Bronchiectasis is a condition that affects the lungs and causes the airways to become damaged and widened. This can lead to chronic infections, coughing, and difficulty breathing. For those who have been diagnosed with bronchiectasis, obtaining life insurance can be challenging. Many insurance companies consider it a high-risk condition and may charge higher premiums or even deny coverage altogether. However, with some knowledge and guidance, it is possible to get approved for life insurance with bronchiectasis.

In this article, we’ll discuss what bronchiectasis is and how it affects life insurance approval, what insurance companies look for when underwriting policies for those with bronchiectasis, and some tips on how to improve your chances of getting approved for life insurance.

What is Bronchiectasis?

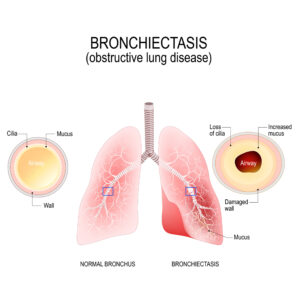

Bronchiectasis is a chronic condition that affects the airways in the lungs. It occurs when the bronchial tubes become damaged, widened, and scarred. As a result, the airways are unable to clear mucus effectively, leading to a buildup of bacteria and recurrent infections. Over time, this can cause irreparable damage to the airways and lead to permanent lung damage.

Causes:

There are several possible causes of bronchiectasis, including:

- Infections: Infections, such as pneumonia, whooping cough, and tuberculosis, can damage the bronchial tubes and lead to bronchiectasis.

- Genetic disorders: In some cases, bronchiectasis may be caused by genetic disorders such as cystic fibrosis or primary ciliary dyskinesia.

- Autoimmune diseases: Autoimmune diseases such as rheumatoid arthritis or lupus can cause inflammation in the lungs that can lead to bronchiectasis.

- Inhalation of harmful substances: Inhaling harmful substances, such as chemicals or pollutants, can cause damage to the bronchial tubes and lead to bronchiectasis.

Symptoms:

The symptoms of bronchiectasis can vary depending on the severity of the condition. Some common symptoms include:

- Chronic cough: A persistent cough that produces a large amount of phlegm is a common symptom of bronchiectasis.

- Recurrent respiratory infections: Frequent respiratory infections, such as pneumonia or bronchitis, can be a sign of bronchiectasis.

- Shortness of breath: Difficulty breathing, especially during physical activity, is a common symptom of bronchiectasis.

- Chest pain: Chest pain may occur due to the inflammation and damage to the bronchial tubes.

- Fatigue: Bronchiectasis can cause fatigue due to the increased effort required to breathe.

Treatment:

While there is no cure for bronchiectasis, treatment can help manage the symptoms and prevent complications. Treatment options may include:

- Antibiotics: Antibiotics are used to treat infections and prevent them from recurring.

- Airway clearance techniques: Techniques such as chest physiotherapy or breathing exercises can help clear mucus from the airways.

- Bronchodilators: Medications that help open up the airways and improve breathing.

- Oxygen therapy: Oxygen therapy may be necessary in severe cases to help improve oxygen levels in the blood.

- Surgery: In some cases, surgery may be necessary to remove damaged portions of the lung and improve breathing.

Life Insurance Approval with Bronchiectasis

If you have bronchiectasis, getting approved for traditional life insurance can be challenging. Even with mild symptoms and effective treatment, insurance companies may view you as a higher risk, which can result in higher premiums, reduced coverage, or even denial of coverage.

Table rated A at best or guaranteed issue policies may be your best options for obtaining life insurance coverage with bronchiectasis. Here’s a closer look at what these policies entail:

Table Rated A at Best

Table rated A at best is a term used to describe a policy where the insurance company approves coverage, but assigns a table rating to reflect an increased risk. Table ratings typically range from A to H, with A being the least risky and H being the most risky.

The table rating is used to adjust the premium to reflect the increased risk. For example, if a policy with a $500,000 death benefit would have a premium of $1,000 per year for a healthy individual, a policy with a table rating of A would increase the premium to $1,200 per year, while a policy with a table rating of H would increase the premium to $3,000 per year.

It’s important to note that table ratings can vary from one insurance company to another. Some insurance companies may be more lenient than others when it comes to underwriting policies for those with bronchiectasis. Working with an independent insurance agent can help you find an insurance company that is more likely to approve coverage and offer favorable rates.

Guaranteed Issue Policies

If you are unable to qualify for traditional life insurance or table rated A at best policies due to your bronchiectasis, you may want to consider a guaranteed issue policy. Guaranteed issue policies are designed for individuals who are considered high risk or who have pre-existing medical conditions.

These policies typically have no medical underwriting requirements, which means you cannot be denied coverage due to your health status. However, they typically have higher premiums and lower coverage amounts than traditional life insurance policies.

Guaranteed issue policies also have a waiting period before the full death benefit is available. This waiting period can range from two to three years, depending on the policy. If you pass away during the waiting period, your beneficiaries will receive a reduced death benefit or a refund of the premiums paid.

It’s important to carefully review the terms and conditions of a guaranteed issue policy before purchasing one. Some policies may have restrictions or exclusions that limit coverage, such as accidental death only coverage or limited benefits for death due to natural causes.

Tips for Getting Approved for Life Insurance with Bronchiectasis

There are steps you can take to improve your chances of getting approved. Here are some tips for getting approved for life insurance with bronchiectasis:

- Work with an Independent Insurance Agent: Working with an independent insurance agent can help you find an insurance company that is more likely to approve coverage and offer favorable rates. Independent agents work with multiple insurance companies and can compare policies and rates to find the best options for you.

- Be Honest About Your Health: It’s important to be honest about your health status when applying for life insurance. Failing to disclose your bronchiectasis or other health conditions can result in denial of coverage or cancellation of the policy.

- Quit Smoking: Smoking can worsen the symptoms of bronchiectasis and increase the risk of complications. Insurance companies typically view smokers as higher risk and may charge higher premiums or deny coverage altogether. If you smoke or use any nicotine products, quitting for at least one year before applying for life insurance can improve your chances of getting approved for traditional coverage.

- Control Your Symptoms: Managing your symptoms and adhering to your treatment plan can help demonstrate to insurance companies that you are taking steps to control your condition. This can improve your chances of getting approved for traditional coverage or reduce the severity of table ratings.

- Consider Table Rated A at Best or Guaranteed Issue Policies: Table rated A at best policies and guaranteed issue policies may be your best options for obtaining coverage if you are unable to qualify for traditional coverage. These policies typically have higher premiums and lower coverage amounts than traditional policies, but can provide valuable coverage for your loved ones.

- Review Policy Terms and Conditions Carefully: Before purchasing any life insurance policy, it’s important to carefully review the terms and conditions to ensure it meets your needs and provides the coverage you need to protect your loved ones. Be sure to ask your agent about any restrictions or exclusions that may limit coverage.

In conclusion, getting approved for life insurance with bronchiectasis may require some extra effort, but it’s not impossible. By working with an independent agent, being honest about your health status, quitting smoking, managing your symptoms, considering alternative policies, and reviewing policy terms and conditions carefully, you can improve your chances of getting the coverage you need to protect your loved ones.

Conclusion:

Getting approved for life insurance with bronchiectasis can be challenging, but it is not impossible. By understanding what insurance companies look for when underwriting policies for those with bronchiectasis and following the tips outlined in this article, you can improve your chances of getting approved for coverage. Remember to be honest about your medical history, provide detailed medical records, and work with an independent insurance agent to find the best coverage and rates for your situation. Finally, focus on improving your overall health to reduce your risk of complications and increase your chances of getting approved for life insurance.

Frequently Asked Questions

What is bronchiectasis?

Bronchiectasis is a chronic lung condition that causes permanent damage to the airways. The damage leads to widening and scarring of the airways, making it difficult to clear mucus from the lungs. This can lead to frequent lung infections, coughing, and shortness of breath.

Can I get approved for traditional life insurance with bronchiectasis?

It can be challenging to get approved for traditional life insurance with bronchiectasis because it is a chronic condition that can lead to serious health complications. However, it is possible to get approved for traditional coverage if you can demonstrate that you are managing your symptoms and adhering to your treatment plan.

What is a table rating?

A table rating is a method used by insurance companies to adjust premiums based on an individual’s health status. Table ratings range from A to D, with A being the best rating and D being the worst. Individuals with bronchiectasis may be given a table rating to reflect their increased risk of health complications.

What is a guaranteed issue policy?

A guaranteed issue policy is a type of life insurance policy that does not require a medical exam or health questionnaire. These policies are typically more expensive and offer lower coverage amounts than traditional policies, but they can provide coverage for individuals who are unable to qualify for traditional coverage due to health conditions like bronchiectasis.

How long do I need to quit smoking before applying for life insurance with bronchiectasis?

Insurance companies typically require individuals to be smoke-free for at least one year before applying for traditional life insurance. If you smoke or use any nicotine products, quitting for at least one year can improve your chances of getting approved for traditional coverage.

Can I still get approved for life insurance if I have other health conditions in addition to bronchiectasis?

It depends on the severity of your health conditions and how well they are managed. Insurance companies will take into account all of your health conditions when determining your eligibility for coverage and your premium rates. It’s important to be honest about all of your health conditions when applying for life insurance.