Life insurance is an essential aspect of financial planning. It provides a safety net for your loved ones in case of an untimely demise. However, for individuals with pre-existing medical conditions like a pacemaker, getting life insurance coverage can be a daunting task. Many insurance companies consider pacemaker patients as high-risk clients and may either deny coverage or charge high premiums. In this article, we will discuss life insurance approvals with a pacemaker and what you can do to increase your chances of getting coverage.

Understanding Pacemakers

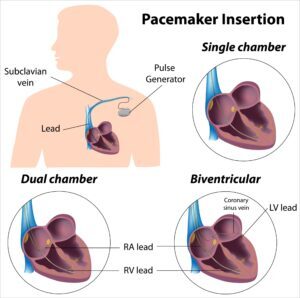

A pacemaker is a small device that is implanted under the skin in the chest to regulate the heartbeat. The device sends electrical impulses to the heart muscle, causing it to contract and pump blood to the body. Pacemakers are commonly used to treat an irregular heartbeat, a condition known as arrhythmia.

Arrhythmia can be caused by various factors, such as damage to the heart from a heart attack or heart disease, genetic conditions, or side effects from medications. When the heart is not beating regularly, it can cause a range of symptoms, including fatigue, shortness of breath, fainting, and chest pain. In severe cases, arrhythmia can lead to heart failure or sudden cardiac arrest.

Pacemakers can help regulate the heartbeat and reduce symptoms associated with arrhythmia. The device monitors the heart’s electrical activity and sends electrical signals to the heart muscle when needed to maintain a regular heartbeat. Pacemakers can be programmed to work at different rates, depending on the patient’s needs. They can also store data about the heart’s activity, which can be used to adjust the device’s settings or monitor the patient’s condition over time.

In addition to treating arrhythmia, pacemakers can also be used to treat other heart conditions, such as heart block. Heart block is a condition where the electrical signals in the heart are blocked, preventing the heart from beating regularly. Pacemakers can help regulate the heart’s electrical activity and ensure that the heart beats regularly, reducing symptoms associated with heart block.

Pacemakers are typically implanted in a minor surgical procedure under local anesthesia. The device is placed under the skin in the chest and connected to the heart using one or more leads. The procedure usually takes about an hour and requires a short hospital stay for observation. After the procedure, patients need to avoid strenuous activity and avoid lifting heavy objects for several weeks while the incision heals.

Overall, pacemakers are an effective treatment option for individuals with arrhythmia or heart block. They can help regulate the heartbeat and reduce symptoms associated with these conditions. If you are experiencing symptoms of an irregular heartbeat or heart block, talk to your doctor about whether a pacemaker may be an appropriate treatment option for you.

Why do insurance companies consider pacemaker patients high-risk?

Life insurance companies consider pacemaker patients high-risk because they have a pre-existing medical condition that requires ongoing medical care and monitoring. Pacemaker patients are at a higher risk of complications and may require additional medical interventions, which can increase the cost of healthcare.

From an insurance perspective, high-risk individuals are more likely to file a claim and cost the insurance company money. As a result, insurance companies may view pacemaker patients as a higher risk and charge higher premiums or deny coverage altogether.

Pacemaker patients may also be considered high-risk due to the underlying condition that led to the need for a pacemaker. For example, individuals with heart disease, diabetes, or other chronic conditions are more likely to require a pacemaker. These conditions may increase the risk of complications and may require additional medical care, which can impact insurance coverage and cost.

Despite the challenges of obtaining life insurance coverage as a pacemaker patient, it’s important to remember that coverage may still be possible. This is why the underwriter may require additional information from the applicant’s cardiologist, including:

- The date the pacemaker was implanted

- The reason for implantation

- The type of pacemaker used

- The frequency of pacemaker checks and follow-up appointments

- Any complications or health issues related to the pacemaker

Based on this information, the underwriter may approve or deny coverage or offer coverage with a higher premium.

Possible Approval rates

When it comes to obtaining life insurance as a pacemaker patient, approval rates can vary depending on various factors such as overall health, age, and the type of policy being applied for. Generally speaking, the approval rates for pacemaker patients are lower than those for individuals without pre-existing medical conditions.

In many cases, pacemaker patients may be approved for coverage, but at a higher premium rate than individuals without pre-existing conditions. It’s important to note that the best rate that a pacemaker patient can typically expect, even if approved, would be a substandard rate. This is because the insurance company will consider the pacemaker patient as a higher risk, which may result in higher premiums or a reduced death benefit.

The premium rates for pacemaker patients are often based on the individual’s overall health, age, and the type of policy being applied for. For example, a pacemaker patient applying for a term life insurance policy may be approved at a substandard rate, but with an additional premium to account for the higher risk. The substandard rate reflects the increased risk that the pacemaker patient poses to the insurance company.

The approval rates for pacemaker patients can also be impacted by the type of policy being applied for. Graded or guaranteed issue policies may have higher approval rates for pacemaker patients, as these policies are designed to provide coverage for individuals who may not be able to qualify for traditional life insurance policies. However, these policies may also come with higher premiums and reduced death benefits.

It’s important to work with an independent insurance agent who specializes in working with high-risk individuals, such as pacemaker patients. These agents can help navigate the application process, provide guidance on the types of policies available, and work with the insurance company to negotiate the best possible rates and coverage.

Overall, while the approval rates for pacemaker patients may be lower than those for individuals without pre-existing conditions, it’s important to remember that coverage is still possible. By working with a knowledgeable and experienced insurance agent and providing accurate and detailed medical information, pacemaker patients can increase their chances of obtaining coverage, even if it means paying a substandard rate.

Tips for getting life insurance with a pacemaker

Getting life insurance with a pacemaker can be challenging, but it’s not impossible. Here are some tips for pacemaker patients to increase their chances of obtaining coverage:

- Work with an independent insurance agent: As mentioned earlier, it’s important to work with an independent insurance agent who specializes in working with high-risk individuals, such as pacemaker patients. These agents can help navigate the application process, provide guidance on the types of policies available, and work with the insurance company to negotiate the best possible rates and coverage.

- Be upfront and honest about your medical history: It’s essential to provide accurate and detailed medical information when applying for life insurance as a pacemaker patient. This includes information about your pacemaker, your overall health, and any other pre-existing conditions you may have. Failure to disclose this information accurately could result in a denial of coverage or a claim being denied later.

- Provide additional medical records if necessary: Insurance companies may require additional medical records or testing before approving a pacemaker patient for coverage. Be prepared to provide these records and any other relevant medical information to support your application.

- Improve your overall health: While pacemaker patients may be considered higher risk, taking steps to improve your overall health can help improve your chances of obtaining coverage. This includes maintaining a healthy diet, exercising regularly, and following any treatment plans prescribed by your doctor.

What if I can’t qualify for traditional coverage?

If you are unable to qualify for traditional life insurance coverage as a pacemaker patient, there are other options available. Here are some solutions to consider:

- Group life insurance: If you are employed, your employer may offer group life insurance coverage as part of your benefits package. Group life insurance typically does not require a medical exam or health screening, which means that pre-existing conditions like having a pacemaker will not disqualify you from coverage. However, the death benefit amount may be limited and may not be enough to meet your needs.

- Guaranteed issue life insurance: Guaranteed issue life insurance is a type of policy that does not require a medical exam or health screening, making it a good option for pacemaker patients who cannot qualify for traditional coverage. However, guaranteed issue policies may come with higher premiums and lower death benefits. These policies may also have a waiting period before the death benefit is paid out.

- Accidental death insurance: Accidental death insurance provides coverage in the event of accidental death, such as a car accident or a fall. These policies may not require a medical exam or health screening, and may be a good option for pacemaker patients who cannot qualify for traditional coverage. However, these policies only cover accidental death, which means that death from natural causes or illness is not covered.

It’s important to carefully review and compare the terms and conditions of these policies before making a decision. Consider factors such as the cost, the death benefit amount, the waiting period (if any), and any restrictions or exclusions on coverage.

It’s also important to remember that while these policies may be an option for pacemaker patients who cannot qualify for traditional coverage, they may not provide enough coverage to meet your needs. Consider other options such as savings or investments, or working with a financial planner to develop a comprehensive financial plan.

In conclusion…

Getting life insurance coverage with a pacemaker can be challenging, but it is not impossible. Working with an independent insurance agent, providing accurate and detailed medical information, maintaining good overall health, getting regular check-ups with your cardiologist, considering graded or guaranteed issue policies, and group life insurance coverage can help increase your chances of getting approved. It’s essential to remember that having a pacemaker does not mean you cannot get life insurance coverage. With some patience and persistence, you can find the right policy to meet your needs and provide the financial security your loved ones need in case of an untimely demise.