Securing life insurance is a critical step in protecting your loved ones and ensuring their financial security in the event of your untimely demise. However, individuals with hypothyroidism often face challenges when applying for life insurance coverage.

This article aims to shed light on the factors that impact life insurance approvals for individuals with hypothyroidism and provide guidance on navigating the application process successfully.

Understanding Hypothyroidism:

Hypothyroidism is a medical condition wherein the thyroid gland fails to produce enough thyroid hormones to meet the body’s needs. The two primary thyroid hormones involved are thyroxine (T4) and triiodothyronine (T3). These hormones are responsible for maintaining various bodily functions, including metabolism, heart rate, body temperature, and energy levels.

Causes of Hypothyroidism:

There are several causes of hypothyroidism, including:

- Hashimoto’s Thyroiditis: This autoimmune disorder occurs when the body’s immune system mistakenly attacks the thyroid gland, leading to inflammation and impaired hormone production.

- Iodine Deficiency: The thyroid gland requires iodine to produce thyroid hormones. Insufficient dietary intake of iodine can result in hypothyroidism.

- Medical Treatments: Certain medical treatments, such as radiation therapy or surgical removal of the thyroid gland, can lead to hypothyroidism.

- Medications: Some medications, such as lithium or amiodarone, can interfere with thyroid hormone production.

- Congenital Hypothyroidism: Infants may be born with an underactive thyroid gland due to a genetic defect or abnormal development.

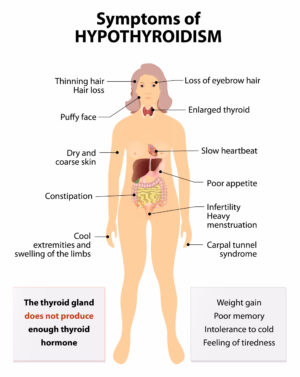

Symptoms of Hypothyroidism:

The symptoms of hypothyroidism can vary in severity and may develop gradually over time. Common symptoms include:

- Fatigue and Weakness: Feeling tired, lethargic, and lacking energy.

- Weight Gain: Unexplained weight gain or difficulty losing weight, despite maintaining a healthy diet and exercise routine.

- Cold Intolerance: Increased sensitivity to cold temperatures.

- Slowed Heart Rate: A slower heart rate than usual.

- Dry Skin and Hair: Dry, rough skin, and brittle hair.

- Muscle and Joint Pain: Experiencing muscle aches, stiffness, and joint pain.

- Constipation: Difficulty passing stools and infrequent bowel movements.

- Depression and Cognitive Issues: Feeling depressed, experiencing memory problems, and having difficulty concentrating.

- Menstrual Irregularities: Irregular or heavy menstrual periods.

- Hoarse Voice: A deepening or hoarseness in the voice.

Treatment of Hypothyroidism:

Hypothyroidism is typically treated with synthetic thyroid hormone replacement medication. The most commonly prescribed medication is levothyroxine, which is a synthetic form of T4. The medication aims to restore normal thyroid hormone levels in the body. The dosage is determined based on individual needs and is adjusted over time through regular blood tests to ensure optimal hormone levels.

Worst-Case Scenario:

If left untreated or inadequately managed, hypothyroidism can lead to various complications, including:

- Myxedema: Myxedema is a severe form of hypothyroidism that can result in life-threatening complications, such as extreme drowsiness, confusion, low body temperature, slowed breathing, and even coma.

- Goiter: In some cases, the thyroid gland may enlarge, resulting in a visible swelling in the neck known as a goiter. This can cause discomfort, difficulty swallowing, or breathing.

- Cardiovascular Issues: Hypothyroidism can increase the risk of cardiovascular problems, including high blood pressure, high cholesterol levels, and heart disease.

Impact on One’s Life Insurance Application:

When applying for life insurance with hypothyroidism, the severity of the condition and any associated complications play a significant role in the underwriting process. Insurance companies assess the risk associated with providing coverage to individuals with hypothyroidism, considering factors such as treatment compliance, stability of the condition, and overall health.

For individuals with mild hypothyroidism and few complications, it is possible to be eligible for preferred rates, which offer more favorable premiums. These individuals typically have well-managed conditions, stable hormone levels, and minimal impact on overall health. Insurance companies view them as lower risk compared to individuals with more severe hypothyroidism or significant complications.

However, for individuals with moderate to severe hypothyroidism or complications, the underwriting process may be more challenging. In such cases, insurers typically evaluate the applicant’s medical records, including thyroid hormone levels, medication history, and any comorbidities. They may request additional information from healthcare providers to assess the overall health and stability of the condition.

Tips for Obtaining Life Insurance with Hypothyroidism:

While obtaining life insurance with hypothyroidism might present some challenges, it’s not impossible. Consider the following tips to increase your chances of securing a life insurance policy:

Seek Proper Treatment: Ensure you’re receiving appropriate treatment for your hypothyroidism and follow your doctor’s instructions. Regularly monitoring your hormone levels and adjusting medication dosages if necessary will demonstrate your commitment to managing the condition effectively.

Provide Comprehensive Medical Records: When applying for life insurance, gather and provide detailed medical records related to your hypothyroidism. Include any laboratory test results, medication history, and specialist consultations. These records will offer insurers a comprehensive view of your condition and treatment.

Lifestyle Factors: Lead a healthy lifestyle by maintaining a balanced diet, engaging in regular physical exercise, and avoiding tobacco or excessive alcohol consumption. These lifestyle choices can positively influence insurers’ perceptions of your overall health and mitigate the perceived risks associated with hypothyroidism.

Work with an Experienced Agent: Engage an insurance agent or broker with experience in dealing with high-risk medical conditions. They can guide you through the application process, help you understand your options, and identify insurance providers more likely to approve coverage for individuals with hypothyroidism.

Shop Around: Different insurance providers have varying underwriting guidelines and risk tolerance. It’s crucial to obtain quotes from multiple companies to compare rates and find one that offers favorable terms for individuals with hypothyroidism.

Consider Specialized Policies: In some cases, traditional life insurance policies may be more challenging to obtain. You can explore specialized policies such as guaranteed issue life insurance or simplified issue life insurance, which have less stringent underwriting requirements. However, these policies may come with higher premiums or lower coverage amounts.

Conclusion…

While hypothyroidism may present hurdles in securing life insurance coverage, it’s important not to get discouraged. By proactively managing your condition, providing comprehensive medical records, and working with experienced professionals, you can improve your chances of obtaining life insurance.

Remember to explore various insurance providers, understand their underwriting criteria, and consider specialized policies if necessary. With determination and the right approach, individuals with hypothyroidism can protect their loved ones’ future through life insurance coverage.

Frequently Asked Questions

Can I get life insurance if I have hypothyroidism?

Yes, it is possible to obtain life insurance if you have hypothyroidism. The approval and rates will depend on factors such as the severity of your condition, stability of your thyroid hormone levels, treatment compliance, and overall health.

Will having hypothyroidism affect my life insurance rates?

Having hypothyroidism can impact your life insurance rates. Mild cases with well-managed conditions may be eligible for preferred rates. However, individuals with more severe hypothyroidism or complications may receive offers with higher premiums or have certain exclusions or limitations in their coverage.

What information do I need to provide when applying for life insurance with hypothyroidism?

When applying for life insurance with hypothyroidism, you will typically need to provide detailed medical records related to your condition. This includes thyroid hormone level test results, medication history, treatment compliance, and any specialist consultations. The more comprehensive the information you provide, the better insurers can evaluate your insurability.

Should I work with an insurance agent or broker when applying for life insurance with hypothyroidism?

Working with an insurance agent or broker who has experience with high-risk medical conditions, including hypothyroidism, can be beneficial. They can guide you through the application process, help you understand the underwriting guidelines of different insurance providers, and identify companies that are more likely to approve coverage for individuals with hypothyroidism.

Can I improve my chances of getting approved for life insurance with hypothyroidism?

Yes, there are steps you can take to improve your chances of getting approved for life insurance with hypothyroidism. These include maintaining stability in your condition through proper treatment, following your doctor’s instructions, leading a healthy lifestyle, providing comprehensive medical records, and working with an experienced insurance professional who can advocate for you.

Do I need to disclose my hypothyroidism when applying for life insurance?

Yes, it is crucial to disclose your hypothyroidism when applying for life insurance. Providing accurate and complete information is essential for the underwriting process. Failure to disclose relevant medical conditions can result in policy denial or potential issues with the validity of your coverage in the future.

Remember, it is advisable to consult with an insurance professional or financial advisor to address specific questions and concerns related to your personal circumstances when applying for life insurance with hypothyroidism.