When it comes to life insurance, having a bicuspid aortic valve may make it more difficult to obtain coverage or result in higher premiums. However, with some careful planning and preparation, it is possible to secure life insurance coverage that meets your needs.

In this article, we’re going to examine how most traditional life insurance companies will view an applicant with a Bicuspid Aortic Value as well as provide a few tips to help you obtain the coverage you’re looking for.

Understanding Bicuspid Aortic Valve

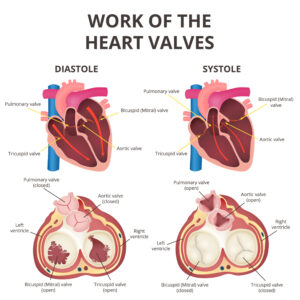

Bicuspid aortic valve (BAV) is a heart condition where the aortic valve in the heart has two leaflets instead of the normal three. This condition affects about 1-2% of the population and is the most common congenital heart defect.

Causes:

The exact cause of BAV is not known, but it is believed to be a result of abnormal fetal development during pregnancy. BAV may also be associated with certain genetic conditions such as Turner syndrome and Marfan syndrome.

Symptoms:

Many people with BAV do not experience any symptoms and are not aware of the condition until it is detected during a routine medical exam. However, in some cases, BAV can lead to complications such as aortic stenosis (narrowing of the aortic valve), aortic regurgitation (leakage of blood through the aortic valve), or an enlarged aortic aneurysm.

Symptoms of aortic stenosis and aortic regurgitation may include chest pain or tightness, shortness of breath, fatigue, dizziness, and fainting. An enlarged aortic aneurysm may cause chest or back pain, difficulty breathing, and an irregular heartbeat.

Treatment:

Treatment for BAV depends on the severity of the condition and any associated complications. In many cases, no treatment is necessary and individuals with BAV can live normal, healthy lives.

If complications such as aortic stenosis, aortic regurgitation, or an enlarged aortic aneurysm are present, treatment options may include medication to manage symptoms, surgery to repair or replace the aortic valve, or close monitoring with regular medical exams.

In some cases, individuals with BAV may also need to take antibiotics before certain dental or medical procedures to reduce the risk of infection. This is because individuals with BAV are at a higher risk of developing infective endocarditis, a rare but serious infection of the heart lining.

Obtaining Life Insurance with Bicuspid Aortic Valve

When it comes to obtaining life insurance with a bicuspid aortic valve, there are a few things to keep in mind. First and foremost, it is important to be upfront and honest about your medical history and current health status. This includes providing details about your bicuspid aortic valve, any related complications, and any treatment you have received.

Life insurance companies will typically require a medical exam as part of the application process. This may include an electrocardiogram (ECG) to check the electrical activity of your heart, as well as an echocardiogram to check the structure and function of your heart. These tests can help the insurer assess your overall health and the potential risk you pose as a policyholder.

It is also important to work with an experienced insurance agent who can help you navigate the application process and find the right policy for your needs. An agent can help you compare rates and coverage options from different insurers, as well as negotiate on your behalf to secure the best possible rates.

That said, what you’re likely going to find is that individuals with bicuspid aortic valve who have mild symptoms or no complications may be able to qualify for a preferred rate when applying for life insurance coverage. A preferred rate typically indicates that an individual is considered a low-risk applicant, and as such, may be eligible for lower premiums.

However, individuals with more severe symptoms or complications may be considered higher risk by insurers and may be denied coverage or offered a substandard rating. The severity of the condition and any associated complications will play a significant role in determining the level of risk that an individual presents to the insurer.

For example, individuals with aortic stenosis or aortic regurgitation may be considered higher risk because these conditions can lead to heart failure or other serious complications. As such, insurers may require additional medical documentation or may decline coverage altogether.

Factors Affecting Life Insurance Approval

When applying for life insurance coverage, there are several factors that insurers consider when evaluating an individual’s application. Some of the most significant factors that can affect life insurance approval include:

- Age: Age is one of the most significant factors that insurers consider when evaluating an application for life insurance coverage. Generally, younger individuals are considered lower risk and may be able to obtain coverage at lower premiums.

- Health: An individual’s overall health is a critical factor in determining eligibility for life insurance coverage. Individuals with pre-existing medical conditions or a history of significant health issues may be considered higher risk and may face higher premiums or may be denied coverage altogether.

- Lifestyle: Insurers also consider an individual’s lifestyle habits, such as smoking, drinking, and recreational drug use when evaluating an application for coverage. Individuals who engage in high-risk behaviors may face higher premiums or may be denied coverage.

- Occupation: Certain occupations may be considered higher risk by insurers, such as jobs that involve hazardous work conditions or frequent travel. Individuals who work in these types of occupations may face higher premiums or may be denied coverage.

- Family history: Insurers also consider an individual’s family medical history when evaluating an application for coverage. Individuals who have a family history of certain medical conditions, such as heart disease or cancer, may be considered higher risk and may face higher premiums or may be denied coverage.

- Amount of coverage: The amount of coverage an individual is applying for can also impact eligibility for coverage. Insurers may require additional medical documentation or may deny coverage for individuals who are applying for a significant amount of coverage.

In addition to these factors, insurers may also consider other factors such as the individual’s credit history and driving record when evaluating an application for coverage. It is important for individuals to be honest and transparent when applying for life insurance coverage and to work with an experienced insurance agent who can provide guidance on the underwriting process and help identify insurers who are more likely to offer coverage to individuals with pre-existing medical conditions or other risk factors.

Options for Life Insurance Coverage

If you have a bicuspid aortic valve, there are several options for life insurance coverage. These include:

- Traditional life insurance policies: Traditional life insurance policies require a medical exam and are typically more difficult to obtain for individuals with pre-existing medical conditions. However, if you are in good overall health and your bicuspid aortic valve is well-managed, you may be able to obtain coverage at a reasonable rate.

- Guaranteed issue life insurance: Guaranteed issue life insurance policies do not require a medical exam and are designed for individuals with pre-existing medical conditions. However, these policies often have lower coverage limits and higher premiums than traditional policies.

- Accidental death and dismemberment (AD&D) insurance: AD&D insurance provides coverage in the event of accidental death or injury. This type of insurance may be easier to obtain than traditional life insurance, but it does not provide coverage for death due to natural causes.

Conclusion:

Obtaining life insurance with a bicuspid aortic valve may require some extra effort and planning, but it is possible to secure coverage that meets your needs. By working with an experienced insurance agent, being honest about your medical history and current health status, and maintaining a healthy lifestyle, you can improve your chances of obtaining coverage at a reasonable rate.

Frequently Asked Questions

What is bicuspid aortic valve?

Bicuspid aortic valve is a heart condition in which the aortic valve, which controls blood flow from the heart to the rest of the body, has only two leaflets instead of the usual three.

Can individuals with bicuspid aortic valve obtain life insurance coverage?

Yes, individuals with bicuspid aortic valve can obtain life insurance coverage. However, the severity of the condition and any associated complications will play a significant role in determining the level of risk that an individual presents to the insurer.

What factors do insurers consider when evaluating an application for life insurance coverage?

Insurers consider several factors when evaluating an application for life insurance coverage, including an individual’s age, health, lifestyle habits, occupation, family medical history, and the amount of coverage being applied for.

Can individuals with bicuspid aortic valve qualify for preferred rates?

Individuals with mild symptoms or no complications from bicuspid aortic valve may be able to qualify for a preferred rate when applying for life insurance coverage. However, individuals with more severe symptoms or complications may be considered higher risk and may be denied coverage or offered a substandard rating.

What should individuals with bicuspid aortic valve do when applying for life insurance coverage?

Individuals with bicuspid aortic valve who are seeking life insurance coverage should work with an experienced insurance agent who understands the underwriting process and can help identify insurers who are more likely to offer coverage to individuals with pre-existing medical conditions. They should also be prepared to provide detailed medical documentation when applying for coverage and be honest and transparent when providing this information.

Are there any alternative options for obtaining life insurance coverage for individuals with bicuspid aortic valve?

Individuals with bicuspid aortic valve may be able to obtain coverage through a group life insurance policy, such as through an employer or professional organization. Group policies often have less stringent underwriting requirements than individual policies and may offer coverage to individuals who would not be eligible for individual coverage.