When it comes to life insurance, there are a number of factors that can impact your ability to get approved for coverage. One of these factors is a medical condition called Diverticulosis.

If you have been diagnosed with diverticulosis and are considering purchasing life insurance, it’s important to understand how this condition can impact your ability to get approved for coverage, and what you can do to improve your chances of getting approved. Here are some things you should know about life insurance approvals and diverticulosis:

Diverticulosis Defined:

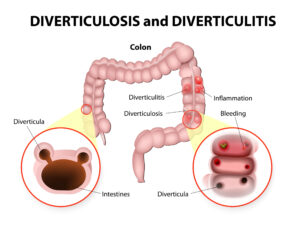

Diverticulosis is a medical condition that occurs when small pockets or pouches called diverticula form in the lining of the colon or large intestine. While diverticula can occur anywhere along the digestive tract, they most commonly develop in the lower part of the colon.

Causes:

The exact cause of diverticulosis is not known, but it is believed to be related to a combination of factors, including a low-fiber diet, age, and genetics. A low-fiber diet can cause the colon to work harder to move stool through the intestines, which can lead to increased pressure in the colon. This increased pressure can cause the colon walls to weaken and bulge out, forming diverticula.

Symptoms:

Most people with diverticulosis do not experience any symptoms. However, some individuals may experience the following:

- Abdominal pain, usually on the left side of the lower abdomen

- Bloating

- Constipation or diarrhea

- Cramping

- Nausea and vomiting

- Rectal bleeding

Treatment:

Treatment for diverticulosis typically involves making dietary and lifestyle changes. Eating a high-fiber diet and drinking plenty of water can help soften stools and reduce pressure in the colon. Exercise and maintaining a healthy weight can also help improve colon function.

If symptoms are severe or complications occur, medication or surgery may be necessary. Medications may be prescribed to relieve pain or cramping, reduce inflammation, or treat infection. Surgery may be necessary if diverticula become infected, bleed, or rupture.

Worst Case Scenario:

Complications of diverticulosis are rare, but they can be serious. One of the most serious complications is diverticulitis, which occurs when the diverticula become inflamed or infected. Symptoms of diverticulitis include severe abdominal pain, fever, nausea, and vomiting. Treatment may involve hospitalization and antibiotics, and surgery may be necessary in severe cases.

In rare cases, diverticula can bleed or rupture, causing severe pain and rectal bleeding. Emergency medical attention may be necessary in these cases.

How Diverticulosis Can Impact Life Insurance Approvals

When you apply for life insurance, the insurer will typically ask you a series of questions about your medical history. These questions will include information about any medical conditions you have been diagnosed with, as well as any medications you are taking.

If you have been diagnosed with diverticulosis, the insurer will want to know more about your condition. They will likely ask for details about your diagnosis, including when you were diagnosed, the severity of your condition, and any treatments you have undergone.

Based on this information, the insurer will evaluate your application and determine whether or not to approve you for coverage. In some cases, if the insurer believes that your diverticulosis presents a high risk of complications, they may either deny your application or offer you coverage at a higher premium. Whereas in cases where the applicant isn’t experiencing any significant complications due to their diverticulosis, they may actually be able to qualify for a preferred rate!

This is why it can be so difficult to provide an accurate quote for those diagnosed with Diverticulosis because each individual case can vary so significantly from one another.

Improving Your Chances of Getting Approved for Life Insurance with Diverticulosis

If you have been diagnosed with diverticulosis and are concerned about your ability to get approved for life insurance, there are some steps you can take to improve your chances of getting coverage:

Be honest about your condition.

It’s important to be upfront and honest with your insurer about your diverticulosis. Failing to disclose your condition could result in the denial of your application or the cancellation of your policy down the line.

Provide detailed medical records.

When you apply for life insurance, the insurer will want to see detailed medical records that outline your diagnosis, treatment history, and any other relevant information about your condition. Be sure to provide your insurer with complete and accurate records to help them make an informed decision about your application.

Work with an experienced life insurance agent.

If you have diverticulosis, working with an experienced life insurance agent can be beneficial. An agent who has experience working with clients who have medical conditions can help you navigate the application process and find a policy that meets your needs.

Take steps to manage your condition.

If you have diverticulosis, taking steps to manage your condition can help improve your chances of getting approved for life insurance. This may include making changes to your diet and lifestyle, as well as taking any prescribed medications.

In Conclusion:

If you have been diagnosed with diverticulosis and are considering purchasing life insurance, it’s important to understand how your condition can impact your ability to get approved for coverage. While having diverticulosis may make it more difficult to get approved for traditional life insurance, there are steps you can take to improve your chances of getting coverage.

Be honest and upfront about your condition, provide detailed medical records, work with an experienced agent, consider a guaranteed issue policy, and take steps to manage your condition. By doing so, you can increase your chances of getting approved for life insurance and find a policy that meets your needs.

It’s also important to note that the impact of diverticulosis on life insurance approval can vary from person to person. Some individuals with mild or well-controlled diverticulosis may be able to obtain coverage at preferred rates, while others with more severe or poorly controlled cases may face higher premiums or even be denied coverage.

Ultimately, the decision to approve or deny a life insurance application is up to the insurer, and they will evaluate each application on a case-by-case basis.

Frequently Asked Questions

Can I still qualify for life insurance if I have been diagnosed with diverticulosis?

Yes, it is possible to qualify for life insurance if you have been diagnosed with diverticulosis. The severity and management of your condition will impact the approval process and the cost of premiums.

Will my premiums be higher if I have diverticulosis?

It is possible that your premiums may be higher if you have diverticulosis. The severity of your condition, as well as your overall health and medical history, will be taken into consideration when determining your premiums.

What information will I need to provide when applying for life insurance with diverticulosis?

When applying for life insurance with diverticulosis, you will need to provide information about your condition, including the severity and frequency of symptoms, any treatments or medications you are taking, and any complications that have arisen from your condition.

Will I need to undergo a medical exam to qualify for life insurance with diverticulosis?

In many cases, yes, you will need to undergo a medical exam as part of the life insurance application process. The medical exam may include blood tests, urine tests, and other diagnostic tests to assess your overall health.

Are there any life insurance policies that do not require a medical exam?

Yes, there are some life insurance policies that do not require a medical exam. These policies are typically more expensive, and coverage limits may be lower.

How can I improve my chances of being approved for life insurance with diverticulosis?

To improve your chances of being approved for life insurance with diverticulosis, you should be upfront and honest about your condition when applying for coverage. Additionally, taking steps to manage your condition, such as making dietary and lifestyle changes, can help demonstrate to insurance providers that you are taking steps to maintain your health.

Can I still qualify for life insurance if I have a history of diverticulitis?

Yes, it is possible to qualify for life insurance if you have a history of diverticulitis. However, the severity and frequency of your past episodes of diverticulitis may impact the approval process and the cost of premiums.

How can I find the best life insurance policy for my needs with diverticulosis?

To find the best life insurance policy for your needs with diverticulosis, it’s important to shop around and compare policies from multiple providers. Working with an experienced insurance agent or broker can also help you navigate the process and find the right coverage for your unique needs.