Securing life insurance is an essential step in safeguarding the financial future of you and your loved ones. However, individuals living with Parkinson’s disease may face unique challenges when it comes to obtaining life insurance coverage.

In this article, we will delve into the intricacies of life insurance approvals for those with Parkinson’s disease and shed light on the factors that insurance providers consider during the underwriting process.

Understanding Parkinson’s Disease

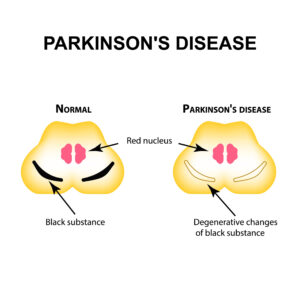

Parkinson’s disease is characterized by the degeneration of dopamine-producing cells in a region of the brain called the substantia nigra. Dopamine is a neurotransmitter that plays a crucial role in coordinating movement. The loss of dopamine results in the motor symptoms associated with Parkinson’s disease.

Causes:

The exact cause of Parkinson’s disease is still unknown. However, research suggests that a combination of genetic and environmental factors contributes to its development. Some genetic mutations have been identified as risk factors for Parkinson’s disease. Additionally, exposure to certain toxins, such as pesticides and herbicides, has been associated with an increased risk of developing the condition. However, it is important to note that not everyone exposed to these risk factors will develop Parkinson’s disease.

Symptoms:

The symptoms of Parkinson’s disease can vary from person to person and usually develop gradually over time. The primary motor symptoms include:

- Tremors: Typically starting in the hands, fingers, or limbs, tremors are involuntary shaking movements that are often more pronounced at rest.

- Bradykinesia: This refers to slowness of movement and difficulty initiating movements. It can manifest as stiffness, decreased facial expressions, and reduced arm swing while walking.

- Rigidity: Muscles become stiff and resistant to movement, leading to a feeling of muscle tension or stiffness.

- Postural Instability: Impaired balance and coordination, making it challenging to maintain an upright posture or prevent falls.

In addition to motor symptoms, Parkinson’s disease may also cause non-motor symptoms, such as depression, anxiety, sleep disturbances, cognitive changes, and autonomic dysfunction.

Treatment:

While there is no cure for Parkinson’s disease, treatment aims to manage symptoms, slow down disease progression, and improve quality of life. The following approaches are commonly used:

- Medications: Various medications are available to increase dopamine levels, alleviate motor symptoms, and manage non-motor symptoms. Levodopa, dopamine agonists, and MAO-B inhibitors are commonly prescribed.

- Deep Brain Stimulation (DBS): This surgical procedure involves implanting electrodes into specific regions of the brain. These electrodes deliver electrical impulses to regulate abnormal brain activity and help control motor symptoms.

- Physical Therapy: Physical therapy and exercise programs can improve muscle strength, flexibility, and balance, enhancing mobility and reducing the risk of falls.

- Speech Therapy: Speech therapy can help address speech and swallowing difficulties that may arise as Parkinson’s disease progresses.

- Occupational Therapy: Occupational therapy focuses on maintaining independence in daily activities by adapting techniques and using assistive devices.

Worst-Case Scenario:

In advanced stages of Parkinson’s disease, individuals may experience severe motor complications despite treatment. These complications, often referred to as advanced Parkinson’s disease or Parkinson’s disease with end-of-dose fluctuations, can include:

- Dyskinesia: Involuntary, jerky movements or twisting motions that occur as a side effect of long-term medication use.

- Freezing of Gait: A sudden inability to initiate or continue walking, often leading to falls.

- Cognitive Impairment: Some individuals with Parkinson’s disease may develop cognitive changes, including memory problems, difficulty with multitasking and executive functions, and a decline in thinking abilities.

- Hallucinations and Psychosis: In rare cases, individuals with Parkinson’s disease may experience hallucinations, delusions, or psychosis, which can be challenging to manage.

- Increased Dependency: As the disease progresses, individuals with Parkinson’s disease may require more assistance with daily activities and personal care.

It is important to note that not all individuals with Parkinson’s disease will experience these worst-case scenarios. The progression and severity of the disease can vary greatly among individuals. Additionally, advancements in research and treatment options continue to improve outcomes and quality of life for those living with Parkinson’s disease.

Impact on One’s Life Insurance Application

When applying for life insurance, individuals with Parkinson’s disease may encounter challenges that can affect their coverage options and premiums. The impact on life insurance applications varies depending on the severity and progression of the disease. While mild cases may still qualify for coverage, advanced or aggressive cases are more likely to face denial or be subject to higher premiums. Let’s explore the potential impact on life insurance applications for individuals with different stages of Parkinson’s disease.

Mild Cases:

In mild cases of Parkinson’s disease, where symptoms are relatively well-managed and there is minimal impact on daily functioning, individuals may still be able to obtain life insurance coverage. However, it is important to note that the underwriting process for individuals with Parkinson’s disease involves a thorough assessment of medical history, symptoms, and overall health.

Insurance providers typically evaluate factors such as:

- Medical Records: The insurance company will review your medical records to understand the diagnosis, treatment, and management of Parkinson’s disease. They may request specific details about your symptoms, medication regimen, and any lifestyle modifications you have made.

- Stability of Symptoms: If your symptoms are stable and well-managed, it can have a positive impact on your life insurance application. Demonstrating effective symptom control through medications, therapies, and regular medical follow-ups can increase your chances of qualifying for coverage.

- Age at Diagnosis: The age at which you were diagnosed with Parkinson’s disease can influence the underwriting decision. Individuals diagnosed at a younger age may have a better chance of obtaining coverage compared to those diagnosed later in life, as the disease progression may be slower in younger individuals.

- Co-existing Conditions: Insurance providers consider any other health conditions you may have in addition to Parkinson’s disease. The presence of significant co-existing conditions may impact the underwriting decision or result in higher premiums.

Substandard Rates:

In some cases, individuals with mild Parkinson’s disease may be able to qualify for coverage at substandard rates. Substandard rates are higher than standard rates due to the increased risk associated with the medical condition. However, these rates still provide the opportunity to secure life insurance coverage, albeit at a higher premium cost.

Advanced or Aggressive Cases:

Individuals with advanced or aggressive cases of Parkinson’s disease, where symptoms are severe, significantly impact daily functioning, and have not responded well to treatment, are more likely to face challenges in obtaining life insurance coverage. Insurance providers may view advanced Parkinson’s disease as a higher risk, which can lead to denial of coverage or significantly increased premiums.

In such cases, insurance companies may consider the following factors:

- Disease Progression: The speed at which the disease has progressed and the severity of symptoms are critical considerations. Advanced stages of Parkinson’s disease with severe motor complications, cognitive impairment, or frequent hospitalizations may be perceived as a higher risk by insurance providers.

- Unstable Symptoms: If your symptoms are not well-managed, characterized by frequent fluctuations or unpredictable response to treatment, it can negatively impact your life insurance application.

- Dependency and Functional Limitations: The level of dependency on others for daily activities and functional limitations caused by Parkinson’s disease can influence the underwriting decision.

- Other Health Conditions: The presence of significant co-existing health conditions or comorbidities can further complicate the underwriting process and increase the likelihood of denial or higher premiums.

It’s important to note that each insurance company has its own underwriting guidelines and may assess Parkinson’s disease differently. Working with an experienced insurance agent or broker who specializes in high-risk cases or has knowledge of Parkinson’s disease can be beneficial in finding insurance companies that are more likely to provide coverage or offer competitive rates based on your specific circumstances.

Factors that Affect Life Insurance Approval

Insurance providers assess several factors when determining coverage eligibility for individuals with Parkinson’s disease. Let’s explore some of the key considerations:

- Medical History: Insurance companies typically review your medical records to understand the severity of your condition, the stage of Parkinson’s disease, and the treatments you are undergoing. They may request information from your primary care physician or neurologist to gather a comprehensive view of your health.

- Age at Diagnosis: The age at which you were diagnosed with Parkinson’s disease can impact the insurance approval process. Generally, individuals diagnosed at an older age may face more challenges due to the potential for advanced disease progression.

- Symptom Management: Insurance providers pay close attention to how well your symptoms are managed. If you are effectively controlling your symptoms through medications, therapies, or lifestyle modifications, it can positively influence the underwriting decision.

- Co-existing Conditions: Insurance companies consider any other health conditions you may have in addition to Parkinson’s disease. These conditions, such as cardiovascular diseases or diabetes, can affect the overall risk assessment.

Tips for Obtaining Life Insurance with Parkinson’s Disease

- Work with an Experienced Agent: Collaborating with an insurance agent who specializes in high-risk cases or has experience working with individuals with Parkinson’s disease can greatly enhance your chances of obtaining coverage. They can guide you through the application process and help you find suitable insurance companies.

- Provide Detailed Information: It is crucial to be transparent and provide comprehensive information about your condition, including your medical history, medications, and any lifestyle modifications you have made. Clear communication with the insurance company regarding your Parkinson’s disease and its management can help them make a more accurate assessment of your risk.

- Gather Relevant Documentation: Gather all relevant medical records, test results, and treatment plans to support your application. Providing detailed documentation can strengthen your case and demonstrate your commitment to managing your health effectively.

- Consider Group Life Insurance: If you are currently employed, explore the possibility of obtaining life insurance through your employer’s group insurance plan. Group plans often have less stringent underwriting requirements and may provide coverage without medical examinations or individual assessments.

- Explore Guaranteed Issue Policies: Guaranteed issue life insurance policies are designed for individuals who have difficulty obtaining traditional coverage due to health conditions. These policies typically have higher premiums and lower coverage amounts, but they can provide a viable option if you are struggling to secure coverage elsewhere.

Conclusion…

Obtaining life insurance coverage with Parkinson’s disease may require extra effort and consideration, but it is not impossible. By understanding the factors that insurance providers assess during the underwriting process and following the tips outlined in this article, you can increase your chances of obtaining the coverage you need to protect your loved ones financially.