This article aims to shed light on the significance of life insurance for individuals with sciatica, exploring the options available, and factors influencing coverage, and providing valuable tips to secure favorable policies. By addressing the intersection of life insurance and sciatica, we aim to empower individuals to protect their financial future, no matter the circumstances.

Understanding Sciatica

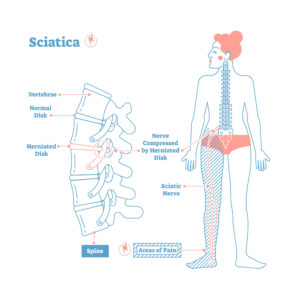

Sciatica is a condition that can cause persistent pain along the sciatic nerve, which extends from the lower back down through the hips, buttocks, and legs. It typically occurs when the nerve becomes compressed or irritated, leading to various discomforting symptoms. In order to navigate life insurance with sciatica, it is essential to have a comprehensive understanding of this condition.

Causes:

Sciatica is commonly caused by a herniated disc, where the soft inner portion of a spinal disc protrudes and puts pressure on the nerve roots. Other potential causes include spinal stenosis, bone spurs, piriformis syndrome (irritation of the sciatic nerve by the piriformis muscle), or even pregnancy, which can exert pressure on the sciatic nerve.

Symptoms:

The hallmark symptom of sciatica is pain that radiates from the lower back or buttocks down to the leg, often only affecting one side of the body. The intensity of the pain can range from a mild ache to a sharp, shooting sensation. Other symptoms may include numbness, tingling, muscle weakness, and difficulty in controlling leg movements. Prolonged sitting, coughing, sneezing, or straining can exacerbate these symptoms.

Treatment:

Treatment options for sciatica depend on the severity and underlying cause of the condition. Initially, conservative approaches such as rest, over-the-counter pain medications, hot or cold compresses, and gentle exercises or stretching may be recommended. Physical therapy, chiropractic care, and acupuncture can also provide relief. In more severe cases, medical interventions like steroid injections or surgical procedures might be considered.

Worst-Case Scenario:

In rare instances, sciatica can lead to severe complications. These can include progressive neurological deficits, loss of bladder or bowel control (indicative of cauda equina syndrome), or prolonged motor weakness. These scenarios require immediate medical attention to prevent permanent damage.

Impact on One’s Life Insurance Application:

When applying for life insurance with sciatica, the impact on your application will largely depend on the severity of your condition. Insurance companies typically assess the risk associated with pre-existing medical conditions, including sciatica, to determine the premium rates and coverage options. Here’s a breakdown of how different levels of sciatica severity may affect your life insurance application:

- Mild Cases: If you have mild sciatica with occasional or manageable symptoms, it is likely to have little to no impact on your life insurance application. Insurance providers often classify mild cases as low-risk, and you may still qualify for preferred rates or the most favorable policy options available. It’s important to provide accurate information about your condition and any treatments or medications you may be undergoing.

- Moderate Cases: For individuals with moderate sciatica, where symptoms may be more frequent or slightly more severe, you can still qualify for standard or standard plus life insurance coverage. Insurance companies may consider this level of severity as a moderate risk, but it should not necessarily result in being denied coverage. Providing comprehensive medical records, including diagnostic tests and treatment history, can strengthen your application.

- Severe Cases: In severe cases of sciatica where symptoms are debilitating and significantly impact your daily life, the insurance company will likely evaluate your application on a case-by-case basis. Severe sciatica may be viewed as a higher risk, potentially affecting the type of coverage you qualify for and the premium rates. Insurance providers will closely examine medical records, including specialist reports, surgical history, and the effectiveness of any ongoing treatments or medications.

It’s important to note that each insurance company has its own underwriting guidelines and may assess sciatica differently. Factors such as age, overall health, and other medical conditions can also influence the impact of sciatica on your life insurance application.

Factors that will be considered

When applying for life insurance with sciatica, several factors will be considered by insurance companies to assess the impact of the condition and determine the terms of coverage. The following are some key factors that are typically taken into account:

- Medical History: Insurance providers will review your medical history, including the details of your sciatica diagnosis, the date of diagnosis, and any relevant medical reports or imaging results. They will also consider the underlying cause of your sciatica, such as a herniated disc or spinal stenosis.

- Symptom Severity: The severity of your sciatica symptoms will play a significant role. Insurance companies may assess the frequency and intensity of your pain, as well as the impact on your daily activities and quality of life. Severe, debilitating symptoms may have a greater impact on your application.

- Treatment Plan: The type and effectiveness of your treatment plan will be evaluated. Insurance companies may want to know if you are receiving conservative treatments, such as physical therapy or medication, or if you have undergone more invasive interventions like surgery or steroid injections. They will also consider whether your treatment has provided relief or improved your condition.

- Functional Limitations: Insurance providers may assess the functional limitations caused by sciatica. This can include limitations in mobility, work capacity, or engaging in specific activities. The extent to which your condition affects your ability to perform daily tasks and maintain employment may be considered.

- Medical Compliance: Demonstrating compliance with recommended treatments and following medical advice is important. Consistency in attending medical appointments, taking prescribed medications, and actively participating in physical therapy or rehabilitation can positively influence your application.

- Overall Health: Insurance companies will evaluate your overall health beyond sciatica. They may consider your body mass index (BMI), blood pressure, cholesterol levels, and any other existing medical conditions you may have. A comprehensive assessment of your health will help insurers assess the overall risk.

- Age: Your age at the time of application will also be taken into account. Younger individuals with sciatica may have better prospects for obtaining coverage compared to older applicants, as they are perceived to have a longer life expectancy.

It’s important to note that every insurance company has its own underwriting guidelines and may weigh these factors differently. It is advisable to disclose all relevant information accurately and consult with an experienced insurance agent or broker who can assist you in finding insurance providers that specialize in offering coverage for individuals with sciatica.

Tips for qualifying for coverage

When applying for life insurance with sciatica, here are some tips to help improve your chances of qualifying for coverage:

- Provide Accurate and Comprehensive Information: Ensure that you provide complete and accurate information about your sciatica condition on your application. Disclose all relevant details regarding your diagnosis, treatment, and any associated medical conditions. Omitting or providing misleading information can lead to complications or denial of coverage.

- Work with an Experienced Insurance Agent or Broker: Collaborate with an insurance professional who has expertise in dealing with pre-existing medical conditions like sciatica. They can guide you through the application process, navigate the underwriting guidelines of different insurance companies, and help you find insurers that are more likely to accommodate your specific needs.

- Be Transparent about Medications and Treatments: Clearly communicate all medications you are taking for sciatica, including dosage and frequency. If you have undergone surgeries, steroid injections, or other procedures, disclose these treatments as well. Insurance companies need this information to assess the impact of your treatment plan on your condition and overall insurability.

- Emphasize Lifestyle Management: Highlight any efforts you make to manage your sciatica through lifestyle modifications. This can include engaging in regular exercise, maintaining a healthy weight, practicing good posture, and avoiding activities that exacerbate your symptoms. Demonstrating proactive steps to minimize the impact of sciatica on your daily life can positively influence insurers.

- Regular Medical Check-ups: Consistent follow-up with your healthcare provider shows that you are actively managing your condition. Regular check-ups, adherence to treatment plans, and documented improvements in your sciatica symptoms can strengthen your application.

Remember, the specific requirements and considerations may vary among insurance companies. Therefore, it is essential to consult with an insurance professional who can assess your individual situation and recommend the most suitable options for your coverage needs.

Final thoughts…

Obtaining life insurance coverage with sciatica is possible, regardless of the severity of your condition. While mild cases may have little to no impact on your application, moderate cases can still qualify for standard coverage, and severe cases are evaluated on a case-by-case basis. By providing accurate information, comprehensive medical documentation, and working with an experienced insurance agent or broker, you can enhance your chances of securing favorable coverage. Emphasizing lifestyle management, regular medical check-ups, and demonstrating compliance with treatments are additional steps that can positively influence insurers.

Remember, each insurance company has its own underwriting guidelines, so exploring multiple options and comparing offers can help you find the best coverage tailored to your needs. By taking these steps, you can protect your financial future and gain peace of mind, knowing that your loved ones will be financially secure in the event of the unexpected.