In this article, we will delve into the intricacies of life insurance with scoliosis, exploring the impact of the condition on coverage, factors influencing underwriting decisions, strategies to obtain affordable policies, and alternative options available for those facing challenges. By shedding light on this topic, we aim to empower individuals with scoliosis to navigate the insurance landscape with confidence and secure the protection they deserve.

Understanding Scoliosis

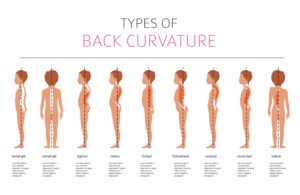

Scoliosis is a spinal condition characterized by an abnormal sideways curvature of the spine. Instead of a straight vertical alignment, the spine may curve to the left or right, forming an “S” or “C” shape. This condition affects people of all ages, but it is most commonly diagnosed during adolescence.

Causes:

The exact cause of scoliosis is often unknown and referred to as idiopathic scoliosis. However, there are several recognized types of scoliosis, including congenital scoliosis (present at birth due to spinal abnormalities), neuromuscular scoliosis (caused by underlying neuromuscular conditions such as cerebral palsy or muscular dystrophy), and degenerative scoliosis (developing in older adults due to wear and tear on the spine).

Symptoms:

Symptoms of scoliosis may vary depending on the severity and progression of the condition. In mild cases, individuals may not experience any noticeable symptoms. However, as scoliosis worsens, the following signs may appear:

- Uneven shoulder heights or shoulder blades

- One hip appears higher than the other

- Visible curvature of the spine

- Asymmetry in the waist or torso area

- Back pain, particularly in severe cases

Treatment:

Treatment options for scoliosis depend on factors such as the severity of the curve, the individual’s age, and the risk of progression. Mild cases may only require observation and regular check-ups to monitor the curve’s progression. In more severe cases or cases at risk of progression, treatment options may include:

- Bracing: Wear a brace to help prevent the curve from worsening, particularly during periods of growth.

- Physical Therapy: Specialized exercises to strengthen the muscles supporting the spine and improve posture.

- Surgery: In severe cases where the curve is progressing rapidly or causing significant pain or deformity, spinal fusion surgery may be recommended. This procedure involves fusing the vertebrae together using rods, screws, and bone grafts to stabilize and correct the curve.

Worst-case scenarios:

In worst-case-scenarios, scoliosis can lead to severe spinal deformity, reduced lung capacity, chronic pain, and psychological distress. Severe curves can put pressure on internal organs and cause breathing difficulties. It is crucial to diagnose and manage scoliosis early to prevent these potential complications.

Impact on One’s Life Insurance Application

When it comes to applying for life insurance with scoliosis, the impact on the application process can vary depending on the severity of the condition. Insurance companies assess scoliosis cases individually, considering factors such as the degree of curvature, treatment history, and overall health. Here’s an overview of how scoliosis can affect the life insurance application:

- Mild Cases: Individuals with mild scoliosis, typically defined as curves measuring less than 20 degrees, may have little to no impact on their life insurance application. In many cases, they can qualify for preferred rates, which are the best rates offered by insurance companies.

- Moderate Cases: Moderate scoliosis, with curves ranging from 20 to 50 degrees, may still allow individuals to qualify for standard or better rates. However, the insurance company may request additional medical information, including X-rays or specialist reports, to evaluate the stability and progression of the condition.

- Severe Cases: Severe scoliosis, with curves exceeding 50 degrees or cases that have undergone surgical intervention, can present challenges during the application process. While it’s still possible to obtain life insurance coverage, individuals with severe scoliosis may qualify for a substandard rate, which means higher premiums compared to individuals without scoliosis. In some cases, insurance companies may even deny coverage due to the perceived higher risk associated with severe scoliosis.

It’s important to note that each insurance company has its own underwriting guidelines and may assess scoliosis cases differently. Some companies may specialize in high-risk cases and have more lenient underwriting criteria for scoliosis. It’s advisable to research and approach insurance providers that have experience in dealing with scoliosis-related applications.

Factors that will be considered during underwriting

When underwriting a life insurance application for an individual with scoliosis, insurance companies take several factors into consideration to assess the risk associated with the condition. These factors help determine the insurability and premium rates. Here are some key factors that are typically considered during the underwriting process:

- Degree of Curvature: The degree of curvature in the spine is an important factor. Insurance companies may request recent X-rays or medical reports to determine the severity of scoliosis. The higher the degree of curvature, the greater the potential impact on underwriting decisions.

- Stability and Progression: Insurance companies are interested in understanding the stability of the scoliosis and its likelihood of progression. They may review medical records and treatment history to assess if the condition has stabilized or if it continues to progress. Stable curves are generally viewed more favorably during underwriting.

- Age at Diagnosis: The age at which scoliosis was diagnosed can play a role in underwriting. Scoliosis diagnosed during adolescence (adolescent idiopathic scoliosis) may have a different underwriting assessment compared to scoliosis diagnosed in adulthood.

- Treatment History: Insurance companies review the individual’s treatment history to evaluate the effectiveness of any interventions. The type of treatment received, such as bracing or surgical intervention, and the outcome of the treatment may influence underwriting decisions.

- Overall Health: The applicant’s overall health is taken into consideration, including any other medical conditions or underlying health issues. Insurance companies may review medical records to assess the overall health status and determine if there are any additional risks that need to be considered.

- Lifestyle Factors: Lifestyle choices, such as smoking, alcohol consumption, and participation in high-risk activities, may also be considered during underwriting. These factors can impact the overall risk assessment and premium rates.

Tips to help qualify for the best rate possible

While securing the best rate on life insurance with scoliosis can be challenging, there are strategies you can employ to increase your chances of qualifying for a favorable premium. Here are some tips to help you qualify for the best rate possible:

- Maintain Regular Medical Check-ups: Consistently attending medical check-ups and following your healthcare provider’s recommendations for scoliosis management demonstrates your commitment to maintaining your health. Regular monitoring and documentation of your condition can provide valuable evidence of stability and proactive management to insurance underwriters.

- Follow Treatment Plans: Adhering to prescribed treatment plans, such as wearing a brace or engaging in physical therapy, can have a positive impact on underwriting decisions. It shows your dedication to managing and minimizing the impact of scoliosis on your overall health.

- Demonstrate Good Overall Health: Maintain a healthy lifestyle by engaging in regular exercise, eating a balanced diet, and avoiding harmful habits such as smoking or excessive alcohol consumption. Leading a healthy lifestyle not only benefits your general well-being but also portrays you as a responsible and low-risk applicant to insurance companies.

- Provide Comprehensive Medical Documentation: When applying for life insurance, gather all relevant medical documentation related to your scoliosis, including recent medical reports, X-rays, and treatment records. Submitting comprehensive and up-to-date information about your condition can provide a clearer picture to underwriters and help them make a more accurate assessment.

- Communicate with Your Insurance Agent: Openly discuss your scoliosis and related medical information with your insurance agent. They can guide you through the application process and help you present your case in the best possible light to insurance underwriters. Providing clear and accurate information upfront can prevent misunderstandings or delays in the underwriting process.

- Seek Professional Assistance: Consider working with an insurance broker or financial advisor who specializes in high-risk cases or has experience with scoliosis-related life insurance applications. They can provide expert advice, help you navigate the complexities of the underwriting process, and connect you with insurance companies that have favorable policies for individuals with scoliosis.

Remember that each insurance company has its own underwriting guidelines and policies regarding scoliosis. Therefore, shopping around and comparing quotes from multiple insurers can increase your chances of finding the best rate available.

By implementing these tips and taking a proactive approach to managing your scoliosis, you can enhance your insurability and improve your chances of securing the most favorable premium rates for life insurance coverage.