Sickle cell anemia, a genetic blood disorder characterized by misshapen red blood cells, affects millions of individuals worldwide. In the United States alone, approximately 100,000 people grapple with the daily challenges of living with this condition.

Sickle cell anemia not only impacts health but also raises important considerations for financial planning, including the need for life insurance. This article aims to explore the intricacies of obtaining life insurance for individuals with sickle cell anemia. By shedding light on the available options, factors affecting premiums, and crucial steps to take, we aim to empower individuals and their families to make informed decisions about securing financial protection in the face of this condition’s uncertainties.

Understanding Sickel Cell Anemia

Sickle cell anemia is a hereditary blood disorder characterized by the production of abnormal hemoglobin, the protein in red blood cells responsible for carrying oxygen throughout the body. This condition primarily affects individuals of African, Mediterranean, Middle Eastern, and South Asian descent.

Causes:

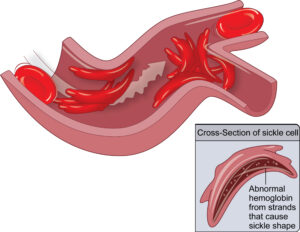

Sickle cell anemia is caused by a genetic mutation in the hemoglobin gene. Normally, red blood cells are round and flexible, allowing them to move easily through blood vessels. However, in individuals with sickle cell anemia, the mutation leads to the production of abnormal hemoglobin called hemoglobin S. This abnormal hemoglobin causes red blood cells to become rigid, sticky, and assume a crescent or “sickle” shape. The sickle-shaped cells can block blood flow, leading to pain, organ damage, and other complications.

Trait vs. Disease:

Sickle cell trait and sickle cell disease are two different conditions related to sickle cell anemia. Sickle cell trait occurs when a person inherits one normal hemoglobin gene (HbA) and one sickle cell gene (HbS). People with sickle cell trait usually do not experience symptoms and lead normal lives, but they can pass the sickle cell gene to their children. Sickle cell disease, on the other hand, occurs when an individual inherits two copies of the sickle cell gene (HbS/HbS). This results in the production of abnormal hemoglobin and leads to the symptoms and complications associated with sickle cell anemia.

Symptoms:

The symptoms of sickle cell anemia can vary in severity and can include:

- Fatigue and weakness

- Episodes of severe pain, called sickle cell crises, which can occur in various parts of the body, such as the chest, abdomen, joints, or bones.

- Anemia, characterized by a low red blood cell count, leading to pale skin, shortness of breath, and rapid heartbeat.

- Increased susceptibility to infections.

- Delayed growth and development in children.

- Vision problems.

- Yellowing of the skin and eyes (jaundice) due to the breakdown of red blood cells.

Treatment:

Although there is no cure for sickle cell anemia, various treatment options are available to manage its symptoms and complications. These can include:

- Pain management: Medications are used to relieve pain during sickle cell crises.

- Hydroxyurea: This medication helps increase the production of fetal hemoglobin, which can reduce the frequency and severity of pain episodes.

- Blood transfusions: In severe cases, regular blood transfusions may be required to manage anemia and prevent complications.

- Bone marrow or stem cell transplantation: This procedure is considered in selected cases and can potentially cure sickle cell anemia by replacing faulty stem cells with healthy ones.

- Management of complications: Treating and preventing complications such as infections, organ damage, and stroke is an essential part of the overall care for individuals with sickle cell anemia.

Worst Case Scenario:

In severe cases of sickle cell anemia, individuals can experience life-threatening complications. Some of the worst-case scenarios include:

- Acute chest syndrome: This is a condition characterized by chest pain, shortness of breath, and fever. It can be caused by a blocked blood vessel in the lungs and may require hospitalization and intensive care.

- Stroke: Blockage of blood vessels in the brain can lead to a stroke, causing potentially severe neurological damage.

- Organ damage: The inadequate blood supply caused by sickle cell anemia can damage organs such as the liver, heart, kidneys, and spleen, leading to organ failure.

- Infections: People with sickle cell anemia are more susceptible to infections, particularly bacterial infections. Infections can become severe and life-threatening, especially in individuals with weakened immune systems.

- Acute pain crisis: Severe and prolonged episodes of pain, known as vaso-occlusive crises, can occur in various parts of the body. If not properly managed, these crises can lead to tissue damage and organ dysfunction.

- Pulmonary hypertension: Sickle cell anemia can cause high blood pressure in the blood vessels of the lungs. Over time, this can lead to pulmonary hypertension, which can strain the heart and potentially result in heart failure.

It’s important to note that with advancements in medical care and early interventions, the prognosis for individuals with sickle cell anemia has significantly improved. Regular medical follow-up, early detection, and appropriate management of complications can help prevent and minimize the occurrence of these worst-case scenarios. It’s crucial for individuals with sickle cell anemia to work closely with their healthcare team to receive proper care and support.

Impact on One’s Life Insurance Application

When it comes to life insurance applications, sickle cell anemia can have an impact on the eligibility and rates offered to individuals. The specific impact can vary depending on whether the applicant has sickle cell trait or sickle cell disease.

For individuals with sickle cell trait, who are carriers of the gene but typically do not experience symptoms or complications, they may still be eligible for preferred rates or standard rates, similar to individuals without the trait. Sickle cell trait carriers are generally considered to have a lower risk of developing the complications associated with sickle cell disease.

On the other hand, individuals with mild sickle cell anemia, which falls under the category of sickle cell disease, may be able to qualify for a substandard or table rate. This means that they may be offered a life insurance policy but at higher premium rates compared to individuals without sickle cell anemia. The specific rates and eligibility can vary depending on the severity of the disease and the insurer’s underwriting guidelines.

For individuals with moderate to severe sickle cell anemia, it is more likely that their life insurance application will be denied. This is because the condition is considered to pose a higher risk of complications and a potentially shorter life expectancy.

It’s important to note that the eligibility and rates for life insurance can vary among insurance companies. Some insurers may have more lenient underwriting guidelines or specialize in providing coverage for individuals with pre-existing medical conditions. It’s recommended for individuals with sickle cell anemia to work with an experienced insurance agent or broker who can guide them through the application process and help find the best options available based on their specific circumstances.

Tips to help qualify for a coverage

While qualifying for life insurance coverage with sickle cell anemia may present some challenges, there are several tips that may help improve your chances:

- Work with an experienced agent or broker: Seek guidance from an insurance professional who specializes in high-risk cases or has experience with clients who have pre-existing medical conditions. They can help navigate the insurance market and find insurers that are more likely to provide coverage for individuals with sickle cell anemia.

- Gather detailed medical records: Obtain comprehensive medical records that detail your condition, treatments received, and overall health history. Providing thorough and accurate information can help insurers better assess your situation.

- Maintain regular medical check-ups: Consistently follow up with your healthcare provider and adhere to the recommended treatment plan. Regular medical care demonstrates your commitment to managing your condition and can be seen as a positive factor by insurers.

- Optimize your overall health: Take steps to maintain good overall health by following a healthy lifestyle. This includes exercising regularly, eating a balanced diet, getting sufficient rest, managing stress, and avoiding smoking or excessive alcohol consumption. A healthier lifestyle can positively impact your insurability.

- Consider getting a medical opinion letter: If you have been managing your condition well and have shown good health stability, it may be beneficial to obtain a letter from your treating physician. This letter can outline your treatment history, response to treatment, and overall prognosis, providing additional supporting evidence for your application.

- Explore alternative insurance options:group If you are unable to qualify for traditional coverage, check if your employer offers group life insurance coverage. Group plans or consider alternative policies such as guaranteed issue life insuranc or accidental death policies which often have less stringent underwriting requirements and may provide coverage without medical exams or individual underwriting.

- Be transparent and provide accurate information: It is essential to be truthful and transparent in your application. Provide accurate information regarding your medical history, treatments, and any other relevant details. Failing to disclose or misrepresenting information can lead to policy cancellation or denial of claims in the future.

Remember that the availability and terms of coverage can vary among insurance companies. Shopping around and comparing quotes from multiple insurers can increase your chances of finding a policy that suits your needs.

Final thoughts…

While obtaining life insurance coverage with sickle cell anemia can present challenges, it is not impossible. By working with an experienced insurance professional, gathering comprehensive medical records, maintaining regular medical check-ups, optimizing overall health, obtaining a medical opinion letter, considering group insurance options, and providing accurate information, you can increase your chances of qualifying for coverage.

Remember to be patient, persistent, and explore multiple insurance options to find the best policy that meets your needs.