Life insurance is a crucial component of any financial plan. It provides protection to your loved ones in case of an unexpected event, such as illness or death. However, obtaining life insurance can be challenging if you have a medical condition like ulcers. Ulcers can be painful, but they can also have an impact on your ability to get approved for life insurance. In this article, we’ll discuss the process of getting life insurance with ulcers and what you can do to improve your chances of approval.

What are ulcers?

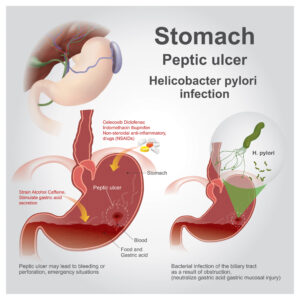

Ulcers are open sores that develop on the lining of the digestive tract. They can occur in the stomach (gastric ulcers) or in the small intestine (duodenal ulcers). Ulcers are caused by a bacterial infection called Helicobacter pylori (H. pylori) or by the use of non-steroidal anti-inflammatory drugs (NSAIDs).

Causes:

There are two main causes of ulcers: H. pylori infection and the use of NSAIDs. H. pylori infection is a common bacterial infection that can cause inflammation of the stomach lining and lead to the development of ulcers. NSAIDs, which are commonly used to treat pain and inflammation, can irritate the stomach lining and increase the risk of developing ulcers.

Types:

There are two main types of ulcers: gastric ulcers and duodenal ulcers (including Peptic Ulcers). Gastric ulcers develop in the stomach, while duodenal ulcers develop in the first part of the small intestine. Both types of ulcers have similar symptoms, but they can be diagnosed using different tests.

Symptoms:

The most common symptom of ulcers is abdominal pain, which can be described as a burning or gnawing sensation. Other symptoms may include bloating, nausea, vomiting, indigestion, loss of appetite, and weight loss. In severe cases, ulcers can cause bleeding, which can lead to anemia and other complications.

Treatment:

The treatment for ulcers will depend on the cause of the ulcer. If the ulcer is caused by H. pylori infection, antibiotics may be prescribed to kill the bacteria. Medications such as proton pump inhibitors (PPIs) and histamine blockers may also be prescribed to reduce stomach acid and promote healing of the ulcer. If the ulcer is caused by NSAID use, the medication may need to be discontinued or switched to a different type of pain reliever. In some cases, surgery may be necessary to remove the ulcer or repair any damage caused by the ulcer.

Worst case scenario:

In rare cases, ulcers can lead to serious complications such as bleeding, perforation, and obstruction. Bleeding can occur when the ulcer erodes a blood vessel, causing blood to leak into the digestive tract. Perforation can occur when the ulcer penetrates the wall of the stomach or intestine, allowing the contents of the digestive tract to leak into the abdominal cavity. Obstruction can occur when the ulcer causes a blockage in the digestive tract, preventing food from passing through. These complications can be life-threatening and require immediate medical attention.

How do ulcers affect life insurance?

When you apply for life insurance, the insurance company will ask you to fill out a health questionnaire and may also require you to take a medical exam. The insurance company will use this information to assess your risk of dying during the policy term. If you have a medical condition like ulcers, the insurance company may view you as a higher risk and may charge you a higher premium or deny you coverage altogether.

Insurance companies will consider various factors when assessing the risk of an applicant with ulcers. These factors can include:

- The severity of the ulcer

- The frequency of symptoms

- The treatment plan

- Whether there are any complications or underlying conditions

If your ulcers are well-managed and you have a good treatment plan in place, you may still be able to get approved for life insurance. However, if your ulcers are severe or you have other underlying conditions that increase your risk, you may have a harder time getting approved.

Impact on One’s life insurance application

If you have a mild case of ulcers and your condition is well-controlled with medication or lifestyle modifications, it may not have a significant impact on your life insurance application. In fact some applicants may even be able to qualify for a preferred rate.

However, if you have a more severe case of ulcers or have experienced complications such as bleeding, perforation, or obstruction, you may be considered a higher risk and may be offered a policy with higher premiums or exclusions for ulcer-related claims.

Tips for getting approved for life insurance with ulcers

If you have ulcers and are applying for life insurance, there are several things you can do to improve your chances of approval:

Be upfront about your condition

It’s important to be honest and upfront about your medical condition when applying for life insurance. Failing to disclose your condition can result in your policy being canceled or your beneficiaries not receiving the death benefit. By being honest, you can work with the insurance company to find a policy that fits your needs.

Get treatment

If you have ulcers, it’s important to get treatment and follow your doctor’s orders. This can include taking medication to manage your symptoms, making lifestyle changes (such as avoiding certain foods), and getting regular check-ups. By following your treatment plan, you can demonstrate to the insurance company that you are taking steps to manage your condition and reduce your risk.

Shop around

Not all insurance companies view ulcers in the same way. Some may be more willing to offer coverage to individuals with ulcers than others. By shopping around and getting quotes from multiple insurance companies, you can find the best policy for your needs and budget.

Consider a graded death benefit policy

If you are unable to get approved for a traditional life insurance policy, you may want to consider a graded death benefit policy. These policies have a waiting period before the full death benefit is paid out. During this waiting period (usually two to three years), the policy will only pay out a portion of the death benefit. These policies may be more expensive than traditional policies, but they can be a good option if you are unable to get approved for other coverage.

Work with an independent insurance agent

Working with an independent insurance agent can help you find the best life insurance policy for your needs. Independent agents work with multiple insurance companies and can help you compare policies and rates. They can also provide valuable advice and guidance throughout the application process.

Improve your overall health

Improving your overall health can also improve your chances of getting approved for life insurance with ulcers. This can include maintaining a healthy weight, getting regular exercise, quitting smoking, and reducing stress. By making healthy lifestyle choices, you can demonstrate to the insurance company that you are taking steps to reduce your overall risk of illness or death.

Conclusion…

Getting approved for life insurance with ulcers can be challenging, but it’s not impossible. By being honest about your condition, getting treatment, shopping around, considering a graded death benefit policy, working with an independent agent, and improving your overall health, you can improve your chances of approval. It’s important to remember that each insurance company has its own underwriting guidelines and may view ulcers differently. By being persistent and taking the necessary steps to manage your condition, you can find a policy that fits your needs and provides protection for your loved ones.

Frequently Asked Questions

Can I get life insurance if I have a history of ulcers?

Yes, it is possible to get life insurance if you have a history of ulcers. However, the impact on your life insurance application will depend on several factors, including the severity of your condition, any complications or underlying medical conditions, and how well your condition is managed. In some cases, you may be offered a policy with higher premiums or exclusions for ulcer-related claims. It’s important to be upfront and honest about your medical history when applying for life insurance and to work with an experienced insurance agent or broker to find the best policy to meet your needs.

Will I need to undergo a medical exam to get life insurance if I have a history of ulcers?

It depends on the life insurance company’s underwriting policies. In general, if you have a history of ulcers, you may be required to undergo additional medical underwriting, such as a medical exam or blood tests, to assess your risk more accurately. However, some insurers may offer policies that do not require a medical exam. It’s important to shop around and compare policies from different insurers to find one that is willing to offer you coverage at a reasonable rate.

How can I improve my chances of getting approved for life insurance if I have a history of ulcers?

To improve your chances of getting approved for life insurance if you have a history of ulcers, it’s important to manage your condition and maintain good overall health. This may include following your healthcare provider’s recommended treatment plan, adopting a healthy diet and exercise routine, reducing stress, and avoiding smoking and excessive alcohol consumption. Working with an experienced insurance agent or broker can also help you navigate the application process and find the best policy to meet your needs and budget.

Can I still get life insurance if I have had complications from my ulcer condition, such as bleeding or perforation?

Yes, it is still possible to get life insurance if you have had complications from your ulcer condition. However, you may be considered a higher risk and may be offered a policy with higher premiums or exclusions for ulcer-related claims. It’s important to be upfront and honest about your medical history when applying for life insurance and to work with an experienced insurance agent or broker to find the best policy to meet your needs.

How long does it take to get approved for life insurance if I have a history of ulcers?

The time it takes to get approved for life insurance with a history of ulcers can vary depending on the insurer’s underwriting process and the severity of your condition. In general, it may take longer to get approved if additional medical underwriting is required, such as a medical exam or blood tests. It’s important to be patient and to work closely with your insurance agent or broker to ensure a smooth application process.

Can I get life insurance if I have a history of ulcers and other medical conditions?

Yes, it is possible to get life insurance if you have a history of ulcers and other medical conditions. However, your risk will be assessed based on all of your medical history and any underlying health conditions that may contribute to your risk. Depending on the severity of your conditions, you may be offered a policy with higher premiums or exclusions for certain claims. It’s important to work with an experienced insurance agent or broker to find the best policy to meet your needs.

What happens if I don’t disclose my history of ulcers when applying for life insurance?

It’s important to be honest and upfront about your medical history when applying for life insurance. If you fail to disclose your history of ulcers, it could result in denial of coverage or cancellation of your policy. It’s not worth the risk of being caught for misrepresentation or omission of medical information. It’s better to be upfront and honest to ensure you get the coverage you need and avoid any legal or financial repercussions in the future.

Will my life insurance premiums be higher if I have a history of ulcers?

It’s possible that your life insurance premiums may be higher if you have a history of ulcers. This is because insurers assess risk based on a range of factors, including your overall health, medical history, and lifestyle. If your ulcer condition is well-managed and has not resulted in any complications or underlying medical conditions, you may still be able to obtain coverage at standard rates. However, if your condition is severe or has led to complications, you may be considered a higher risk and may be offered a policy with higher premiums or exclusions for ulcer-related claims.

Can I purchase life insurance if I have active ulcers?

It may be difficult to purchase life insurance if you have active ulcers, particularly if your condition is severe or has led to complications. Insurers typically prefer to offer coverage to individuals with well-managed medical conditions and a lower risk of claims. However, it’s still possible to obtain coverage, particularly if you work with an experienced insurance agent or broker who can help you navigate the application process and find a policy that meets your needs.