Life insurance is an important tool to protect your loved ones in the event of an untimely death. However, if you have a chronic condition like bronchitis, it may be more difficult to get approved for life insurance. In this article, we’ll discuss the challenges of getting life insurance with chronic bronchitis and provide some tips on how to improve your chances of approval.

Understanding Chronic Bronchitis

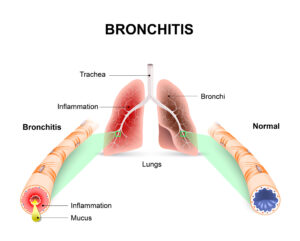

Chronic bronchitis is a type of chronic obstructive pulmonary disease (COPD) that causes inflammation and narrowing of the bronchial tubes, leading to breathing difficulties. The condition is defined as the presence of a persistent cough that lasts for at least three months per year for two consecutive years.

Causes of Chronic Bronchitis:

The primary cause of chronic bronchitis is smoking, which damages the lining of the bronchial tubes and leads to inflammation. Other factors that can contribute to the development of chronic bronchitis include air pollution, exposure to secondhand smoke, and repeated respiratory infections.

Symptoms of Chronic Bronchitis:

The symptoms of chronic bronchitis include a persistent cough that produces mucus, shortness of breath, wheezing, chest tightness, and fatigue. These symptoms may be mild at first and gradually worsen over time.

Treatments for Chronic Bronchitis:

The treatment for chronic bronchitis aims to relieve symptoms, prevent complications, and slow the progression of the disease. Treatment options include:

- Medications: Bronchodilators, inhaled corticosteroids, and antibiotics may be prescribed to manage symptoms and prevent infections.

- Oxygen therapy: In severe cases, oxygen therapy may be needed to improve breathing and reduce the risk of complications.

- Pulmonary rehabilitation: This involves a combination of exercise, breathing techniques, and education to improve lung function and overall health.

- Lifestyle changes: Quitting smoking, avoiding secondhand smoke and other respiratory irritants, and maintaining a healthy diet and exercise routine can also help manage symptoms and slow the progression of the disease.

Worst-case Scenario:

If left untreated, chronic bronchitis can lead to serious complications, including respiratory failure, heart failure, and pneumonia. In some cases, chronic bronchitis can also increase the risk of developing lung cancer. Therefore, it is important to seek medical attention if you experience any symptoms of chronic bronchitis, especially if you have a history of smoking or other respiratory conditions.

Challenges of Getting Life Insurance with Chronic Bronchitis

When you apply for life insurance, the insurance company will evaluate your health status to determine the level of risk you pose. They will look at a variety of factors, including your age, medical history, and lifestyle habits. If you have chronic bronchitis, the insurance company will view you as a higher risk candidate for life insurance.

One of the biggest challenges of getting life insurance with chronic bronchitis is that it can be difficult to accurately assess your health status. Chronic bronchitis is a progressive disease that worsens over time. This means that even if you are currently managing your symptoms, you may develop more serious complications in the future. Insurance companies may be hesitant to approve coverage for someone with chronic bronchitis because of this uncertainty.

As a result, most carriers will automatically consider someone with chronic bronchitis a high-risk applicant. It also means that those who will be able to qualify for traditional coverage will likely only be able to qualify for a substandard rate. We should also note that individuals with chronic bronchitis who have used tobacco within the past 12 months are typically automatically declined for life insurance coverage, regardless of whether they have quit smoking or not.

Tips for Getting Approved for Life Insurance with Chronic Bronchitis

Getting approved for life insurance with chronic bronchitis can be challenging, but there are steps you can take to improve your chances of approval. Here are some tips for getting approved for life insurance with chronic bronchitis:

- Quit Smoking: One of the most effective ways to reduce the risk of complications associated with chronic bronchitis is to quit smoking. If you are a smoker, quitting smoking can help improve your lung function and decrease the severity of your symptoms. Additionally, quitting smoking can help improve your chances of getting approved for life insurance coverage.

- Maintain a Healthy Lifestyle: Maintaining a healthy lifestyle can also help improve your chances of getting approved for life insurance coverage. This includes getting regular exercise, maintaining a healthy diet, and avoiding exposure to environmental pollutants and other respiratory irritants.

- Manage Your Symptoms: Managing your symptoms through medication, pulmonary rehabilitation, and other treatments can help improve your lung function and reduce the severity of your symptoms. This can also help improve your chances of getting approved for life insurance coverage.

- Work with an Experienced Insurance Agent: Working with an experienced insurance agent who specializes in high-risk cases can help improve your chances of getting approved for life insurance coverage. An experienced agent can help you navigate the underwriting process, find the best life insurance options for your individual needs, and negotiate with insurance companies on your behalf.

- Provide Accurate and Detailed Information: When applying for life insurance coverage, it is important to provide accurate and detailed information about your health and lifestyle. This includes providing information about your chronic bronchitis diagnosis, symptoms, treatments, and any other medical conditions you may have. Providing accurate and detailed information can help insurance companies better understand your individual risk and increase your chances of getting approved for coverage.

If you have been declined coverage by traditional life insurance companies due to your chronic bronchitis, don’t lose hope. There are alternative options available that may provide you with the coverage you need. Here are a few options to consider:

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of life insurance that does not require a medical exam or health questions. As long as you meet the age requirements, you are guaranteed to be approved for coverage. While the premiums for guaranteed issue life insurance may be higher than traditional life insurance policies, it can be a good option for those who have been declined coverage due to a chronic health condition like bronchitis.

Accidental Death and Dismemberment Insurance

Accidental death and dismemberment insurance (AD&D) provides coverage in the event of an accidental death or dismemberment. This type of insurance does not require a medical exam or health questions and may be easier to qualify for than traditional life insurance. While AD&D insurance does not provide coverage for natural causes of death, it can be a good option for those who have been declined coverage due to a chronic health condition.

Group Life Insurance

Many employers offer group life insurance as part of their employee benefits package. Group life insurance policies are typically offered without medical underwriting, which means that you may be able to qualify for coverage even if you have a chronic health condition like bronchitis. While the coverage amounts for group life insurance policies may be lower than individual policies, it can be a good option for those who need coverage but have been declined by traditional life insurance companies.

Final Thoughts:

Chronic bronchitis can make it more difficult to get approved for life insurance, but it is not impossible. By being honest about your condition, providing detailed medical records, and working with an experienced insurance agent, you can improve your chances of approval. If traditional life insurance is not an option for you, consider alternative options like guaranteed issue life insurance, accidental death and dismemberment insurance, or group life insurance. Regardless of the type of coverage you choose, remember that life insurance is an important tool to protect your loved ones in the event of an untimely death.

Frequently Asked questions

What is chronic bronchitis?

Chronic bronchitis is a type of chronic obstructive pulmonary disease (COPD) that causes inflammation and irritation of the bronchial tubes in the lungs. This can lead to symptoms such as coughing, wheezing, and shortness of breath.

Can I get life insurance with chronic bronchitis?

Yes, it is possible to get life insurance with chronic bronchitis, but it can be more difficult and expensive than for individuals without a chronic illness. Insurance companies may require additional medical information or may offer coverage at a higher premium.

What types of life insurance policies are available for individuals with chronic bronchitis?

Individuals with chronic bronchitis may be able to qualify for term life insurance, whole life insurance, or universal life insurance policies. However, the premiums for these policies may be higher than for individuals without a chronic illness.

What factors do insurance companies consider when underwriting life insurance policies for individuals with chronic bronchitis?

Insurance companies will consider a variety of factors when underwriting life insurance policies for individuals with chronic bronchitis, including the severity of the condition, the age at which it was diagnosed, the individual’s smoking history, and the effectiveness of any treatments used.

What can I do to improve my chances of getting approved for life insurance with chronic bronchitis?

Some steps you can take to improve your chances of getting approved for life insurance with chronic bronchitis include quitting smoking, maintaining a healthy lifestyle, managing your symptoms through medication and other treatments, working with an experienced insurance agent, and providing accurate and detailed information about your health and lifestyle.

What should I do if I am denied life insurance coverage due to chronic bronchitis?

If you are denied life insurance coverage due to chronic bronchitis, there are still some alternatives that may be available to you. These include group life insurance, guaranteed issue life insurance, AD&D insurance, simplified issue life insurance, and final expense insurance. Working with an experienced insurance agent can help you explore your options and find the best coverage for your individual needs.