In this article, we will discuss the challenges individuals with migraines may face when applying for life insurance and provide some tips on how to increase your chances of getting approved.

Understanding Migraines

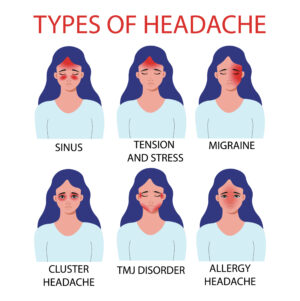

Migraines are recurrent and intense headaches characterized by pulsating or throbbing pain, often on one side of the head. They typically last between four and 72 hours and can be accompanied by a range of symptoms, such as nausea, vomiting, sensitivity to light and sound, and visual disturbances. Migraines are considered a neurological disorder and can significantly impact daily activities, including work, social interactions, and overall well-being.

Causes of Migraines:

The exact cause of migraines is still not fully understood. However, research suggests that they may be influenced by a combination of genetic and environmental factors. Some common triggers include:

- Hormonal Changes: Hormonal fluctuations, particularly in women, can trigger migraines. Many women experience migraines during specific phases of their menstrual cycle.

- Environmental Factors: Certain environmental factors, such as bright lights, loud noises, strong smells, and changes in weather patterns, can trigger migraines in susceptible individuals.

- Food and Drinks: Certain foods and beverages, such as aged cheeses, chocolate, alcohol (especially red wine), and foods containing additives like monosodium glutamate (MSG), can trigger migraines in some people.

- Stress and Emotional Factors: High levels of stress, anxiety, and emotional upheaval can contribute to the onset of migraines in susceptible individuals.

- Sleep Disruptions: Lack of sleep or changes in sleep patterns can trigger migraines in some individuals.

Symptoms of Migraines:

Migraine symptoms can vary from person to person, and even from one episode to another. The common symptoms of migraines include:

- Intense Headache: Migraines are characterized by severe, throbbing or pulsating headaches, often on one side of the head. The pain can worsen with physical activity.

- Nausea and Vomiting: Many migraine sufferers experience nausea, sometimes leading to vomiting.

- Sensitivity to Light and Sound: Migraines can cause an increased sensitivity to light (photophobia) and sound (phonophobia). Exposure to bright lights or loud noises can worsen the symptoms.

- Visual Disturbances: Some individuals experience visual disturbances, often referred to as an “aura,” before or during a migraine attack. This can include seeing flashing lights, blind spots, or zigzag patterns.

- Fatigue and Dizziness: Migraines can leave individuals feeling exhausted and lightheaded, making it challenging to perform daily tasks.

Treatment Options for Migraines:

While there is no definitive cure for migraines, several treatment options are available to help manage the condition and alleviate symptoms. These include:

- Medications: Over-the-counter pain relievers, such as nonsteroidal anti-inflammatory drugs (NSAIDs), can be effective in relieving mild to moderate migraines. For severe migraines, prescription medications, including triptans, may be prescribed by a healthcare professional.

- Lifestyle Modifications: Identifying and avoiding triggers can help reduce the frequency and severity of migraines. Maintaining a consistent sleep schedule, managing stress levels, regular exercise, and a healthy diet can also contribute to migraine prevention.

- Alternative Therapies: Some individuals find relief from migraines through alternative therapies such as acupuncture, biofeedback, relaxation techniques, and cognitive-behavioral therapy. These approaches aim to reduce stress, promote relaxation, and improve overall well-being.

- Preventive Medications: In cases where migraines are frequent or significantly impact daily life, healthcare professionals may recommend preventive medications. These medications are taken regularly to reduce the frequency and severity of migraine attacks. They include beta-blockers, antidepressants, anti-seizure medications, and Botox injections.

- Pain Management Techniques: During a migraine attack, pain management techniques such as applying cold or hot compresses to the head, resting in a dark and quiet room, and practicing relaxation exercises can provide temporary relief.

Worst-Case Scenarios:

While most migraines can be managed effectively with proper treatment and lifestyle modifications, there are rare cases where migraines can lead to complications. These complications may include:

- Status Migrainosus: This is a severe form of migraine that lasts longer than 72 hours, causing extreme pain and debilitating symptoms. Status migrainosus requires immediate medical attention to prevent complications and provide relief.

- Medication Overuse Headaches: Overusing certain pain medications, such as opioids or triptans, to treat migraines can lead to medication overuse headaches. These headaches occur when the body becomes dependent on the medication, causing rebound headaches that are more severe and frequent.

- Migrainous Infarction: Migrainous infarction, although rare, is a severe complication characterized by a stroke-like episode during a migraine attack. It requires immediate medical attention to prevent further damage.

- Chronic Migraine: Some individuals may experience chronic migraines, defined as having migraines on 15 or more days per month for at least three months. Chronic migraines significantly impact quality of life and often require a comprehensive treatment plan.

It’s important to note that while these worst-case scenarios are possible, they are relatively rare. Most individuals with migraines can effectively manage their condition with the appropriate treatment and lifestyle adjustments.

Factors Influencing Life Insurance Approval:

- Medical History: When evaluating life insurance applications, insurance companies carefully examine the applicant’s medical history. They will review any records related to your migraine, including the frequency and severity of your headaches, any associated medical conditions, and the treatments you have undergone. Be prepared to provide detailed information about your migraine history, including doctor’s visits, medications, and any lifestyle changes you have made to manage the condition.

- Frequency and Severity of Migraine Attacks: The frequency and severity of your migraine attacks can impact your life insurance approval. If your migraines occur infrequently and are relatively mild, insurance companies may view them as a minor health concern. On the other hand, if your migraines are frequent, severe, or require hospitalization, it may raise red flags for insurers.

- Treatment and Management: The insurance provider will also evaluate how you manage your migraines. If you have sought regular medical care, follow your doctor’s treatment plan, and respond well to medications, it demonstrates responsible management of your condition. On the other hand, inconsistent treatment or failure to manage your migraines effectively may raise concerns for insurance companies.

Impact on One’s Life Insurance Application

When it comes to life insurance applications, the impact of migraines can vary depending on the severity and frequency of the condition. Mild cases of migraines may not significantly affect your life insurance application, and you may still be eligible for a preferred rate.

However, more severe cases of migraines may require additional evaluation and could potentially result in higher premiums or more limited coverage.

It’s important to note that each insurance company has its own underwriting guidelines, and their approach to migraines may differ. Some insurers may be more accommodating toward individuals with migraines, considering factors such as the effectiveness of treatments, overall health, and lifestyle choices. Therefore, it is advisable to shop around and compare quotes from multiple insurers to find the best coverage options tailored to your specific needs.

Additionally, working with an experienced insurance agent or broker who specializes in high-risk cases, such as individuals with pre-existing conditions like migraines, can be beneficial. They can guide you through the application process, help you understand your options, and connect you with insurance companies that are more lenient towards migraine sufferers.

Tips for Increasing Your Chances of Life Insurance Approval

- Provide Accurate and Detailed Information: When completing your life insurance application, be thorough and accurate when providing information about your migraines. Include all relevant details about your condition, medical history, and treatments. Failure to disclose accurate information may result in denial of coverage or a claim being denied in the future.

- Obtain Medical Records: Request copies of your medical records, including any specialist consultations or diagnostic tests related to your migraines. These records will help insurance underwriters understand the nature and severity of your condition, increasing the likelihood of a fair evaluation.

- Seek Professional Advice: Consulting with an experienced insurance agent or broker who specializes in high-risk cases, such as individuals with pre-existing conditions like migraines, can be highly beneficial. They can guide you through the application process, help you understand your options, and connect you with insurance companies that are more lenient towards migraine sufferers.

- Shop Around: Different insurance companies have varying underwriting guidelines, and some may be more accommodating to individuals with migraines than others. It’s wise to obtain quotes from multiple insurers to find the best coverage options tailored to your specific needs.

Conclusion…

While obtaining life insurance approval with migraines may present challenges, it’s important to be proactive, provide accurate information, and explore different options. By understanding the factors that influence insurance underwriting, seeking professional guidance, and improving your overall health, you can increase your chances of securing the life insurance coverage you and your loved ones need. Remember that each insurance company has its own guidelines, so shopping around and comparing quotes from different insurers will help you find the most suitable coverage for your specific situation.