Life insurance is a crucial financial tool for protecting loved ones in case of unexpected events such as illness, disability, or death. However, for individuals diagnosed with Nephritis, obtaining life insurance coverage can be challenging.

In this article, we will discuss FGN and the process of obtaining life insurance coverage for individuals with this condition.

Understanding Nephritis

Nephritis is a medical condition that involves inflammation of the kidneys, which can damage the kidneys’ ability to function properly. The kidneys are responsible for filtering waste products from the blood and removing excess fluid from the body. When the kidneys are inflamed, they can become less efficient at performing these functions, which can lead to a buildup of toxins in the body.

Types of Nephritis

There are several types of nephritis, including:

- Acute nephritis: This type of nephritis typically occurs suddenly and can be caused by a bacterial or viral infection, certain medications, or autoimmune disorders.

- Chronic nephritis: This type of nephritis develops over a longer period and can be caused by long-term exposure to certain medications, toxins, or chronic infections.

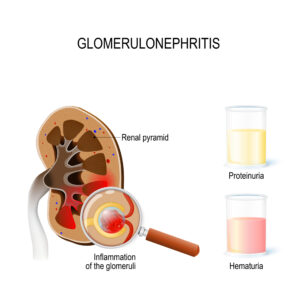

- Glomerulonephritis: This type of nephritis specifically affects the glomeruli, the tiny blood vessels in the kidneys responsible for filtering waste products from the blood. Focal glomerulonephritis is a subtype of this condition, which we have discussed in a previous article.

- Interstitial nephritis: This type of nephritis affects the connective tissue between the kidney tubules and can be caused by medications, infections, or autoimmune disorders.

Symptoms of Nephritis

The symptoms of nephritis can vary depending on the type and severity of the condition. Some common symptoms of nephritis include:

- Blood or protein in the urine

- Swelling in the legs, ankles, or feet

- High blood pressure

- Fatigue or weakness

- Loss of appetite

- Nausea or vomiting

- Fever or chills

- Joint pain or swelling

In some cases, nephritis may not cause any noticeable symptoms, which can make it difficult to diagnose without proper medical testing.

Treatment of Nephritis

The treatment of nephritis will depend on the underlying cause and severity of the condition. In many cases, treatment will focus on reducing inflammation and managing symptoms. Common treatments for nephritis include:

- Medications: Depending on the underlying cause of nephritis, medications may be used to reduce inflammation, manage blood pressure, or suppress the immune system.

- Diet and lifestyle changes: Individuals with nephritis may be advised to make dietary and lifestyle changes, such as reducing sodium intake, increasing water consumption, and quitting smoking.

- Dialysis: In severe cases of nephritis, dialysis may be required to filter waste products from the blood and remove excess fluid from the body.

- Kidney transplant: In some cases, a kidney transplant may be necessary to replace a damaged or diseased kidney.

Worst-Case Scenarios of Nephritis

In some cases, nephritis can lead to serious health complications, including:

- Chronic kidney disease: If left untreated, nephritis can damage the kidneys over time, leading to chronic kidney disease.

- Kidney failure: In severe cases, nephritis can lead to complete kidney failure, which may require dialysis or a kidney transplant.

- High blood pressure: Nephritis can cause high blood pressure, which can increase the risk of heart disease and stroke.

- Fluid buildup in the lungs: In rare cases, nephritis can lead to a buildup of fluid in the lungs, which can make it difficult to breathe.

Impact on One’s life insurance application

When it comes to life insurance applications, the impact of focal glomerulonephritis and other types of nephritis on approval will depend largely on the individual’s kidney function. Life insurance underwriters will typically assess the individual’s overall health and medical history, including any chronic conditions or illnesses, to determine their level of risk and likelihood of making a claim.

If an individual has focal glomerulonephritis or another type of nephritis but has well-controlled symptoms and good kidney function, they may be able to qualify for life insurance at standard rates. This means that they will pay the same premiums as a healthy individual of the same age and gender.

However, if an individual has advanced nephritis and poor kidney function, they may be considered a higher risk for life insurance and may be required to pay higher premiums or may be denied coverage altogether. This is because individuals with advanced nephritis may be more likely to experience serious health complications and may have a shorter life expectancy.

It is important to note that every life insurance company has its own underwriting guidelines and may have different criteria for evaluating individuals with nephritis. Some companies may be more lenient when it comes to underwriting individuals with certain types of nephritis, while others may be more strict.

Tips for Obtaining Life Insurance with Nephritis

In addition to working with an agent, there are some steps you can take to improve your chances of getting approved for life insurance with nephritis, such as:

- Stabilizing your condition: If your nephritis is not well-controlled, work with your healthcare provider to develop a treatment plan that can help stabilize your condition and improve your kidney function.

- Providing detailed medical records: Make sure you provide detailed medical records to the life insurance company, including information about your diagnosis, treatment, and kidney function. This can help the underwriter get a more complete picture of your overall health and level of risk.

- Quitting smoking: If you smoke, quitting can help improve your overall health and reduce your risk of complications from nephritis, which may improve your chances of getting approved for life insurance.

- Following a healthy lifestyle: Following a healthy diet and exercise routine, managing stress, and getting enough sleep can all help improve your overall health and reduce your risk of complications from nephritis.

In summary, the impact of focal glomerulonephritis and other types of nephritis on life insurance approval will depend largely on the individual’s kidney function and overall health. While individuals with well-controlled symptoms and good kidney function may be able to qualify for standard life insurance coverage, those with advanced nephritis may face higher premiums or limited coverage. Working with an experienced life insurance agent and following a healthy lifestyle can help improve your chances of getting approved for life insurance coverage.

Conclusion…

Obtaining life insurance coverage with Nephritis can be challenging, but it is not impossible. By understanding the application process and working with an independent insurance agent, individuals with FGN can find coverage that meets their needs and provides financial protection for their loved ones.

When applying for life insurance coverage, it is important to be honest and transparent about your FGN diagnosis and provide accurate information about your health history and treatment plan. By following these tips and working with experienced insurance professionals, individuals with FGN can obtain the life insurance coverage they need to protect their loved ones and provide peace of mind for the future

Frequently Asked Questions

Can I qualify for life insurance if I have nephritis?

Yes, it is possible to qualify for life insurance if you have nephritis. However, the impact of nephritis on your life insurance application will depend on the severity of your condition, your kidney function, and other factors related to your overall health.

Will I have to pay higher premiums if I have nephritis?

If you have well-controlled nephritis and good kidney function, you may be able to qualify for standard life insurance coverage and pay the same premiums as a healthy individual of the same age and gender. However, if you have advanced nephritis and poor kidney function, you may be considered a higher risk and may be required to pay higher premiums or may be denied coverage altogether.

What information do I need to provide to the life insurance company if I have nephritis?

When you apply for life insurance with nephritis, you will need to provide detailed medical records that include information about your diagnosis, treatment, and kidney function. You may also need to undergo a medical exam and provide blood and urine samples for testing.

Can I get life insurance if I have other health conditions in addition to nephritis?

Yes, it is possible to get life insurance if you have other health conditions in addition to nephritis. However, the impact of these conditions on your life insurance application will depend on the severity of the conditions and their overall impact on your health.

Should I work with an agent when applying for life insurance with nephritis?

Yes, it can be helpful to work with an experienced life insurance agent when applying for life insurance with nephritis. An agent can help you compare policies from different insurance companies, determine your level of risk, and advocate for you during the underwriting process.

What can I do to improve my chances of getting approved for life insurance with nephritis?

To improve your chances of getting approved for life insurance with nephritis, you can take steps to stabilize your condition, provide detailed medical records to the life insurance company, quit smoking, follow a healthy lifestyle, and work with an experienced life insurance agent.

Can I get life insurance if I am currently undergoing treatment for nephritis?

It may be more difficult to get life insurance if you are currently undergoing treatment for nephritis, especially if your kidney function is severely impaired. However, every life insurance company has its own underwriting guidelines, and working with an experienced agent can help you find the right policy and navigate the underwriting process.