Securing life insurance coverage is an important financial decision that offers peace of mind and financial protection for the future. However, individuals with pre-existing conditions may face unique challenges when applying for life insurance. One such condition is intestinal polyps, which can raise concerns for insurance underwriters.

This article aims to provide a comprehensive understanding of how intestinal polyps can impact life insurance approvals. We will explore the nature of intestinal polyps, the underwriting process, and the factors considered by insurance companies when evaluating applications from individuals with this condition.

Understanding Intestinal Polyps

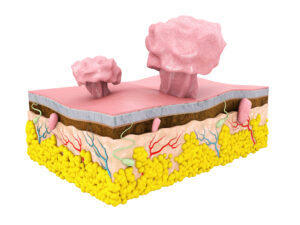

Intestinal polyps are abnormal growths that develop in the lining of the large intestine (colon) or rectum. They are typically small, noncancerous tissue formations that protrude from the inner wall of the intestine. These polyps can vary in size and shape and are often attached to the intestinal wall by a stalk or peduncle.

Types of intestinal polyps:

There are different types of intestinal polyps, each with distinct characteristics and implications. The most common types include:

- Adenomatous polyps: These polyps are the most prevalent and have the potential to develop into colon cancer over time. They are categorized as either tubular adenomas, tubulovillous adenomas, or villous adenomas based on their structural composition.

- Hyperplastic polyps: Hyperplastic polyps are typically small and do not pose a significant risk of becoming cancerous. They are more common in the rectum and distal colon.

- Serrated polyps: Serrated polyps are less common but can also have the potential for malignant transformation. They include sessile serrated adenomas and traditional serrated adenomas.

Causes and risk factors:

The exact cause of intestinal polyps is not fully understood, but several factors contribute to their development. Some potential causes and risk factors include:

- Age: The risk of developing intestinal polyps increases with age, especially after the age of 50.

- Genetic factors: Certain inherited conditions, such as familial adenomatous polyposis (FAP) and Lynch syndrome, can significantly increase the risk of developing polyps.

- Lifestyle and dietary choices: A diet high in fat and low in fiber, along with sedentary behavior and obesity, may increase the likelihood of developing polyps.

- Inflammatory bowel disease (IBD): Individuals with conditions like ulcerative colitis or Crohn’s disease have an elevated risk of developing polyps.

Common symptoms:

Intestinal polyps often do not cause noticeable symptoms, particularly when they are small. However, larger polyps or those in certain locations can lead to the following symptoms:

- Rectal bleeding: Polyps located near the rectum may cause bleeding during bowel movements.

- Changes in bowel habits: Persistent diarrhea, constipation, or a change in stool consistency or shape may occur.

- Abdominal pain and discomfort: Polyps can cause cramping or abdominal pain, particularly if they become large or numerous.

Diagnostic procedures:

Detecting and diagnosing intestinal polyps typically involves the following procedures:

- Colonoscopy: This procedure involves inserting a flexible tube with a camera into the colon to examine its lining and identify any polyps. If polyps are found, they can often be removed during the colonoscopy.

- Flexible sigmoidoscopy: Similar to a colonoscopy, this procedure uses a flexible tube to examine the lower part of the colon and rectum.

- Virtual colonoscopy: Also known as CT colonography, this non-invasive procedure uses specialized X-rays and computer technology to create detailed images of the colon, allowing for the detection of polyps.

- Biopsy: If a polyp is discovered during a diagnostic procedure, a small tissue sample (biopsy) may be taken for further examination under a microscope to determine if it is cancerous or precancerous.

By understanding the nature of intestinal polyps, their types, causes, common symptoms, and diagnostic procedures, individuals can be better equipped to discuss their condition with healthcare providers and insurance underwriters, leading to a smoother life insurance application process.

Impact on One’s Life Insurance Application

When it comes to the impact of intestinal polyps on a life insurance application, the specific circumstances surrounding the polyps play a significant role. If the polyps are few in number, benign (noncancerous), and there is no family history of cancer, applicants can often qualify for a preferred rate. This means they may be eligible for a lower premium compared to individuals with more complex medical histories.

However, if the polyps are numerous or have the potential to become cancerous, underwriters typically adopt a case-by-case approach. In such situations, the approval decision may depend on several factors, including the size, type, and pathology results of the polyps, as well as the applicant’s overall health and age.

In some cases, individuals with numerous polyps or a higher risk profile may face challenges in obtaining life insurance coverage. Insurance companies may deny coverage or offer it at higher premiums to mitigate the perceived risk. Each applicant’s situation is evaluated individually, and the underwriting decision will depend on the insurer’s specific guidelines and risk tolerance.

It’s also important to note that different insurance companies may have varying underwriting standards and criteria for applicants with intestinal polyps. Therefore, it is advisable to explore multiple insurance providers and compare their offerings to find the best possible coverage at a competitive rate.

Factors influencing the approval decision

When evaluating life insurance applications from individuals with intestinal polyps, several key factors come into play that can influence the approval decision. Factors such as:

- Type and size of polyps: The type and size of intestinal polyps play a significant role in the life insurance approval process. Different types of polyps have varying levels of malignancy potential. Adenomatous polyps, for example, are considered precancerous and may raise more concerns for underwriters. Larger polyps also carry a higher risk. Insurance companies will assess the characteristics of the polyps to determine the level of risk they pose and how it may impact the applicant’s insurability.

- Histology and pathology results: Histology and pathology results provide critical information about the cellular characteristics of the polyps. Insurance underwriters may review these results to determine the level of malignancy or potential for future complications. If the pathology report indicates a higher risk of cancer or progression, it may influence the underwriting decision and the terms offered by the insurance company.

- Family history of polyps or related conditions: A family history of polyps or related conditions, such as colorectal cancer, can be a significant consideration for life insurance underwriters. The presence of a family history suggests a potential genetic predisposition to develop polyps or related diseases. Insurance companies may inquire about the family medical history to assess the applicant’s risk profile and make an informed decision regarding coverage and premiums.

- Age and overall health of the applicant: The age and overall health of the applicant are crucial factors in the life insurance underwriting process. Younger individuals with fewer health issues, aside from the presence of intestinal polyps, generally have a better chance of securing coverage at more favorable rates. Insurance companies consider the applicant’s overall health, including factors like body mass index (BMI), blood pressure, and cholesterol levels. Applicants with good overall health, despite the presence of polyps, may be more likely to obtain coverage and potentially receive more favorable premium rates.

It’s important to note that these factors are evaluated in combination and not in isolation. Insurance underwriters consider the overall risk profile of the applicant to make an informed decision.

While certain factors may raise concerns, a favorable combination of other factors, such as a small number of benign polyps, negative pathology results, no family history of cancer, and good overall health, can increase the likelihood of approval and potentially secure more favorable insurance terms.

Tips for Success:

When applying for life insurance with intestinal polyps, implementing key strategies can enhance your chances of a successful application and obtaining the coverage you need. Strategies such as:

- Maintain open communication with the insurance provider: Open and transparent communication with the insurance provider is crucial throughout the application process. Be proactive in sharing relevant information about your intestinal polyps, including the type, size, and any treatment or surveillance plans. Discussing your condition openly can help the underwriters better understand your situation and make a more informed decision. It’s important to promptly respond to any requests for additional information or medical records to ensure a smooth and efficient process.

- Seek professional guidance: Navigating the life insurance application process can be complex, especially when dealing with pre-existing conditions like intestinal polyps. Consider seeking guidance from an experienced insurance agent or broker who specializes in working with individuals with medical histories. They can provide valuable insights, help you understand the underwriting process, and guide you towards insurance providers who are more lenient or have specific expertise in covering applicants with intestinal polyps.

- Prepare a strong application: Take the time to prepare a thorough and accurate application. Provide detailed information about your medical history, including your diagnosis, treatments, and any preventive measures you have taken. It is essential to include all relevant medical records and pathology reports to support your application. Providing comprehensive and well-organized documentation can demonstrate your proactive approach to managing your health and increase your chances of a favorable underwriting decision.

- Compare different insurance companies: Insurance companies have varying underwriting guidelines and risk appetites, which means their policies and premiums may differ significantly. It’s advisable to compare multiple insurance companies to find the one that offers the most favorable terms for applicants with intestinal polyps. Consider factors such as their experience with similar cases, their willingness to provide coverage, and the competitiveness of their premium rates. Working with an insurance agent or broker can be invaluable in helping you navigate this process and find the best possible coverage for your needs.

By following these tips, you can increase your chances of a successful life insurance application. Remember to stay proactive, seek professional assistance when needed, present a strong application, and explore different insurance companies to find the coverage that suits your requirements and budget.

Final thoughts…

It is important for individuals with intestinal polyps to proactively explore life insurance options and not be discouraged by their medical condition. While the presence of polyps can raise concerns during the underwriting process, it does not necessarily disqualify individuals from obtaining coverage. By maintaining open communication, seeking professional guidance, and preparing a strong application, individuals with intestinal polyps can increase their chances of securing the life insurance coverage they deserve. Remember, each insurance company has its own underwriting guidelines, so it’s worth exploring multiple options to find the best fit for your specific circumstances.

Life insurance provides valuable financial protection for yourself and your loved ones, and with the right approach, you can find the coverage that meets your needs and offers peace of mind for the future.