Obtaining life insurance is a critical financial decision for individuals seeking to protect their loved ones in the face of unforeseen circumstances. However, for those diagnosed with Tetralogy of Fallot (TOF), a congenital heart defect consisting of four heart abnormalities, navigating the life insurance landscape can be particularly challenging.

In this comprehensive guide, we aim to shed light on the intricacies of securing life insurance with TOF. By addressing the unique considerations, hurdles, and available options, we provide valuable information and guidance to empower individuals with TOF in making informed decisions about their life insurance needs.

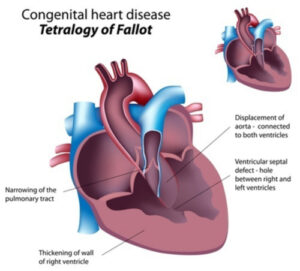

Understanding Tetralogy of Fallot (TOF)

Tetralogy of Fallot (TOF) is a congenital heart defect characterized by a combination of four heart abnormalities that affect the structure and function of the heart. These four defects include a ventricular septal defect (VSD), pulmonary stenosis (PS), overriding aorta, and right ventricular hypertrophy (RVH). This complex condition occurs during fetal development when the heart doesn’t form properly.

Causes:

The exact cause of TOF is still unknown, but it is believed to involve a combination of genetic and environmental factors. Some studies suggest that certain genetic mutations or chromosomal abnormalities may increase the risk of TOF. Additionally, maternal factors such as maternal diabetes, maternal alcohol or drug abuse, and certain medications taken during pregnancy may contribute to the development of TOF.

Symptoms:

Individuals with TOF may exhibit various symptoms, which can range from mild to severe. Common symptoms include cyanosis (a bluish tint to the skin), shortness of breath, rapid breathing, fatigue, poor weight gain, clubbing of fingers and toes, fainting, and heart murmurs. The severity of symptoms depends on the degree of obstruction in the pulmonary artery and the size of the ventricular septal defect.

Treatment:

Treatment for TOF typically involves surgical intervention. The primary goal of surgery is to correct the defects and improve blood flow to the lungs. The most common surgical procedure is called a “complete repair,” which involves closing the ventricular septal defect and relieving the pulmonary stenosis. In some cases, additional surgeries or procedures may be required as the child grows and develops.

Worst-case scenario:

In the worst-case scenario, individuals with TOF may experience life-threatening complications. These can include severe cyanotic episodes (often referred to as “Tet spells”) where oxygen levels drop significantly, leading to loss of consciousness and potential brain damage. Prolonged untreated cyanosis can also result in complications such as arrhythmias, heart failure, and an increased risk of infection in the heart.

It is important to note that with appropriate medical care and surgical interventions, the prognosis for individuals with TOF has significantly improved over the years. Many individuals with TOF go on to lead healthy and fulfilling lives, particularly with early detection, timely treatment, and ongoing follow-up care.

Impact on One’s Life Insurance Application

When it comes to obtaining life insurance with Tetralogy of Fallot (TOF), the severity of the condition and the presence of complications can significantly impact the approval process and the terms of coverage. Understanding how TOF severity affects life insurance applications can help individuals with TOF navigate the process more effectively.

Mild TOF:

For individuals with mild TOF who have undergone corrective surgeries and experience few complications, it is often possible to qualify for life insurance at a substandard (or higher) rate. Substandard rates typically mean higher premiums due to the increased risk associated with the pre-existing condition. However, even with the substandard rate, it is still possible to secure life insurance coverage to protect loved ones financially.

Moderate to Severe TOF:

On the other hand, for individuals with moderate to severe TOF or ongoing symptoms, the life insurance approval process becomes more challenging. Insurance companies evaluate each application on a case-by-case basis, considering factors such as the individual’s overall health, medical history, current symptoms, and prognosis. Approval for coverage may be more difficult to obtain, and in many cases, individuals with moderate to severe TOF may face denials or receive limited coverage options.

Insurance companies assess the risk associated with TOF based on factors such as the potential for complications, the need for ongoing medical treatment or surgeries, and the impact on life expectancy. These factors influence the underwriting decision and may result in higher premiums, exclusions for pre-existing conditions, or even denial of coverage.

Factors that will be considered

When evaluating a life insurance application for individuals with Tetralogy of Fallot (TOF), insurance companies consider several factors to assess the risk associated with the condition. The following factors are typically taken into account:

- Severity of TOF: The severity of TOF plays a significant role in the underwriting process. Insurance companies will assess the extent of the heart defects, the presence of complications, and the impact on overall health and life expectancy.

- Medical History: The applicant’s complete medical history, including details of TOF diagnosis, surgeries, treatments, and any associated complications or procedures, will be carefully reviewed. The insurance company will consider the individual’s response to treatment and the stability of their condition.

- Current Symptoms: The presence and severity of current symptoms, such as cyanosis, shortness of breath, or heart murmurs, will be evaluated. The impact of these symptoms on the applicant’s daily life and functional abilities may influence the underwriting decision.

- Treatment and Medications: The insurance company will assess the individual’s compliance with recommended treatments, medications, and follow-up care. Adherence to a treatment plan and regular medical check-ups may demonstrate responsible management of the condition and potentially improve the chances of approval.

- Surgical Interventions: If the applicant has undergone corrective surgeries for TOF, insurance companies will consider the success of the procedures, the time elapsed since the surgeries, and any associated complications or ongoing medical needs.

- Overall Health: The applicant’s overall health and any co-existing medical conditions will be evaluated. Insurance companies consider factors such as body weight, blood pressure, cholesterol levels, and the presence of other cardiovascular or systemic diseases that may impact life expectancy.

- Age at Diagnosis: The age at which TOF was diagnosed may be a relevant factor. Early diagnosis and intervention may indicate better long-term outcomes and potentially improve the chances of obtaining life insurance coverage.

- Lifestyle Factors: Insurance companies may consider lifestyle choices such as smoking, alcohol consumption, and participation in high-risk activities when evaluating the application. Unhealthy habits or behaviors may increase the perceived risk and affect the underwriting decision.

- Family Medical History: The applicant’s family medical history, particularly the presence of congenital heart defects or cardiovascular diseases, may be considered. Genetic factors can influence the underwriting decision and the perceived risk of future complications.

- Prognosis and Follow-up Care: The insurance company will review the prognosis provided by the applicant’s healthcare providers and the frequency and quality of follow-up care. Regular monitoring and adherence to recommended check-ups and tests may positively impact the underwriting decision.

It is important to note that each insurance company has its own underwriting guidelines, and the consideration of these factors may vary. Consulting with a specialized insurance agent or broker experienced in dealing with pre-existing conditions like TOF can provide valuable guidance and help navigate the application process effectively.

Improving Your Chances of Obtaining Life Insurance with Tetralogy of Fallot (TOF)

While securing life insurance with Tetralogy of Fallot (TOF) can be challenging, there are several steps you can take to improve your chances of approval. Consider the following tips:

- Gather Comprehensive Medical Records: Collect and organize all relevant medical records, including diagnosis information, surgical reports, treatment history, and follow-up care details. Providing a complete picture of your medical journey helps insurance underwriters understand the management of your condition.

- Be Honest and Disclose Information: It is crucial to be transparent and provide accurate information about your TOF and any related health conditions. Disclosing all relevant details, even if they may seem minor or unrelated, ensures that the underwriters have a comprehensive understanding of your health status.

- Work with a Specialized Insurance Agent or Broker: Seek assistance from an insurance professional who has experience in dealing with pre-existing conditions like TOF. They can guide you through the application process, help you choose the right insurance company, and advocate on your behalf to find the best possible coverage options.

- Maintain Regular Medical Check-ups: Consistent and proactive medical care is essential. Attend regular check-ups with your healthcare provider and follow the recommended treatment plan. A history of regular medical care demonstrates responsible management of your condition and may increase your chances of approval.

- Maintain a Healthy Lifestyle: Adopting a healthy lifestyle can positively impact your overall health and improve your insurability. Engage in regular exercise, eat a balanced diet, avoid smoking, limit alcohol consumption, and manage any co-existing health conditions to demonstrate your commitment to maintaining your well-being.

- Provide Additional Supporting Documentation: If necessary, obtain additional documentation from your healthcare providers, such as letters explaining your condition, treatment history, and your overall prognosis. These supporting documents can help strengthen your application and provide a clearer understanding of your health status.

- Consider Alternative Insurance Options: If traditional life insurance options are not feasible due to denials or high premiums, explore alternative options such as guaranteed issue life insurance or group life insurance through employers or associations. These options may have more lenient underwriting requirements and provide coverage when individual policies are not accessible.

- Be Patient and Persistent: The process of obtaining life insurance with TOF may require patience and persistence. Understand that it may take time to find the right insurance company and policy that suits your needs. Don’t get discouraged by potential rejections and continue to explore different options.

Remember, each insurance company has its own underwriting guidelines, so what works with one company may not apply to others. By taking these tips into consideration and seeking professional guidance, you can increase your chances of obtaining life insurance coverage that protects your loved ones financially.

Final thoughts…

While obtaining life insurance with Tetralogy of Fallot (TOF) may present challenges, it is not an impossible task. By being proactive, transparent, and seeking specialized assistance, you can improve your chances of securing the coverage you need. Remember to gather comprehensive medical records, work with an experienced insurance professional, maintain regular medical check-ups, and lead a healthy lifestyle. In cases where traditional life insurance is not attainable, explore alternative options that provide some form of coverage. By taking these steps and advocating for yourself, you can navigate the life insurance landscape with TOF and provide financial protection for your loved ones.