Life insurance is an essential tool for anyone who wants to protect their loved ones financially in the event of their unexpected death. However, when you have a pre-existing medical condition, like cerebral embolism, getting approved for life insurance can be challenging.

This guide will explain what cerebral embolism is, how it affects your ability to get life insurance, and what steps you can take to increase your chances of getting approved.

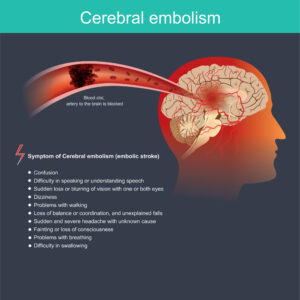

What is Cerebral Embolism?

Cerebral embolism is a type of stroke that occurs when a blood clot or other particle, such as plaque or fat, travels from another part of the body to the brain and blocks a blood vessel. This can cause damage to brain cells due to the lack of oxygen and nutrients, leading to serious health problems.

Causes:

Cerebral embolism is usually caused by blood clots that form in other parts of the body and travel to the brain. The most common causes of blood clots are irregular heartbeats, such as atrial fibrillation, heart valve disease, and atherosclerosis. Other risk factors for cerebral embolism include smoking, high blood pressure, high cholesterol, diabetes, and obesity.

Symptoms:

The symptoms of cerebral embolism can vary depending on the location and size of the clot. Common symptoms include sudden numbness or weakness in the face, arm, or leg on one side of the body, difficulty speaking or understanding speech, sudden confusion, severe headache, dizziness, and loss of balance or coordination. These symptoms usually come on suddenly and can be severe.

Treatment:

Immediate medical attention is crucial for cerebral embolism as early treatment can help reduce the risk of long-term complications. Treatment for cerebral embolism usually involves blood thinners, which can help prevent further blood clots from forming, and antiplatelet drugs, which can help prevent the existing clot from getting bigger. In some cases, surgery may be necessary to remove the clot.

Worst case scenario:

If cerebral embolism is not treated promptly, it can lead to severe brain damage or even death. The longer the brain is deprived of oxygen and nutrients, the greater the risk of permanent damage. The worst-case scenario for cerebral embolism is complete paralysis, cognitive impairment, and death. Even with treatment, some patients may still experience long-term complications, such as difficulty speaking, weakness, and memory problems.

Prevention:

The best way to prevent cerebral embolism is to manage any underlying health conditions that increase the risk of blood clots, such as high blood pressure, high cholesterol, and diabetes. Quitting smoking, maintaining a healthy weight, and exercising regularly can also help reduce the risk of blood clots. For those at high risk, anticoagulant therapy, such as warfarin or heparin, can help prevent blood clots from forming.

How Does Cerebral Embolism Affect Life Insurance Approval?

When you apply for life insurance, the insurer will ask you a series of questions about your health and medical history. They will also ask you to undergo a medical exam, which may include blood tests, urine tests, and a physical exam. Based on this information, the insurer will assess your risk of dying prematurely and decide whether to approve your application and at what premium rate.

Now since most life insurance companies will consider those who have suffered from a cerebral embolism will be considered a high-risk applicant, this means if approved for coverage, they will likely only be able to qualify for a substandard or table rate at best.

How Can You Increase Your Chances of Getting Approved for Life Insurance?

If you have cerebral embolism and want to get life insurance, there are several steps you can take to increase your chances of getting approved:

Be upfront about your condition

When you apply for life insurance, it’s essential to be honest and upfront about your medical history. If you try to hide your condition, the insurer may find out anyway and deny your claim later on. Instead, be honest about your condition and provide as much information as possible, including your diagnosis, treatment plan, and current medications.

Work with an experienced insurance broker

If you have a pre-existing medical condition like cerebral embolism, it’s a good idea to work with an experienced insurance broker who specializes in high-risk cases. A broker can help you find insurers who are more likely to approve your application and can negotiate on your behalf to get you the best possible premium rate.

Shop around for multiple quotes

Different insurers have different underwriting criteria, which means that one insurer may approve your application while another may deny it. To increase your chances of getting approved, it’s a good idea to shop around for multiple quotes from different insurers. This will give you a better idea of which insurers are more willing to work with someone with your medical condition and can help you find the best possible premium rate.

Improve your overall health

While you can’t cure cerebral embolism, you can take steps to improve your overall health and reduce your risk of

dying prematurely. This can help you not only live a healthier and happier life but also increase your chances of getting approved for life insurance. Some steps you can take to improve your overall health include:

- Follow your treatment plan: If you have been diagnosed with cerebral embolism, it’s essential to follow your treatment plan as prescribed by your doctor. This may include taking medications to prevent blood clots, managing any underlying conditions that increase your risk of stroke, and making lifestyle changes to reduce your risk of future strokes.

- Quit smoking: Smoking is a major risk factor for stroke and other serious health conditions. If you smoke, quitting can not only improve your overall health but also increase your chances of getting approved for life insurance.

- Maintain a healthy weight: Being overweight or obese can increase your risk of many health problems, including stroke. Maintaining a healthy weight through regular exercise and a healthy diet can help you reduce your risk of future strokes and improve your overall health.

- Manage your stress: Chronic stress can increase your risk of many health problems, including stroke. Finding ways to manage your stress, such as through meditation, yoga, or therapy, can help you reduce your risk of future strokes and improve your overall health.

What if you can’t qualify for a traditional life insurance policy?

If you can’t qualify for a traditional life insurance policy due to a medical condition such as cerebral embolism, there are still options available. Two popular options are guaranteed issue life insurance and accidental death policies. Here are the pros and cons of each option:

Guaranteed Issue Life Insurance

Pros:

- No medical exam or health questions required: Guaranteed issue life insurance policies are available to anyone, regardless of their health condition or age.

- Guaranteed approval: As long as you meet the age requirements, you will be approved for a guaranteed issue life insurance policy.

- Death benefit: Guaranteed issue life insurance policies offer a death benefit, which means that your loved ones will receive a payout when you pass away.

Cons:

- Expensive premiums: Guaranteed issue life insurance policies are typically more expensive than traditional life insurance policies.

- Low coverage limits: Guaranteed issue life insurance policies offer lower coverage limits than traditional life insurance policies.

- Waiting period: Most guaranteed issue life insurance policies have a waiting period before the death benefit is paid out. If you pass away during the waiting period, your beneficiaries will only receive a refund of the premiums paid.

Accidental Death Policy

Pros:

- Affordable premiums: Accidental death policies are usually much cheaper than traditional life insurance policies.

- No medical exam or health questions required: Accidental death policies do not require a medical exam or health questions.

- Quick payout: Accidental death policies usually pay out quickly after the policyholder’s death.

Cons:

- Limited coverage: Accidental death policies only pay out if the policyholder dies as a result of an accident.

- No coverage for natural causes: If the policyholder dies of natural causes, the policy will not pay out.

- Exclusions: Accidental death policies often have exclusions for certain activities, such as skydiving or scuba diving.

Conclusion:

Getting approved for life insurance with a pre-existing medical condition like cerebral embolism can be challenging, but it’s not impossible. By being honest about your condition, working with an experienced insurance broker, shopping around for multiple quotes, considering a guaranteed issue policy, and improving your overall health, you can increase your chances of getting approved for life insurance and protecting your loved ones financially in the event of your unexpected death.

Now if you can’t qualify for a traditional life insurance policy, guaranteed issue life insurance and accidental death policies are both viable options to consider. For more information on what you might be able to qualify for, give us a call, we’d be more than happy to help!