Life insurance is a vital tool for ensuring that your loved ones are financially protected in the event of your untimely death. It provides financial security and peace of mind for both you and your family, as it can help cover funeral expenses, outstanding debts, and future living expenses. However, obtaining life insurance can be challenging, especially for individuals who have a history of skin cancer, such as basal, squamous, or melanoma.

Therefore, we have created a list of some of the most common questions people with skin cancer have when it comes to getting life insurance.

Our goal is to help you understand the process better and ensure that you are prepared to qualify for the best life insurance policy available.

Frequently Asked Questions

Can I get life insurance if I have been diagnosed with skin cancer?

Yes, you can still get life insurance if you have been diagnosed with skin cancer. However, the availability and cost of coverage will depend on various factors such as the type of skin cancer, the stage of the cancer, and the treatment history. Some life insurance companies may be more willing to offer coverage than others, so it’s important to shop around and compare different policies. In some cases, you may need to pay higher premiums or accept certain exclusions or limitations on coverage.

What types of skin cancer will affect my chances of getting approved for life insurance?

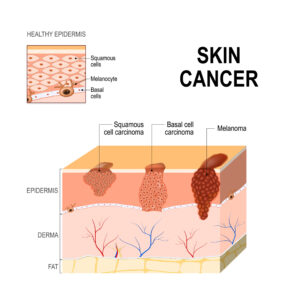

The type of skin cancer you have will affect your chances of getting approved for life insurance. Basal cell carcinoma and squamous cell carcinoma are the two most common types of skin cancer, and they are generally considered less severe than melanoma. As a result, if you have a history of basal or squamous cell carcinoma, you may still be able to qualify for life insurance coverage, especially if the cancer was caught early and treated successfully.

However, if you have a history of melanoma, your chances of getting approved for life insurance may be lower, as melanoma is a more aggressive and potentially deadly form of skin cancer. The stage of cancer, the treatment history, and how long you have been cancer-free will also play a significant role in determining your eligibility for life insurance.

How will the stage of my skin cancer impact my ability to get approved for life insurance?

The stage of your skin cancer can have a significant impact on your ability to get approved for life insurance. Generally, the earlier the stage of the cancer, the better your chances of being approved for coverage. If the cancer was caught early and treated successfully, you may be able to qualify for life insurance coverage with standard rates. However, if the cancer has spread to nearby lymph nodes or other organs, your chances of getting approved for life insurance may be lower, and you may have to pay higher premiums or accept certain exclusions or limitations on coverage. It’s important to disclose your skin cancer history accurately and truthfully when applying for life insurance, including the stage of the cancer, to avoid potential claim denials in the future.

What information do I need to provide to the life insurance company about my skin cancer diagnosis?

When applying for life insurance with a history of skin cancer, you will need to provide the life insurance company with detailed information about your diagnosis and treatment. This may include:

- The type of skin cancer you were diagnosed with (e.g., basal cell carcinoma, squamous cell carcinoma, melanoma).

- The stage of the cancer at diagnosis.

- The date of your diagnosis.

- The date and type of treatment you received (e.g., surgery, radiation, chemotherapy).

- The name and contact information of the doctor who treated you.

- Any medications you are currently taking related to your skin cancer.

- Whether you have experienced any recurrence or metastasis of the cancer.

- Your current status and prognosis.

It’s important to provide accurate and detailed information to the life insurance company to ensure that you receive an accurate quote and to avoid any potential claim denials in the future.

Will my medical records be reviewed when I apply for life insurance with skin cancer?

Yes, your medical records will likely be reviewed when you apply for life insurance with a history of skin cancer. Life insurance companies typically require applicants to provide permission to access their medical records as part of the underwriting process. The company’s underwriters will review your medical records to assess the severity of your skin cancer, the stage of the cancer, and the effectiveness of any treatments you have undergone. Your medical records will also be used to evaluate your overall health and any other risk factors that may affect your eligibility for coverage.

Can I still qualify for life insurance if I am currently undergoing treatment for skin cancer?

It can be difficult to qualify for life insurance while undergoing treatment for skin cancer. Life insurance companies typically require applicants to be cancer-free for a certain period of time before approving coverage. This waiting period can vary depending on the type of skin cancer, the stage of the cancer, and the treatment history. If you are currently undergoing treatment for skin cancer, your chances of qualifying for life insurance coverage may be lower, and you may need to wait until your treatment is complete and you are cancer-free for a certain period of time before applying for coverage.

How long do I need to wait after my skin cancer treatment before applying for life insurance?

The waiting period after skin cancer treatment before applying for life insurance can vary depending on the type of skin cancer, the stage of the cancer, and the treatment history. In general, life insurance companies typically require a waiting period of at least 6 months to 1 year after treatment before considering an application for coverage. During this time, you will need to have regular follow-up appointments with your doctor to monitor your skin cancer and ensure that there is no recurrence. If your cancer was caught early and treated successfully, and you have been cancer-free for a certain period of time, you may be able to qualify for life insurance coverage with standard rates. However, if you have a history of melanoma or the cancer has spread to other areas, your chances of getting approved for coverage may be lower, and you may need to pay higher premiums or accept certain exclusions or limitations on coverage.

Will I need to undergo a medical exam to apply for life insurance with skin cancer?

Whether or not you will need to undergo a medical exam to apply for life insurance with skin cancer depends on the specific insurance company and the type of policy you are applying for. In some cases, the life insurance company may require a medical exam as part of the underwriting process, which may include a physical exam, blood work, and a urine sample. The results of the medical exam will be used to assess your overall health and any potential health risks. However, some life insurance companies offer “no-exam” policies, which may be available for certain applicants, including those with a history of skin cancer. No-exam policies may have higher premiums and lower coverage limits than policies that require a medical exam. It’s important to discuss your options with an insurance agent or broker to determine the best type of policy for your specific situation.

Will my premiums be higher if I have a history of skin cancer?

Having a history of skin cancer can impact your life insurance premiums. The life insurance company will assess the risk of insuring you based on several factors, including the type of skin cancer, the stage of the cancer, the treatment history, and the time since treatment. Depending on these factors, the life insurance company may classify you as a higher risk and charge higher premiums to offset the increased risk of a potential payout.

For example, if you have a history of melanoma, which is a more serious form of skin cancer, you may be charged higher premiums compared to someone with a history of less aggressive types of skin cancer, such as basal or squamous cell carcinoma.

The amount of the premium increase can vary depending on the insurance company and the specific policy. However, some insurance companies may offer policies that are specifically designed for individuals with a history of skin cancer, which may have more affordable premiums than traditional policies.

Can I appeal a decision if my application for life insurance is denied due to my skin cancer history?

Yes, if your application for life insurance is denied due to your skin cancer history, you may be able to appeal the decision. The specific appeals process can vary depending on the insurance company and the reason for the denial, so it’s important to carefully review the denial letter and follow the instructions provided.

Typically, you will need to provide additional information or documentation to support your appeal. For example, you may need to provide more detailed medical records or a letter from your doctor explaining your current health status and prognosis.

It’s important to note that the appeals process can be lengthy and may not always result in a successful outcome. To increase your chances of success, it may be helpful to work with an experienced insurance agent or broker who can help you navigate the process and provide guidance on how to strengthen your case.

How can I improve my chances of getting approved for life insurance with skin cancer?

There are several steps you can take to improve your chances of getting approved for life insurance with a history of skin cancer:

- Be honest and accurate: When applying for life insurance, it’s important to disclose your skin cancer history accurately and truthfully. Providing inaccurate or incomplete information can result in a denial of coverage or a future claim denial.

- Gather and provide detailed medical records: To help the life insurance company assess your risk, it’s important to provide detailed medical records that document your skin cancer diagnosis, treatment history, and current health status. Make sure to include all relevant medical reports, including pathology reports, imaging studies, and progress notes.

- Follow your treatment plan: If you are currently undergoing treatment for skin cancer, it’s important to follow your treatment plan and attend all scheduled appointments. This can help demonstrate your commitment to managing your health and may improve your chances of getting approved for life insurance.

- Wait until you are in remission: If you have recently been treated for skin cancer, it may be beneficial to wait until you are in remission before applying for life insurance. This can demonstrate that you have successfully completed treatment and may reduce the perceived risk of insuring you.

- Work with an experienced insurance agent or broker: Working with an experienced insurance agent or broker who specializes in high-risk cases, such as those with a history of skin cancer, can be beneficial. They can help you navigate the application process, provide guidance on how to improve your chances of approval, and help you find the best policy for your needs.