Life insurance is a crucial investment for individuals who want to protect their loved ones financially in case of their untimely death. However, for individuals with celiac disease, getting approved for life insurance can sometimes become a daunting task.

In this article, we will explore the challenges faced by individuals with celiac disease when trying to obtain life insurance and how to overcome them.

Celiac Disease

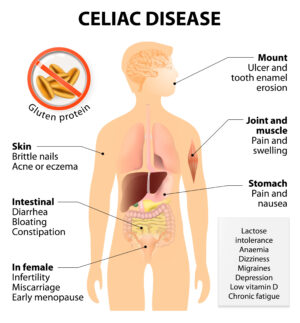

Celiac disease, also known as coeliac disease or sprue, is an autoimmune disorder that affects the small intestine. It occurs when the body’s immune system mistakenly attacks gluten, a protein found in wheat, barley, and rye. This attack causes inflammation in the small intestine, which can lead to a range of symptoms and long-term health complications.

Causes:

The exact cause of celiac disease is unknown, but it is believed to be a combination of genetic and environmental factors. Individuals who have a family history of celiac disease are more likely to develop the condition, and it is more common in individuals with certain genetic markers. Environmental factors, such as the amount of gluten consumed and the timing of gluten introduction to the diet, may also play a role in the development of celiac disease.

Symptoms:

The symptoms of celiac disease can vary widely from person to person, and some individuals may not experience any symptoms at all. However, common symptoms of celiac disease include:

- Abdominal pain and bloating

- Diarrhea or constipation

- Fatigue and weakness

- Anemia

- Weight loss

- Bone and joint pain

- Skin rash

- Mouth ulcers

- Nausea and vomiting

If left untreated, celiac disease can lead to more severe health complications, such as malnutrition, osteoporosis, and an increased risk of certain types of cancer.

Treatment:

The only effective treatment for celiac disease is a strict gluten-free diet. This means avoiding all foods and products that contain wheat, barley, and rye, as well as any foods that may be contaminated with gluten during processing or preparation. This can be challenging, as gluten can be found in a wide range of products, including bread, pasta, cereals, and processed foods.

In addition to a gluten-free diet, individuals with celiac disease may also benefit from nutritional supplements to address any nutrient deficiencies caused by malabsorption. For example, calcium and vitamin D supplements may be recommended to support bone health, and iron supplements may be prescribed to address anemia.

Worst-case scenario:

If celiac disease is left untreated, it can lead to serious health complications, including malnutrition, an increased risk of osteoporosis and other bone disorders, and an increased risk of certain types of cancer. In rare cases, untreated celiac disease can also lead to a condition called refractory celiac disease, which is characterized by ongoing intestinal damage despite adherence to a gluten-free diet. Refractory celiac disease can be difficult to treat and may require more aggressive treatment, such as immunosuppressive therapy or stem cell transplantation.

The impact of celiac disease on life insurance

Celiac disease can have an impact on life insurance applications, depending on the severity of the condition and the individual’s overall health. When mild and under control, celiac disease will have little to no impact on a life insurance application. However, if the condition is more severe or has led to other health complications, it may affect the individual’s ability to obtain life insurance or result in higher premiums.

Life insurance companies consider a range of factors when assessing an individual’s risk and determining their eligibility for coverage. These factors typically include age, gender, occupation, lifestyle habits (such as smoking or drinking), and health history. Individuals with pre-existing medical conditions, such as celiac disease, may face additional scrutiny during the underwriting process.

Types of policies one may be eligible for may include:

Term life insurance

Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, typically ranging from 1 to 30 years. Unlike permanent life insurance policies, which offer coverage for the policyholder’s entire lifetime, term life insurance policies are designed to provide affordable and temporary coverage for a specific period of time. Here are some pros and cons of term life insurance to consider:

Pros:

- Affordable premiums: One of the primary advantages of term life insurance is that it tends to be more affordable than other types of life insurance policies. Because it offers temporary coverage for a specific period of time, the premiums are typically lower than those of permanent policies.

- Flexible coverage: Term life insurance policies offer a great deal of flexibility when it comes to coverage amounts and terms. You can choose the amount of coverage you need and the length of the policy term based on your unique needs and circumstances.

- Simplicity: Term life insurance policies are relatively simple and straightforward. There are no complex investment features or cash value components, which makes them easy to understand and manage.

- Peace of mind: By providing a death benefit to your loved ones in the event of your passing, term life insurance can offer peace of mind and financial protection for you and your family.

Cons:

- Temporary coverage: The primary drawback of term life insurance is that it only provides coverage for a specific period of time. Once the policy term ends, you will need to renew or purchase a new policy if you want to continue your coverage.

- No cash value: Unlike permanent life insurance policies, term life insurance policies do not build cash value over time. This means that you cannot borrow or withdraw money from the policy while you are still alive.

- No investment component: Term life insurance policies do not include any investment features, which means that you cannot use them as a means of investment or savings.

- Increasing premiums: Some term life insurance policies come with increasing premiums, which means that the premiums will increase as you get older. This can make the policy more expensive over time and may make it difficult to maintain coverage.

Whole life insurance

Whole life insurance is a type of permanent life insurance policy that provides coverage for the policyholder’s entire lifetime, as long as the premiums are paid. Here are some pros and cons of whole life insurance to consider:

Pros:

- Lifelong coverage: One of the primary advantages of whole life insurance is that it provides coverage for your entire life, as long as the premiums are paid. This can provide peace of mind and financial protection for your loved ones after your passing.

- Cash value: Whole life insurance policies build cash value over time, which can be borrowed against or used to pay premiums. This can provide a savings or investment component to the policy, which can be helpful for those looking to build wealth over time.

- Fixed premiums: Whole life insurance policies typically come with fixed premiums that do not increase over time, regardless of changes in your health or age. This can provide a predictable and stable source of coverage and premium payments.

- Guaranteed death benefit: Whole life insurance policies come with a guaranteed death benefit, which means that your beneficiaries will receive a specific amount of money upon your passing. This can provide peace of mind and financial protection for your loved ones.

Cons:

- Higher premiums: One of the primary drawbacks of whole life insurance is that the premiums are typically higher than those of term life insurance policies. This can make whole life insurance more expensive and difficult to afford for some individuals.

- Complex policies: Whole life insurance policies can be more complex and difficult to understand than term life insurance policies. There are often more features and components to consider, such as cash value accumulation and dividends.

- Lower returns: While whole life insurance policies do offer a cash value component, the returns on this investment are often lower than other types of investments. This means that you may not receive as much of a return on your investment as you would with other investment options.

- Limited flexibility: Whole life insurance policies can be less flexible than term life insurance policies when it comes to coverage amounts and terms. Once you have purchased a policy, it can be difficult to make changes or adjust your coverage.

Final expense insurance

Final expense insurance, also known as burial insurance, is a type of life insurance policy that is designed to cover the cost of funeral expenses and other end-of-life expenses. Here are some pros and cons of final expense insurance to consider:

Pros:

- Affordable premiums: Final expense insurance policies typically have lower premiums than other types of life insurance policies, making them a more affordable option for many people.

- Simplified underwriting: Final expense insurance policies often have simplified underwriting requirements, meaning that they may be easier to qualify for, especially for those who may have health issues or other factors that could make it difficult to obtain traditional life insurance.

- No medical exam: Many final expense insurance policies do not require a medical exam, which can be a relief for those who may not want to undergo a medical exam or who have health issues that could make it difficult to qualify for other types of insurance.

- Guaranteed death benefit: Final expense insurance policies come with a guaranteed death benefit, which means that your beneficiaries will receive a specific amount of money upon your passing, providing peace of mind and financial protection for your loved ones.

Cons:

- Limited coverage amounts: Final expense insurance policies typically have lower coverage amounts than other types of life insurance policies, which may not be enough to cover all end-of-life expenses. This could leave your loved ones with additional financial burdens.

- Higher premiums for older individuals: Final expense insurance premiums can increase as you get older, which means that it may become more difficult to afford the premiums as you age.

- Limited benefits: Final expense insurance policies typically only cover funeral and burial expenses, which means that they do not provide the same level of coverage as other types of life insurance policies, such as term or whole life insurance.

- No cash value: Final expense insurance policies do not accumulate cash value over time, which means that you will not have a savings or investment component to the policy.

How to increase your chances of getting approved for life insurance with celiac disease.

Maintain good health

To increase your chances of getting approved for life insurance with celiac disease, you should prioritize maintaining good health. This means following a strict gluten-free diet, getting regular check-ups, and managing any health complications related to celiac disease. By showing that you are taking care of your health and managing your condition well, you can demonstrate to the insurance company that you are a responsible and low-risk client.

Be honest about your medical history

When applying for life insurance, it is essential to be honest about your medical history, including your celiac disease diagnosis and any related health complications. Lying or omitting information on your application can result in denial of coverage or cancellation of your policy later on. By being transparent about your medical history, you can work with the insurance company to find a policy that meets your needs and budget.

Shop around

It’s essential to shop around when looking for life insurance with celiac disease. Different insurance companies have different policies and underwriting standards, which can impact your chances of approval and premiums. By comparing multiple quotes from different insurance providers, you can find a policy that offers the best coverage at the most affordable price.

Work with an experienced life insurance agent

Working with an experienced life insurance agent can be incredibly beneficial when trying to obtain coverage with celiac disease. An experienced agent can help you navigate the complex world of life insurance and find policies that fit your specific needs and budget. They can also help you understand the underwriting process, answer any questions you may have, and advocate for you with the insurance company.

Conclusion:

Obtaining life insurance with celiac disease may seem like a daunting task, but it is possible with the right approach. By maintaining good health, being honest about your medical history, shopping around, considering a guaranteed issue policy, and working with an experienced life insurance agent, you can increase your chances of getting approved for coverage that meets your needs and budget. Remember that having life insurance can provide peace of mind and financial security for you and your loved ones, so it’s essential to explore all options available to you.