Colitis is a medical condition that can be both uncomfortable and inconvenient, and it can also impact your ability to get life insurance. If you suffer from colitis, you may be worried that your condition could affect your chances of getting approved for a life insurance policy. In this article, we’ll take a closer look at colitis and how it can impact your life insurance application, as well as some tips for getting approved.

What is Colitis?

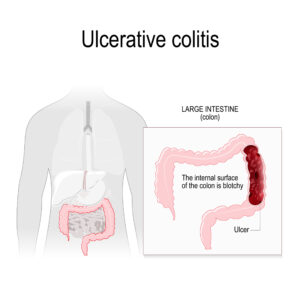

Colitis is a medical condition that affects the colon and rectum. It is a type of inflammatory bowel disease (IBD) characterized by inflammation and ulcers in the lining of the colon, which can cause a range of symptoms. Here’s a closer look at colitis, including its causes, symptoms, treatment, and worst-case scenario.

Definition

Colitis is a chronic inflammatory disease that affects the lining of the colon and rectum. It is characterized by episodes of inflammation and ulceration in the lining of the colon, which can cause a range of symptoms, including diarrhea, abdominal pain, and rectal bleeding.

Causes

The exact cause of colitis is not known, but it is believed to be an autoimmune disorder in which the body’s immune system mistakenly attacks the lining of the colon. Other factors that may contribute to the development of colitis include genetics, environmental factors, and lifestyle factors.

Symptoms

The symptoms of colitis can vary depending on the severity of the inflammation and the extent of the disease. Some of the most common symptoms of colitis include:

- Diarrhea

- Abdominal pain

- Rectal bleeding

- Fatigue

- Weight loss

- Loss of appetite

- Anemia

- Fever

- Dehydration

Treatment

The treatment of colitis depends on the severity of the disease and the extent of the inflammation. In mild cases, treatment may involve dietary changes, such as avoiding foods that trigger symptoms, or over-the-counter medications, such as anti-diarrheals. In more severe cases, prescription medications may be needed, such as corticosteroids or immunosuppressants. In some cases, surgery may be necessary to remove the affected portion of the colon.

Worst-Case Scenario

In some cases, colitis can lead to complications that can be life-threatening. One of the most serious complications of colitis is toxic megacolon, a condition in which the colon becomes dilated and paralyzed, leading to an obstruction of the bowel. This can cause a range of symptoms, including severe abdominal pain, fever, and dehydration. If left untreated, toxic megacolon can be fatal.

Other complications of colitis can include:

- Perforation of the colon

- Colon cancer

- Anemia

- Malnutrition

- Osteoporosis

If you have symptoms of colitis, it is important to see a doctor for a diagnosis and treatment. With proper treatment, most people with colitis are able to manage their symptoms and lead normal lives. However, in some cases, the disease can be more severe and may require more aggressive treatment to prevent complications.

How Colitis Can Affect Life Insurance Approvals

Colitis can affect life insurance approvals in a few ways. Insurance companies typically consider any pre-existing medical condition when evaluating an applicant’s risk level and determining whether to approve coverage. Here are some ways in which colitis can affect life insurance approvals:

- Increased risk: Colitis can be a chronic and progressive disease, and its severity can vary widely. In some cases, the disease can be mild and easily managed with medication and lifestyle changes. In other cases, it can be more severe and require more aggressive treatment, including surgery. Insurance companies may view colitis as a higher risk medical condition, particularly if it is poorly controlled or has resulted in complications.

- Underwriting requirements: Insurance companies may require additional underwriting requirements for applicants with colitis, such as medical exams, blood tests, and a review of medical records. These requirements can delay the approval process and may result in higher premiums or a lower coverage amount.

- Limited coverage options: Some insurance companies may not offer coverage to applicants with colitis or may offer coverage with exclusions or limitations. For example, they may exclude coverage for any complications related to colitis or limit coverage amounts to lower amounts.

- Higher premiums: Applicants with colitis may be considered higher risk and may be charged higher premiums to offset the increased risk of coverage. The cost of premiums can vary depending on the severity of the condition and how well it is managed.

Overall, having colitis can make it more difficult to get approved for life insurance coverage. However, it’s important to note that each insurance company has its own underwriting guidelines and may view colitis differently. Some companies may be more lenient than others and may offer more affordable coverage options. It’s important to shop around and work with an experienced agent who can help you find the best policy for your needs.

Additionally, it’s important to be upfront and honest about your medical condition during the application process to ensure that you receive an accurate quote and avoid any potential issues with coverage in the future.

Tips for Getting Approved for Life Insurance with Colitis

If you have colitis and are looking to get approved for life insurance coverage, there are several things you can do to increase your chances of getting approved and securing affordable coverage. Here are some tips for getting approved for life insurance with colitis:

- Be upfront and honest about your condition: When applying for life insurance, it’s important to be honest and upfront about your medical condition. This includes disclosing any history of colitis, including the type of colitis, the severity of your symptoms, and any treatments or medications you have received.

- Work with an experienced agent: Working with an experienced life insurance agent can help you navigate the application process and find the best coverage options for your needs. An experienced agent can help you understand the underwriting requirements for different insurance companies and can help you find the most affordable options.

- Get your colitis under control: Insurance companies may view colitis as a higher risk condition, particularly if it is not well managed. Taking steps to manage your condition, such as following a healthy diet, staying hydrated, and following your doctor’s recommended treatment plan, can help improve your chances of getting approved for coverage.

- Provide detailed medical records: Providing detailed medical records, including any tests or procedures related to your colitis, can help insurance underwriters better understand your condition and may improve your chances of getting approved for coverage.

- Consider a guaranteed issue policy: If you have been declined for traditional life insurance coverage, you may still be able to secure coverage through a guaranteed issue policy. These policies do not require a medical exam or a review of medical records and are typically available to applicants with pre-existing medical conditions.

- Shop around: Different insurance companies may view colitis differently and may have different underwriting guidelines. Shopping around and comparing coverage options from multiple insurance companies can help you find the most affordable coverage options for your needs.

In summary, getting approved for life insurance coverage with colitis can be challenging, but it’s not impossible. By working with an experienced agent, taking steps to manage your condition, and being honest and upfront about your medical history, you can increase your chances of getting approved for coverage and securing affordable premiums.

Frequently Asked Questions

Can I get approved for life insurance with colitis?

Yes, you can get approved for life insurance with colitis, but it may be more difficult and may require additional underwriting requirements. The cost of premiums may also be higher depending on the severity of your condition.

Will insurance companies automatically decline my application if I have colitis?

No, insurance companies will not automatically decline your application if you have colitis. Each insurance company has its own underwriting guidelines and may view colitis differently. Some companies may be more lenient than others and may offer more affordable coverage options.

How will insurance companies evaluate my application if I have colitis?

Insurance companies will evaluate your application based on a variety of factors, including the severity of your symptoms, how well your condition is managed, any treatments or medications you are taking, and any complications or other health conditions you may have.

Will I be charged higher premiums if I have colitis?

You may be charged higher premiums if you have colitis, particularly if it is poorly managed or has resulted in complications. The cost of premiums can vary depending on the severity of your condition and how well it is managed.

What can I do to improve my chances of getting approved for life insurance with colitis?

To improve your chances of getting approved for life insurance with colitis, you can take steps to manage your condition, be upfront and honest about your medical history, provide detailed medical records, work with an experienced agent, and shop around for the best coverage options.

What types of life insurance policies are available to me if I have colitis?

You may be eligible for a variety of life insurance policies, including term life, whole life, and universal life insurance. The type of policy you choose will depend on your individual needs and circumstances.

Should I consider a guaranteed issue life insurance policy if I have colitis?

If you have been declined for traditional life insurance coverage due to your colitis, you may want to consider a guaranteed issue life insurance policy. These policies do not require a medical exam or a review of medical records and are typically available to applicants with pre-existing medical conditions. However, they may have higher premiums and lower coverage limits.

Can I apply for life insurance while I am experiencing a flare-up of my colitis?

It is generally recommended to wait until your condition is stable before applying for life insurance coverage. Insurance underwriters may view a recent flare-up as a higher risk factor, and this could result in higher premiums or a decline in coverage.

Can I still get approved for life insurance if I have a history of colitis but am currently in remission?

Yes, you can still get approved for life insurance if you have a history of colitis but are currently in remission. Insurance underwriters will take into account the severity of your past symptoms and the length of time you have been in remission.

Will I need to provide medical records if I apply for life insurance with colitis?

Yes, you will likely need to provide medical records if you apply for life insurance with colitis. Insurance underwriters will review your medical history, including any treatments or medications you have received, to determine your eligibility for coverage and to set premiums.

How can I find the most affordable life insurance coverage with colitis?

To find the most affordable life insurance coverage with colitis, you should work with an experienced agent who can help you compare coverage options from multiple insurance companies. Shopping around and comparing quotes from different providers can help you find the most affordable coverage options for your needs.