Securing life insurance is a crucial step in protecting your family’s financial future. However, individuals with pre-existing health conditions, such as hyperthyroidism, often face challenges when applying for life insurance coverage. Hyperthyroidism is a condition characterized by an overactive thyroid gland, which can impact the underwriting process. In this article, we will delve into the complexities of obtaining life insurance with hyperthyroidism and provide useful tips to increase your chances of approval.

Understanding Hyperthyroidism

Hyperthyroidism is a medical condition that occurs when the thyroid gland, located in the neck, produces an excessive amount of thyroid hormones. This hormonal imbalance leads to an accelerated metabolic rate and can cause various health issues. Understanding the causes, symptoms, treatment options, and potential worst-case scenarios associated with hyperthyroidism is essential for managing the condition effectively.

Causes of Hyperthyroidism:

- Graves’ Disease: This autoimmune disorder is the most common cause of hyperthyroidism. It occurs when the body’s immune system mistakenly stimulates the thyroid gland to produce excess hormones.

- Toxic Nodular Goiter: This condition is characterized by the development of nodules within the thyroid gland, which produce excessive amounts of thyroid hormones independently of the body’s control mechanisms.

- Thyroiditis: Inflammation of the thyroid gland due to various factors, such as viral infections or an autoimmune response, can lead to temporary hyperthyroidism.

- Excessive Iodine Intake: Consuming excessive amounts of iodine, either through dietary sources or certain medications, can trigger hyperthyroidism in some individuals.

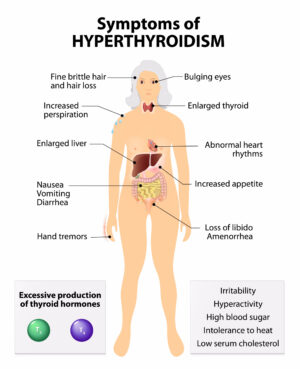

Symptoms of Hyperthyroidism:

The symptoms of hyperthyroidism can vary in severity from person to person. Some common symptoms include:

- Unexplained weight loss despite increased appetite

- Rapid or irregular heartbeat

- Anxiety, restlessness, and irritability

- Heat intolerance and excessive sweating

- Tremors and muscle weakness

- Fatigue and weakness

- Sleep disturbances and insomnia

- Changes in menstrual patterns

- Frequent bowel movements or diarrhea

- Enlarged thyroid gland (goiter)

It’s important to note that some individuals may experience subtle or atypical symptoms, making the condition more challenging to diagnose.

Treatment Options for Hyperthyroidism:

The treatment approach for hyperthyroidism depends on the underlying cause, the severity of symptoms, and the individual’s overall health. Treatment options include:

- Medications: Antithyroid medications, such as methimazole or propylthiouracil, are commonly prescribed to reduce the production of thyroid hormones and manage symptoms. These medications are usually taken for an extended period, and regular monitoring of thyroid hormone levels is necessary.

- Radioactive Iodine Therapy: This treatment involves ingesting a radioactive iodine capsule, which selectively destroys the overactive thyroid cells without affecting other tissues. It may result in permanent hypothyroidism, requiring lifelong hormone replacement therapy.

- Beta Blockers: These medications help alleviate symptoms such as rapid heartbeat, tremors, and anxiety by blocking the effects of thyroid hormones on the body.

- Surgery: In cases where medication and radioactive iodine therapy are not suitable or effective, surgical removal of all or a part of the thyroid gland (thyroidectomy) may be recommended. This option is typically reserved for severe cases or when there is a risk of thyroid cancer.

Worst-Case Scenario:

In rare cases, untreated or poorly managed hyperthyroidism can lead to severe complications, including:

- Thyroid Storm: This life-threatening condition is characterized by a sudden and severe exacerbation of hyperthyroidism symptoms. Symptoms may include high fever, rapid heartbeat, confusion, agitation, and even organ failure. Immediate medical attention is required.

- Heart Problems: Prolonged exposure to excessive thyroid hormones can strain the heart and lead to conditions such as atrial fibrillation, heart failure, or an increased risk of heart attacks.

- Osteoporosis: Hyperthyroidism can accelerate bone loss, increasing the risk of osteoporosis and fractures.

- Thyroid Eye Disease: In Graves’ disease, the immune response that affects the thyroid gland can also cause

Impact on One’s Life Insurance Application

When applying for life insurance with a history of hyperthyroidism, the impact on your application will largely depend on how well your condition is managed and the absence of significant complications. If your hyperthyroidism is well controlled, and you have few or no complications, you should generally be able to qualify for a preferred rate or a standard rate, assuming all other factors are favorable.

If your hyperthyroidism is severe, or if you have experienced complications such as cardiac issues or significant eye problems due to thyroid eye disease, your application may be subject to more scrutiny. In such cases, underwriters may assign a higher risk rating or charge higher premiums to compensate for the increased risk associated with the condition.

It’s important to note that each insurance company has its own underwriting guidelines and may have different views on hyperthyroidism. Some insurers may be more accommodating to individuals with well-managed conditions, while others may take a more conservative approach.

Tips for Obtaining Life Insurance Approval

Work with an Experienced Agent: Collaborating with a knowledgeable and experienced life insurance agent who specializes in high-risk cases is crucial. They can guide you through the application process, help you understand the specific requirements of different insurers, and find the best policy that suits your needs.

Provide Detailed Medical History: When completing your life insurance application, ensure you provide a comprehensive and accurate medical history. Include details of your hyperthyroidism diagnosis, treatment plans, medications, and any related procedures. The more information you provide, the better insurers can assess your situation.

Stay Compliant with Treatment: Adherence to your prescribed treatment plan is essential. Regularly visiting your healthcare provider, taking medication as directed, and keeping your thyroid hormone levels stable will demonstrate your commitment to managing your condition effectively. Consistent treatment compliance can positively influence the insurer’s perception of your health.

Control Your Symptoms: Employ strategies to control the symptoms of hyperthyroidism, such as managing stress levels, adopting a healthy lifestyle, and following a balanced diet. Regular exercise, stress reduction techniques, and a well-rounded diet can contribute to your overall well-being, potentially improving your chances of securing life insurance coverage.

Provide Recent Laboratory Results: Insurance underwriters rely on laboratory test results to assess the severity and stability of your hyperthyroidism. Include recent thyroid function test results, such as thyroid-stimulating hormone (TSH), free thyroxine (FT4), and free triiodothyronine (FT3) levels, to demonstrate the effectiveness of your treatment and the stability of your thyroid hormone levels.

Maintain Regular Follow-ups: Schedule routine follow-up appointments with your endocrinologist or healthcare provider to monitor your thyroid function and overall health. Consistent medical supervision and periodic assessments will ensure your condition is adequately managed and documented, enhancing your chances of obtaining life insurance approval.

Consider Guaranteed Issue or Simplified Issue Policies: If traditional life insurance policies prove challenging to secure due to hyperthyroidism, alternative options like guaranteed issue or simplified issue policies may be suitable. These policies often have minimal underwriting requirements but may have limitations on coverage amounts or higher premiums. Discuss these options with your insurance agent to explore the best alternatives for your specific situation.

Conclusion…

Securing life insurance with hyperthyroidism may require additional effort and patience, but it is an essential step in protecting your loved ones’ financial well-being. By proactively managing your health, providing comprehensive information, and seeking professional guidance, you should be able to navigate the underwriting process successfully and find a life insurance policy that meets your needs.

Frequently Asked Questions

Can I qualify for life insurance if I have hyperthyroidism?

Yes, it is possible to qualify for life insurance even if you have hyperthyroidism. The approval will depend on factors such as the severity of your condition, the stability of your thyroid hormone levels, and your overall health.

Will my premiums be higher if I have hyperthyroidism?

The premiums for life insurance may be higher if you have hyperthyroidism, especially if your condition is severe or if you have experienced complications. Insurance companies assess risk based on various factors, including your medical history. However, the actual impact on your premiums will vary depending on the insurer and your specific circumstances.

What information do I need to provide when applying for life insurance with hyperthyroidism?

When applying for life insurance, you will need to provide detailed information about your medical history, including your hyperthyroidism diagnosis, treatment plans, medications, and any related procedures. It is important to be accurate and thorough in disclosing this information to ensure a fair assessment by the insurance underwriters.

How can I increase my chances of getting approved for life insurance with hyperthyroidism?

To increase your chances of approval, work with an experienced life insurance agent who specializes in high-risk cases. They can guide you through the application process and help you find insurance companies that have favorable underwriting policies for individuals with hyperthyroidism. Additionally, maintaining regular follow-ups with your healthcare provider, adhering to your prescribed treatment plan, and providing recent laboratory results that demonstrate stable thyroid hormone levels can positively impact your application.

Are there specific types of life insurance policies for individuals with hyperthyroidism?

While traditional life insurance policies are typically available to individuals with hyperthyroidism, there may be alternative options such as guaranteed issue or simplified issue policies. These policies often have minimal underwriting requirements but may have limitations on coverage amounts or higher premiums. Discussing these alternatives with your life insurance agent can help you determine the best policy type for your specific situation.

Can my hyperthyroidism be excluded from coverage?

In some cases, insurance companies may offer coverage with an exclusion for hyperthyroidism-related conditions. This means that any claims directly or indirectly related to your hyperthyroidism may not be covered. It is important to carefully review the policy terms and conditions before accepting such an exclusion to understand its implications.

Remember, each insurance company has its own underwriting guidelines, so it’s beneficial to explore multiple options and seek professional advice to find the most suitable life insurance policy for your needs.

Will I need to undergo a medical examination to qualify for life insurance with hyperthyroidism?

In most cases, a medical examination is required as part of the life insurance underwriting process. The examination helps assess your overall health and provides the insurer with objective information about your medical condition, including hyperthyroidism. The examination typically involves measurements such as blood pressure, height, weight, and may include blood tests. However, the specific requirements can vary depending on the insurance company and the coverage amount applied for.

How long should my hyperthyroidism be stable before applying for life insurance?

Insurance companies generally prefer to see a period of stability in your hyperthyroidism before approving your application. The length of stability required can vary among insurers, but it is typically around six months to a year. During this time, your thyroid hormone levels should be consistently within the target range, and you should be following your prescribed treatment plan. Demonstrating stability in your condition increases your chances of obtaining better rates and coverage options.

Can I get life insurance if I have a history of thyroid surgery or radioactive iodine treatment for hyperthyroidism?

Having a history of thyroid surgery or radioactive iodine treatment for hyperthyroidism does not automatically disqualify you from getting life insurance. However, the insurance company may want to review the details of your treatment and assess your current health status. They will consider factors such as the reason for the treatment, the success of the procedure, and any follow-up care or ongoing medication. Providing thorough documentation and medical records related to your treatment will help the underwriters evaluate your application more accurately.

Remember, it’s essential to consult with a knowledgeable life insurance agent who can address your specific concerns and guide you through the application process. They will have experience working with individuals who have hyperthyroidism and can provide personalized advice based on your unique circumstances.