Hepatic Failure, also known as liver failure, is a serious condition that occurs when the liver is no longer able to function properly. This can be caused by a number of factors, including alcohol abuse, viral infections, and certain medications. Unfortunately, this condition can make it essentially impossible to qualify for a traditional life insurance policy. This is why you’ll likely need to consider an alternative product such as a guaranteed issue life insurance policy.

In this article, we will explore the factors that can impact life insurance approvals with Hepatic Failure and offer some tips to help you get the coverage you need.

Understanding Hepatic Failure

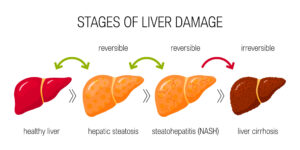

Hepatic Failure, also known as liver failure, is a serious condition that occurs when the liver is no longer able to function properly. This can be caused by a number of factors, including alcohol abuse, viral infections, and certain medications. Hepatic Failure can be either acute or chronic and can lead to serious complications if left untreated.

Causes of Hepatic Failure:

Acute Hepatic Failure can be caused by an overdose of medication or exposure to toxic chemicals. Chronic Hepatic Failure, on the other hand, develops over time and is often the result of long-term alcohol abuse or chronic viral infections like hepatitis B or C. Other causes of Hepatic Failure include autoimmune diseases, genetic disorders, and certain prescription medications.

Symptoms of Hepatic Failure:

The symptoms of Hepatic Failure can vary depending on the cause of the condition, but may include jaundice (yellowing of the skin and eyes), abdominal pain, nausea, and fatigue. Other symptoms may include confusion, agitation, and even coma.

Treatment of Hepatic Failure:

Treatment for Hepatic Failure depends on the cause of the condition. In cases of acute Hepatic Failure, hospitalization may be necessary to provide supportive care while the liver recovers. Treatment may include medications to manage symptoms, such as nausea or pain. If the liver is severely damaged, a liver transplant may be necessary.

In cases of chronic Hepatic Failure, treatment may involve managing the underlying cause of the condition. For example, if alcohol abuse is the cause of the condition, quitting drinking can help prevent further liver damage. In some cases, medications may be used to manage the symptoms of the condition or to slow the progression of the disease.

Worst Case Scenario:

If left untreated, Hepatic Failure can lead to serious complications, including liver cancer, ascites (fluid buildup in the abdomen), and hepatic encephalopathy (brain dysfunction caused by liver failure). In some cases, Hepatic Failure can be life-threatening. If you suspect you may have Hepatic Failure, it is important to seek medical attention immediately.

Impact on One’s life insurance application

If you have been diagnosed with Hepatic Failure, it will impact your ability to obtain traditional life insurance coverage. This is because, life insurance companies view Hepatic Failure as a serious health condition and will consider you an unacceptable high-risk applicant for traditional life insurance coverage. As a result, you will need to consider alternative options such as a Guaranteed Issue Life Insurance Policy, an Accidental Death Policy, or purchasing a Group Life Insurance Policy through your employer should you wish to continue looking for coverage.

Guaranteed Issue Life Insurance Policies:

Guaranteed Issue Life Insurance Policies are designed for individuals who are unable to obtain traditional life insurance coverage due to pre-existing medical conditions, such as Hepatic Failure. With a Guaranteed Issue Policy, you are guaranteed coverage regardless of your health status. These policies typically have lower coverage amounts and higher premiums than traditional life insurance policies, but they can provide peace of mind knowing that your loved ones will be protected financially in the event of your death.

Accidental Death Policies:

An Accidental Death Policy is a type of life insurance policy that pays out a death benefit if you die as a result of an accident. These policies do not require a medical exam or health questionnaire, so they can be easier to obtain than traditional life insurance policies. However, it is important to note that these policies only pay out in the event of an accidental death, so they may not be the best option if you are looking for comprehensive life insurance coverage.

Group Life Insurance Policies:

If you are employed, your employer may offer Group Life Insurance coverage as part of your benefits package. These policies are typically less expensive than traditional life insurance policies, and coverage amounts may be based on your salary. However, it is important to note that these policies may not provide enough coverage to meet your individual needs.

In conclusion…

If you have Hepatic Failure, it will impact your ability to obtain traditional life insurance coverage. However, there are still options available to you, including Guaranteed Issue Life Insurance Policies, Accidental Death Policies, and Group Life Insurance Policies through your employer.

It is important to work with a licensed insurance agent to find the right coverage for your specific needs and budget. Remember, life insurance is an important investment in your family’s financial future, so it is important to explore all of your options.

Frequently Asked Questions

Can I obtain traditional life insurance coverage if I have been diagnosed with Hepatic Failure?

It will probably be impossible for you to qualify for traditional life insurance coverage if you have been diagnosed with Hepatic Failure, as it is considered a high-risk condition. However, it is still possible to obtain coverage through other options such as Guaranteed Issue Life Insurance Policies, Accidental Death Policies, or Group Life Insurance Policies through your employer.

Will I have to pay higher premiums for life insurance if I have Hepatic Failure?

If you are able to obtain traditional life insurance coverage, you will be required to pay higher premiums due to your high-risk health status. However, with other options like Guaranteed Issue Life Insurance Policies or Accidental Death Policies, you may not have to pay higher premiums.

How much coverage can I obtain with a Guaranteed Issue Life Insurance Policy?

Guaranteed Issue Life Insurance Policies typically have lower coverage amounts than traditional life insurance policies. The amount of coverage you can obtain may depend on the insurance company and the policy terms.

Do I have to take a medical exam to obtain Accidental Death Insurance?

No, Accidental Death Insurance policies typically do not require a medical exam or health questionnaire. However, it is important to note that these policies only pay out in the event of an accidental death.

Can I obtain life insurance coverage through my employer if I have been diagnosed with Hepatic Failure?

You may be able to obtain life insurance coverage through your employer’s Group Life Insurance Policy, but coverage amounts may be based on your salary and may not be enough to meet your individual needs. It is important to review your employer’s benefits package and speak with a licensed insurance agent to determine your options.

How can I ensure that my loved ones will be financially protected in the event of my death if I have Hepatic Failure?

It is important to explore all of your options when it comes to life insurance coverage, including Guaranteed Issue Life Insurance Policies, Accidental Death Policies, or Group Life Insurance Policies through your employer. Working with a licensed insurance agent can help you find the right coverage for your specific needs and budget.

In conclusion, if you have been diagnosed with Hepatic Failure, obtaining traditional life insurance coverage may be challenging. However, there are still options available to ensure that your loved ones will be financially protected in the event of your death. It is important to explore all of your options and work with a licensed insurance agent to find the right coverage for your specific needs and budget.