This article aims to shed light on the life insurance approval process for individuals with muscular dystrophy, offering insights into the eligibility criteria, considerations for insurance providers, and tips for navigating the application process.

Understanding Muscular Dystrophy

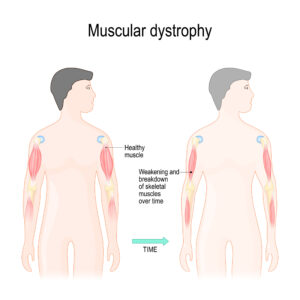

Muscular dystrophy refers to a group of inherited disorders characterized by the progressive weakening and degeneration of skeletal muscles. It is caused by genetic mutations that interfere with the production of proteins necessary for muscle health. As a result, muscle fibers become damaged over time, leading to muscle weakness, loss of muscle mass, and difficulties in movement and coordination.

Causes of Muscular Dystrophy

Muscular dystrophy is primarily caused by genetic mutations that affect the production of proteins involved in muscle structure and function. There are several types of muscular dystrophy, each with its specific genetic cause.

Some forms of muscular dystrophy are inherited in an X-linked recessive manner, while others follow an autosomal recessive or autosomal dominant pattern of inheritance.

Symptoms of Muscular Dystrophy

The symptoms of muscular dystrophy vary depending on the specific type and its progression. However, common symptoms include:

- muscle weakness,

- muscle wasting,

- difficulties with mobility and coordination,

- progressive disability,

- and respiratory complications.

Children with muscular dystrophy may experience delayed motor skills development and have difficulties with running, jumping, and climbing stairs.

Treatment Options for Muscular Dystrophy

While there is no cure for muscular dystrophy, various treatment options aim to manage symptoms, slow down disease progression, and improve quality of life. These may include:

- Physical Therapy: Physical therapy programs can help maintain muscle strength and flexibility, improve mobility, and prevent contractures.

- Medications: Certain medications may be prescribed to manage symptoms such as muscle spasms, pain, and inflammation.

- Assistive Devices: The use of mobility aids, orthotic devices, and assistive technology can enhance independence and mobility.

- Respiratory Support: As respiratory complications can arise in advanced stages of muscular dystrophy, respiratory support such as non-invasive ventilation or mechanical ventilation may be required.

- Gene Therapy and Experimental Treatments: Ongoing research in gene therapy and other experimental treatments holds promise for potential future interventions to modify or halt the progression of muscular dystrophy.

Worst-Case Scenario and Coping Strategies

The worst-case scenario in muscular dystrophy involves the progressive loss of muscle function, leading to severe disability and complications. Individuals may become wheelchair-bound, experience difficulties with daily activities, and require significant assistance for mobility and self-care. Respiratory function may also deteriorate, requiring continuous support or ventilation.

In such cases, it is essential for individuals and their families to seek comprehensive support from healthcare professionals, rehabilitation services, and support groups. Mental health support is crucial to help individuals cope with the emotional challenges associated with progressive disability. Palliative care can also play a vital role in managing symptoms, enhancing comfort, and improving quality of life.

Impact on One’s Life Insurance Application

When individuals with muscular dystrophy apply for life insurance, the impact on their application can vary depending on the severity of the condition. Here’s a breakdown of how the severity of muscular dystrophy can affect life insurance rates and approvals:

- Mild Muscular Dystrophy: For individuals with mild muscular dystrophy, where the symptoms are relatively minimal and the condition has a limited impact on daily functioning, it may be possible to qualify for a substandard table rate. Substandard rates are higher than standard rates but still provide coverage. The specific rate offered will depend on factors such as age, overall health, and any associated risks.

- Moderate Muscular Dystrophy: In cases where muscular dystrophy is moderate, with more noticeable symptoms and functional limitations, life insurance rates and approvals will be symptom-dependent. Insurance providers will evaluate the applicant’s specific symptoms, their impact on daily activities, and the overall health status. Depending on the evaluation, the applicant may receive coverage with adjusted rates that reflect the perceived risk. However, it’s important to note that the rates may be higher than standard rates due to the increased risk associated with the condition.

- Severe Muscular Dystrophy: In severe cases of muscular dystrophy, where symptoms significantly impact mobility, muscle strength, and overall health, obtaining traditional life insurance coverage can be challenging. Insurance providers may consider these cases as high-risk and may deny coverage altogether. This is because the progressive nature of severe muscular dystrophy presents a substantial risk for the insurer. In such cases, applicants may need to explore alternative products, such as guaranteed issue life insurance policies or accidental death policies.

Guaranteed Issue Life Insurance: Guaranteed issue life insurance is a type of policy that does not require a medical examination or health questions. It offers coverage to individuals with pre-existing conditions, including severe muscular dystrophy. While these policies provide coverage, they often have lower coverage amounts and higher premiums compared to traditional policies.

Accidental Death Policy: An accidental death policy provides coverage in the event of death due to an accident. These policies may be easier to obtain for individuals with severe muscular dystrophy because they typically do not require medical underwriting. However, it’s important to note that accidental death policies only pay out in the case of accidental death and do not provide coverage for death resulting from natural causes.

Factors Influencing Life Insurance Approval

When applying for life insurance coverage, several factors come into play that can influence the approval process. Insurance providers carefully evaluate these factors to assess the risks associated with insuring an individual and determine eligibility and premium rates. Let’s explore some of the key factors that can influence life insurance approval:

- Age: Age is a significant factor in life insurance underwriting. Generally, younger individuals are considered to have a lower mortality risk and may be more likely to receive favorable rates. As individuals age, the risk of developing health conditions increases, which can impact the approval process and premium rates.

- Health History: An applicant’s health history plays a crucial role in life insurance approval. Insurance companies typically require a comprehensive evaluation of medical records, including past and current medical conditions, surgeries, treatments, and medications. The presence of certain health conditions may increase the risk associated with insuring an individual and could result in higher premiums or even denial of coverage.

- Pre-existing Conditions: Pre-existing conditions, such as heart disease, diabetes, or cancer, can significantly impact life insurance approval. Insurance providers evaluate the severity, stability, and management of these conditions to assess the risk involved. Individuals with well-managed conditions may still be eligible for coverage, albeit potentially at higher premium rates.

- Lifestyle Factors: Lifestyle choices and habits can also influence life insurance approval. Factors such as smoking, excessive alcohol consumption, participation in hazardous activities (e.g., skydiving, extreme sports), and a poor driving record may increase the risk profile of an applicant. Insurance providers consider these factors when determining eligibility and setting premium rates.

- Family Medical History: Family medical history is another important consideration for life insurance underwriters. Certain hereditary conditions, such as certain types of cancer, heart disease, or neurological disorders, may increase an individual’s risk of developing similar conditions. Insurance providers review family medical history to assess genetic predispositions and potential future health risks.

- Medication Usage: The use of certain medications can impact life insurance approval. Insurers assess the type of medication, the reason for its use, and its potential impact on an individual’s health. Some medications may indicate underlying health conditions, and their usage can affect the approval process and premium rates.

- Occupation: Certain occupations carry inherent risks that can influence life insurance approval. Individuals working in high-risk professions, such as firefighters, police officers, or miners, may face higher premiums due to the increased likelihood of workplace-related accidents or injuries.

It’s important to note that each insurance company has its underwriting guidelines and risk assessment criteria. Therefore, it’s advisable to work with an experienced insurance agent who can guide you through the application process and help find the best coverage options based on your specific circumstances.

Tips for Navigating the Life Insurance Application Process

Work with an Experienced Agent

Seeking assistance from an insurance agent experienced in working with clients with pre-existing conditions, including muscular dystrophy, can be invaluable. Such agents have in-depth knowledge of insurers who specialize in high-risk cases and can guide applicants through the application process.

Gather and Organize Relevant Medical Information

Compile comprehensive medical records, including diagnosis, treatment history, and any relevant test results, to present a clear picture of your health status. Ensure that all relevant information is organized and readily accessible during the application process.

Be Transparent and Disclose All Information

Honesty and transparency are crucial when applying for life insurance. Disclose all relevant information regarding your medical condition, treatments, and lifestyle choices. Failure to disclose information accurately can lead to denial of coverage or cancellation of the policy later on.

Conclusion…

Obtaining life insurance approval with muscular dystrophy may require extra effort and understanding of the process. While it is true that individuals with muscular dystrophy face unique challenges, it’s important to remember that obtaining life insurance coverage is still possible.

By understanding the factors that influence approval, exploring specialized options, and following the tips provided, individuals with muscular dystrophy can increase their chances of securing the necessary coverage to protect their loved ones financially.