Fibromyalgia is a chronic condition that can cause widespread pain, fatigue, and other symptoms. It is a condition that can affect your ability to work and lead a normal life. However, having fibromyalgia does not necessarily mean that you cannot get life insurance. In this article, we will explore the process of getting life insurance with fibromyalgia and some of the things you need to know.

What is Fibromyalgia?

Fibromyalgia is a chronic pain disorder that affects millions of people worldwide. It is characterized by widespread pain throughout the body, along with other symptoms like fatigue, sleep disturbances, and cognitive difficulties. The cause of fibromyalgia is not well understood, but it is thought to involve a combination of genetic, environmental, and psychological factors.

Causes:

The exact cause of fibromyalgia is not known, but research suggests that it may be related to abnormalities in the way the brain and nervous system process pain signals. Other factors that may contribute to the development of fibromyalgia include:

- Genetics: Fibromyalgia tends to run in families, suggesting that there may be a genetic component to the condition.

- Infections: Some infections, such as viral or bacterial infections, have been linked to the development of fibromyalgia.

- Physical or emotional trauma: Fibromyalgia has been linked to physical or emotional trauma, such as car accidents or PTSD.

- Abnormalities in neurotransmitters: Abnormalities in neurotransmitters, such as serotonin and norepinephrine, may play a role in the development of fibromyalgia.

Symptoms:

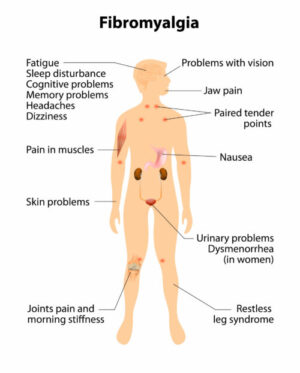

The symptoms of fibromyalgia can vary from person to person, but the most common symptoms include:

- Widespread pain: The pain associated with fibromyalgia is often described as a constant dull ache that affects multiple areas of the body.

- Fatigue: People with fibromyalgia often experience fatigue that is not relieved by sleep or rest.

- Sleep disturbances: Fibromyalgia can cause sleep disturbances, such as difficulty falling asleep or staying asleep.

- Cognitive difficulties: People with fibromyalgia may have difficulty concentrating, remembering things, or processing information.

- Other symptoms: Other symptoms of fibromyalgia may include headaches, irritable bowel syndrome, depression, anxiety, and sensitivity to noise, light, or temperature changes.

Treatment:

There is no cure for fibromyalgia, but there are several treatments that can help manage the symptoms of the condition. Some of the most common treatments include:

- Medications: Certain medications, such as pain relievers, antidepressants, and anti-seizure drugs, may help relieve the pain and other symptoms of fibromyalgia.

- Therapy: Cognitive-behavioral therapy (CBT) can help people with fibromyalgia manage their pain and other symptoms by changing the way they think and behave.

- Exercise: Regular exercise, such as walking, swimming, or yoga, can help reduce pain and fatigue and improve sleep in people with fibromyalgia.

- Alternative therapies: Some people with fibromyalgia find relief from alternative therapies like acupuncture, massage, or chiropractic care.

Worst-case scenario:

In the worst-case scenario, fibromyalgia can lead to severe and debilitating pain that affects a person’s ability to work and carry out daily activities. It can also lead to depression, anxiety, and social isolation. In rare cases, fibromyalgia can lead to complications such as:

- Chronic fatigue syndrome: Some people with fibromyalgia develop chronic fatigue syndrome, a condition characterized by extreme fatigue that is not relieved by rest.

- Disability: Fibromyalgia can be a disabling condition, particularly if the pain and other symptoms are severe and long-lasting.

- Reduced quality of life: Fibromyalgia can significantly reduce a person’s quality of life, affecting their ability to work, socialize, and enjoy leisure activities.

In conclusion, fibromyalgia is a chronic pain disorder that can significantly affect a person’s quality of life. While the exact cause of the condition is not known, there are several treatments available

Impact on One’s life insurance application

What you’re generally going to find is that Fibromyalgia can and often will have an impact on a person’s life insurance application. Mild cases of fibromyalgia that aren’t significantly impacting the patient’s life may be able to qualify for a standard rate. Whereas, more severe cases of fibromyalgia will likely be viewed as a higher risk by insurance companies leading many to either provide coverage at a substandard (or table rate) or denied coverage altogether.

Tips for Getting Life Insurance with Fibromyalgia

If you have fibromyalgia and are looking to get life insurance, there are a few things you can do to increase your chances of approval:

- Be honest about your condition: When applying for life insurance, it is important to be honest about your medical history and your current condition. Failure to disclose your fibromyalgia could result in your policy being canceled or your beneficiaries being denied payment.

- Provide medical documentation: The insurance company will want to see documentation of your fibromyalgia diagnosis and any treatment you have received. This may include medical records, test results, and doctor’s notes.

- Work with a broker: An insurance broker can help you navigate the application process and find an insurance company that is more likely to approve your application. They can also help you compare policies and rates to ensure you get the best coverage for your needs.

- Consider a graded death benefit policy: A graded death benefit policy is a type of life insurance policy that pays out a reduced benefit if the insured dies within the first few years of the policy. This type of policy may be easier to obtain if you have a pre-existing medical condition like fibromyalgia.

- Improve your overall health: Making healthy lifestyle choices like eating a balanced diet, exercising regularly, and managing stress can help improve your overall health and reduce the impact of your fibromyalgia. This can make you a more attractive candidate for life insurance.

Conclusion…

Getting life insurance with fibromyalgia may be more challenging than for someone without the condition, but it is still possible. By being honest about your condition, providing medical documentation, working with a broker, considering a graded death benefit policy, and improving your overall health, you can increase your chances of getting approved for life insurance.

It is important to note that the cost of life insurance for someone with fibromyalgia will likely be higher than for someone without the condition. However, the cost of the policy will depend on several factors, including the severity of your fibromyalgia, your age, and your overall health. It is important to shop around and compare policies to find the best coverage for your needs and budget.

In summary, having fibromyalgia does not necessarily mean that you cannot get life insurance. By following the tips outlined in this article and working with an experienced insurance broker, you can increase your chances of getting approved for life insurance at a reasonable cost. Remember to be honest about your condition, provide medical documentation, and focus on improving your overall health to make yourself a more attractive candidate for life insurance.

Frequently Asked Questions

Can I apply for life insurance if I have fibromyalgia?

Yes, you can apply for life insurance if you have fibromyalgia. However, the premiums you pay may be higher than those paid by someone without fibromyalgia.

Will my fibromyalgia diagnosis affect my ability to get life insurance?

It depends on the severity of your condition and how well you manage it. If your fibromyalgia is well-managed and your symptoms are mild, you may still be able to get life insurance at a standard rate. If your fibromyalgia is more severe, you may have to pay higher premiums or be denied coverage altogether.

What information will I need to provide when applying for life insurance with fibromyalgia?

When applying for life insurance with fibromyalgia, you will need to provide information about your diagnosis, including the date you were diagnosed, the severity of your symptoms, and the medications you take to manage your condition. You may also need to provide medical records or a statement from your doctor.

How can I improve my chances of getting approved for life insurance with fibromyalgia?

To improve your chances of getting approved for life insurance with fibromyalgia, you should work closely with your doctor to manage your symptoms and keep them under control. You may also want to consider shopping around and getting quotes from multiple insurance companies to find the best rates.

Will I have to take a medical exam when applying for life insurance with fibromyalgia?

It depends on the insurance company and the type of policy you are applying for. Some insurance companies may require a medical exam, while others may not. However, if you are applying for a larger policy or a policy with more coverage, you will likely need to take a medical exam.

During a medical exam, the insurance company will typically check your blood pressure, weight, height, and ask you questions about your medical history. They may also take blood and urine samples to test for any underlying medical conditions.

Can I get life insurance without taking a medical exam if I have fibromyalgia?

Yes, some insurance companies offer life insurance policies that don’t require a medical exam. However, these policies may have lower coverage amounts and higher premiums compared to policies that require a medical exam. You should also be aware that insurance companies may ask you additional health-related questions or ask you to provide medical records in lieu of a medical exam.

How long does the life insurance application process take if I have fibromyalgia?

The length of the life insurance application process can vary depending on the insurance company and the type of policy you are applying for. Typically, the process can take anywhere from a few days to several weeks. If you have a complex medical history, it may take longer for the insurance company to review your application and make a decision.

What should I look for when choosing a life insurance policy if I have fibromyalgia?

When choosing a life insurance policy if you have fibromyalgia, it’s important to look for a policy that provides adequate coverage for your needs and fits within your budget. You should also consider the policy’s premium rates, the length of the policy, and any exclusions or restrictions that may apply. It may be helpful to work with an insurance agent who specializes in working with individuals who have pre-existing medical conditions.