Securing life insurance is an essential step in ensuring financial security for you and your loved ones. However, if you have been diagnosed with Meniere’s disease, a chronic condition affecting the inner ear, you may have concerns about obtaining life insurance coverage. In this article, we will explore the intricacies of life insurance approvals for individuals with Meniere’s disease, shedding light on the factors that insurance companies consider and offering guidance on how to navigate the application process.

Understanding Meniere’s Disease

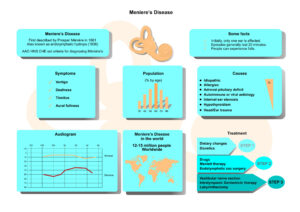

Meniere’s disease is a chronic disorder that affects the inner ear, causing a range of symptoms including vertigo, tinnitus (ringing in the ears), hearing loss, and a feeling of pressure or fullness in the affected ear. This condition was first described by French physician Prosper Meniere in 1861, and it is estimated that approximately 615,000 people in the United States have been diagnosed with Meniere’s disease.

Causes of Meniere’s Disease:

The exact cause of Meniere’s disease is still unknown, although several theories exist. It is believed that a combination of factors contributes to its development. These factors include:

- Abnormal Fluid Buildup: One prevailing theory suggests that Meniere’s disease is caused by an accumulation of fluid in the inner ear. This excess fluid disrupts the delicate balance necessary for proper hearing and balance function.

- Vascular Issues: Some researchers propose that changes in the blood vessels supplying the inner ear may contribute to Meniere’s disease. These vascular abnormalities can affect the delivery of oxygen and nutrients to the inner ear, leading to its dysfunction.

- Autoimmune Response: Another theory suggests that Meniere’s disease may be an autoimmune disorder, in which the immune system mistakenly attacks the tissues of the inner ear.

Symptoms of Meniere’s Disease:

Meniere’s disease is characterized by recurring episodes of symptoms that can last from 20 minutes to several hours. These symptoms may include:

- Vertigo: The hallmark symptom of Meniere’s disease is a severe spinning sensation, often accompanied by nausea, vomiting, and imbalance.

- Tinnitus: Many individuals with Meniere’s disease experience a constant or intermittent ringing, buzzing, or hissing sound in the affected ear.

- Hearing Loss: Hearing loss is typically fluctuating and may affect one or both ears. It can range from mild to profound and may worsen over time.

- Ear Fullness: Individuals with Meniere’s disease often report a sensation of fullness or pressure in the affected ear.

Treatment Options for Meniere’s Disease:

While there is no known cure for Meniere’s disease, various treatment approaches can help manage its symptoms and improve quality of life. These include:

- Medications: Medications such as diuretics, antihistamines, and anti-nausea drugs can be prescribed to alleviate symptoms and reduce the frequency and severity of vertigo episodes.

- Lifestyle Modifications: Making certain lifestyle changes can help manage Meniere’s disease. These may include reducing salt intake, avoiding triggers such as caffeine and alcohol, and adopting stress management techniques.

- Vestibular Rehabilitation Therapy (VRT): VRT is a specialized form of physical therapy that aims to improve balance and reduce dizziness through exercises and techniques that promote vestibular compensation.

- Invasive Procedures: In severe cases where symptoms are not adequately controlled by conservative measures, surgical interventions such as endolymphatic sac decompression, labyrinthectomy, or vestibular nerve section may be considered.

Worst Case Scenario:

In rare cases, Meniere’s disease can lead to long-term complications and significantly impact an individual’s quality of life. Some potential worst-case scenarios may include:

- Severe Hearing Loss: Meniere’s disease can cause progressive hearing loss, leading to profound deafness in some cases.

- Frequent and Debilitating Vertigo: Some individuals may experience frequent and prolonged vertigo episodes that can be severely debilitating, affecting daily activities and overall well-being.

- Emotional and Psychological Impact: The chronic and unpredictable nature of Meniere’s disease can take a toll on a person’s mental health, leading to anxiety, depression, and social isolation.

It’s important to note that while these worst-case scenarios can occur, the majority of individuals with Meniere’s disease can effectively manage their symptoms and maintain a good quality of life with appropriate treatment and lifestyle adjustments. It’s crucial to work closely with healthcare professionals specializing in ear disorders and follow their recommendations to optimize symptom control.

Impact on One’s Life Insurance Application

When applying for life insurance with Meniere’s disease, the impact on one’s application will depend on the severity of the condition and its associated symptoms. In general, life insurance underwriters will consider an individual’s overall health and medical history, including any pre-existing conditions, when determining their eligibility for coverage and premium rates.

For individuals with mild or well-controlled Meniere’s disease, it is possible to qualify for preferred rates, which typically offer the lowest premiums. In this case, underwriters will take into account factors such as the individual’s age, overall health, and the effectiveness of their treatment plan in managing Meniere’s disease symptoms.

However, for those with more severe Meniere’s disease, life insurance underwriters may need to consider the condition on a case-by-case basis. In this scenario, underwriters will likely request additional medical information from the applicant’s healthcare providers, including diagnostic test results, treatment history, and any complications or comorbidities.

Based on this information, underwriters will determine the individual’s overall health risk and may adjust their premium rates accordingly. For instance, if an individual has frequent and debilitating vertigo episodes that significantly impact their daily life, life insurance underwriters may consider them a higher risk and may increase their premium rates accordingly.

It’s important to note that each life insurance provider has its own underwriting guidelines and criteria for evaluating pre-existing conditions, including Meniere’s disease. Therefore, it’s crucial to work with an experienced and knowledgeable insurance agent or broker who can help identify the best life insurance options based on an individual’s unique medical history and coverage needs.

Factors Influencing Life Insurance Approval

- Medical History: Insurance companies will thoroughly evaluate an applicant’s medical history, including the duration and severity of Meniere’s disease symptoms, as well as any related treatments or surgeries. They may also consider any comorbid conditions or medications that could impact the overall risk assessment.

- Frequency and Severity of Episodes: Insurance underwriters may inquire about the frequency and severity of vertigo episodes experienced by individuals with Meniere’s disease. The frequency and severity can vary significantly from person to person, and insurers will consider this information to assess the overall risk associated with the condition.

- Treatment and Management: Demonstrating that you are actively managing your Meniere’s disease through medical treatment and lifestyle modifications can positively impact the insurance approval process. Providing documentation of regular medical check-ups, adherence to prescribed medications, and lifestyle changes to minimize triggers can enhance your chances of obtaining coverage.

- Audiological Evaluations: Insurance companies may request audiometric test results to assess the impact of Meniere’s disease on your hearing. These evaluations can help determine the extent of hearing loss and provide additional insights into the overall risk assessment.

Tips for Obtaining Life Insurance Approval

Research Insurance Providers: Different insurance companies have varying underwriting guidelines and risk tolerance for Meniere’s disease. It is essential to research and identify insurers with a history of offering coverage to individuals with similar health conditions.

Disclose All Relevant Information: Honesty and transparency are crucial when applying for life insurance. Provide detailed and accurate information about your Meniere’s disease, medical history, treatments, and current health status. Failure to disclose relevant information can lead to claim denials or policy cancellations.

Work with an Experienced Agent: Consulting with an experienced insurance agent who specializes in working with individuals with pre-existing conditions can be immensely helpful. They can guide you through the application process, help you understand your options, and advocate on your behalf.

Gather Medical Documentation: Collecting comprehensive medical documentation, including test results, treatment records, and physician statements, can strengthen your application. These documents serve as evidence of your efforts to manage your Meniere’s disease effectively.

Conclusion…

While Meniere’s disease may present some challenges, it shouldn’t deter you from seeking the coverage you need. By understanding the underwriting process, preparing your application carefully, and seeking expert guidance, you can navigate the life insurance approval process successfully.

Remember, each case is unique, and it’s always advisable to consult with insurance professionals who can provide personalized advice based on your specific circumstances. With patience, persistence, and the right approach, you can obtain life insurance coverage that provides peace of mind for you and your family, even with Meniere’s disease.