranteed Issue Life Insurance Policies:

Guaranteed issue life insurance policies are designed for individuals who may not qualify for traditional life insurance coverage due to their medical condition. These policies are typically more expensive than traditional coverage, and they offer lower coverage amounts. With guaranteed issue life insurance, the insurer does not require a medical exam or a detailed health history. Instead, coverage is guaranteed as long as the applicant meets the age and residency requirements.

Pros:

- Guaranteed acceptance, regardless of health status

- No medical exam or detailed health history is required

- Quick and easy application process

Cons:

- Higher premiums for lower coverage amounts

- Typically, only available in smaller coverage amounts, usually up to $25,000

- Waiting periods may apply before coverage takes effect, typically 2-3 years

- May have lower cash value than traditional coverage

Accidental Death Policies:

Accidental death policies are another alternative for individuals who may not qualify for traditional life insurance coverage due to their medical condition. These policies provide coverage only in the event of accidental death, such as a car accident or a fall. They do not provide coverage for natural causes of death or illness.

Pros:

- Guaranteed acceptance, regardless of health status

- No medical exam or detailed health history required

- Quick and easy application process

- Lower premiums than traditional coverage

Cons:

- Limited coverage, only provides coverage in the event of accidental death

- Does not provide coverage for natural causes of death or illness

- Limited benefit payouts compared to traditional coverage

- May not be sufficient to cover all expenses associated with accidental death

Conclusion…

Getting life insurance coverage with cirrhosis of the liver can be challenging, but it is not impossible. Working with an independent insurance agent, being honest on your application, providing detailed medical records, considering a guaranteed issue or graded benefit policy, improving your health, and shopping around for coverage are all ways to increase your chances of getting approved for life insurance coverage.

Remember that life insurance is essential to protect your loved ones in the event of your passing, and it’s worth the time and effort to find the right coverage for your specific needs.

Frequently Asked Questions

Can I get life insurance coverage if I have cirrhosis of the liver?

To our knowledge, individuals who have been diagnosed with cirrhosis of the liver will only be able to qualify for a guaranteed issue life insurance policy or possibly a group life insurance policy through their employer.

Will a life insurance company deny my application if I have cirrhosis of the liver? It is our understanding that most (if not all) life insurance companies will deny any applicant with cirrhosis of the liver when applying for traditional coverage.

Should I disclose my cirrhosis of the liver on my life insurance application?

It is important to be honest and disclose any medical conditions, including cirrhosis of the liver, on your life insurance application. Failure to disclose your condition could result in your policy being canceled or denied.

Will my cirrhosis of the liver be considered a pre-existing condition?

Yes, cirrhosis of the liver would be considered a pre-existing condition when applying for life insurance coverage.

Can I get life insurance coverage if I have hepatitis C? It may be possible to get life insurance coverage if you have hepatitis C, but it will likely be quite challenging. Similar to cirrhosis of the liver, alternative options such as guaranteed issue life insurance policies may be available.

Can I get life insurance coverage if I have liver cancer?

It may be more difficult to obtain traditional life insurance coverage if you have liver cancer, but alternative options such as guaranteed issue life insurance policies may be available.

Will my life insurance premiums increase if I develop cirrhosis of the liver after I have already purchased a policy?

No, your life insurance premiums should not increase if you develop cirrhosis of the liver after you have already purchased a policy. The terms of your policy should remain the same throughout the policy term.

Can I get life insurance coverage if I have a history of alcohol abuse?

It may be more difficult to obtain traditional life insurance coverage if you have a history of alcohol abuse, but alternative options such as guaranteed issue life insurance policies may be available.