In this article, we’ll discuss some important things you should know about obtaining life insurance with emphysema, including what factors insurers consider when evaluating your application and tips for improving your chances of approval.

Understanding Emphysema

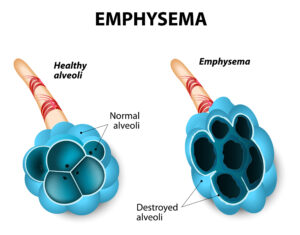

Emphysema is a chronic lung disease that affects the alveoli (air sacs) in the lungs. This disease is one of the two main types of chronic obstructive pulmonary disease (COPD), the other being chronic bronchitis. Emphysema occurs when the walls of the air sacs in the lungs become damaged and lose their elasticity, making it difficult to breathe.

Symptoms:

The symptoms of emphysema can be mild or severe, and they tend to worsen over time. Some of the most common symptoms of emphysema include:

- Shortness of breath, especially during physical activity

- Wheezing

- Chronic cough

- Chest tightness

- Fatigue

- Reduced ability to exercise

- Rapid breathing

Treatments:

There is no cure for emphysema, but there are several treatments that can help manage the symptoms and slow down the progression of the disease. Some common treatments for emphysema include:

- Quitting smoking: This is the most important step in managing emphysema since smoking is the leading cause of the disease.

- Medications: Bronchodilators, steroids, and antibiotics are commonly prescribed to help open up the airways and reduce inflammation.

- Oxygen therapy: Supplemental oxygen can be helpful in managing shortness of breath and improving exercise tolerance.

- Pulmonary rehabilitation: This is a comprehensive program that includes exercise training, breathing techniques, and education on managing the disease.

- Surgery: In severe cases, surgery may be necessary to remove damaged lung tissue and improve lung function.

Worst case scenarios:

In severe cases, emphysema can lead to life-threatening complications, including:

- Respiratory failure: This occurs when the lungs are no longer able to provide enough oxygen to the body.

- Pulmonary hypertension: This is a type of high blood pressure that affects the arteries in the lungs and can lead to heart failure.

- Pneumothorax: This is a condition in which air leaks into the space between the lung and chest wall, causing the lung to collapse.

- Cor pulmonale: This is a type of heart failure that occurs when the right side of the heart is overworked due to lung disease.

It’s important to seek medical attention if you experience any symptoms of emphysema, especially if they are severe or worsening over time. With proper treatment and management, it’s possible to slow down the progression of the disease and improve the quality of life.

Factors Insurers Consider When Evaluating Applications

When you apply for life insurance with emphysema, insurers will evaluate your application based on several factors. These factors help insurers determine your overall health and the level of risk you pose as an applicant.

Here are some of the factors that insurers may consider when evaluating your life insurance application with emphysema:

Age: Your age is an important factor that insurers consider when evaluating your application. Younger applicants with emphysema may have a higher chance of approval since their condition may be less advanced than older applicants.

Smoking History: Smoking is the leading cause of emphysema, so insurers will consider your smoking history when evaluating your application. If you’ve quit smoking, it’s important to provide evidence of your cessation to increase your chances of approval.

Severity of Emphysema: The severity of your emphysema is also an important factor that insurers will consider. If your emphysema is well-managed and you’re receiving appropriate treatment, your chances of approval may be higher.

Other Health Conditions: Insurers will also evaluate your overall health, including any other health conditions you may have. If you have other health conditions in addition to emphysema, your application may be viewed as a higher risk.

Impact on One’s life insurance application

While individuals who have been diagnosed with emphysema may be able to qualify for a traditional life insurance policy, they will usually only be able to do so at a substandard or table rating. This means that they will likely pay higher premiums than someone who is in good health. The specific rating and premium amount will depend on factors such as the severity of the emphysema, the individual’s age and gender, and other health and lifestyle factors.

One factor that can influence an individual’s ability to obtain life insurance with emphysema is whether they are currently smoking or have a history of smoking. Smoking is a leading cause of emphysema, and individuals who smoke or have a history of smoking may be viewed as a higher risk by insurance companies. Quitting smoking can not only improve overall health and well-being, but it may also increase the chances of being approved for life insurance coverage.

Tips for Improving Your Chances of Approval

If you have emphysema and are seeking life insurance, there are several things you can do to improve your chances of approval.

Quit Smoking: If you’re a smoker, quitting smoking can significantly improve your chances of approval. Insurers view smoking as a high-risk factor, when combined with a pre-existing medical condition like COPD or Emphysema, it will often lead to an immediate decline.

Work with an Independent Agent: Working with an independent insurance agent who specializes in high-risk applicants can increase your chances of approval. These agents have relationships with multiple insurers and can help you find an insurer who is more willing to take on high-risk applicants.

Provide Detailed Medical Records: Providing detailed medical records can also increase your chances of approval. Insurers will want to see evidence of your treatment and management of your emphysema to evaluate your overall health.

Consider a Guaranteed Issue Policy: If you’re having difficulty obtaining traditional life insurance, a guaranteed issue policy may be an option. These policies do not require a medical exam or medical underwriting and are typically easier to obtain. However, they may have higher premiums and lower coverage amounts than traditional policies.

Improve Your Overall Health: Improving your overall health can also increase your chances of approval. This may include maintaining a healthy diet and exercise routine and working with your healthcare provider to manage your emphysema and any other health conditions.

Choose the Right Type of Policy: When applying for life insurance with emphysema, it’s important to choose the right type of policy. Term life insurance policies provide coverage for a specific period of time, while permanent life insurance policies provide coverage for your entire life. Permanent policies may be more difficult to obtain with emphysema, but they may be a better option if you’re looking for long-term coverage.

Be Honest on Your Application: When completing your life insurance application, it’s important to be honest and transparent about your health and medical history. Failing to disclose your emphysema or other health conditions could result in your application being denied or your policy being canceled later on.

Conclusion…

Obtaining life insurance with emphysema may be challenging, but it’s not impossible. By understanding what factors insurers consider when evaluating applications and taking steps to improve your overall health and well-being, you can increase your chances of approval. It’s also important to work with an independent insurance agent who specializes in high-risk applicants to find the right insurer and policy for your needs. Remember to be honest and transparent on your application and provide detailed medical records to help insurers evaluate your overall health. With some preparation and effort, you can obtain the life insurance coverage you need to ensure the financial stability of your loved ones in the event of your untimely death.

Frequently Asked Questions

Can I get life insurance if I have emphysema?

Yes, individuals with emphysema can still obtain life insurance coverage. However, they may only be able to do so at a substandard or table rating, which means that they will likely pay higher premiums than someone who is in good health.

Will smoking affect my ability to get life insurance with emphysema?

Smoking is a leading cause of emphysema, and individuals who smoke or have a history of smoking may be viewed as higher risk by insurance companies. Quitting smoking can not only improve overall health and well-being, but it may also increase the chances of being approved for life insurance coverage at a lower rating.

What other factors do insurance companies consider when evaluating applications for life insurance with emphysema?

Insurers will also consider an individual’s overall health and medical history, including the severity of the emphysema, any other health conditions they may have, and any medications they are taking. Individuals who are able to demonstrate that they are actively managing their emphysema and other health conditions may be viewed more favorably by insurers.

Can I get guaranteed issue or simplified issue life insurance with emphysema?

Yes, individuals with emphysema may be able to obtain coverage through a guaranteed issue or simplified issue life insurance policy. These types of policies typically require less underwriting and may be easier to obtain than a traditional policy, but they may also come with higher premiums and lower death benefit amounts.

How can I increase my chances of getting approved for life insurance with emphysema?

Working with an independent insurance agent who specializes in high-risk applicants can be helpful in finding the right insurer and policy for your needs. Providing detailed medical records and being transparent about your health history can also help insurers evaluate overall risk and increase the chances of approval. Additionally, taking steps to improve overall health and well-being, such as quitting smoking and actively managing any other health conditions, may increase the chances of approval at a lower rating.

How much will I have to pay for life insurance if I have emphysema?

The cost of life insurance for individuals with emphysema will depend on a variety of factors, including the severity of the condition, the individual’s age and gender, and other health and lifestyle factors. Generally, individuals with emphysema can expect to pay higher premiums than those who are in good health. However, working with an experienced insurance agent can help identify insurance companies that may offer more competitive rates.

Can I get life insurance if I have been diagnosed with end-stage emphysema?

Individuals with end-stage emphysema may find it more challenging to obtain life insurance coverage, as the condition is more severe and may increase the risk of premature death. However, it’s still possible to obtain coverage at a substandard or table rating, and working with an experienced insurance agent can be helpful in identifying insurers that are more likely to approve coverage.

Do I need life insurance if I have emphysema?

While life insurance is not required for individuals with emphysema, it can provide peace of mind and financial protection for loved ones in the event of premature death. Life insurance can help cover final expenses, such as funeral costs, and provide income replacement for dependents.

Can I apply for life insurance with emphysema if I am currently hospitalized or undergoing treatment?

Generally, insurance companies will require that an individual be stable and out of the hospital before they will consider an application for life insurance. This is to ensure that the individual’s health is stable and to minimize risk for the insurer. However, individuals who are actively managing their emphysema and other health conditions may still be able to obtain coverage.

How long does it take to get approved for life insurance with emphysema?

The timeline for approval of life insurance coverage with emphysema will vary depending on the insurer and the complexity of the application. Generally, it can take anywhere from a few weeks to several months to receive approval. Working with an experienced insurance agent can help ensure that the application process goes as smoothly and quickly as possible.