Life insurance is an essential part of financial planning for individuals and families. It provides a safety net for loved ones in the event of unexpected death or disability. However, individuals with pre-existing medical conditions such as Atrial Septal Defect (ASD) may have concerns about their ability to qualify for life insurance.

As a result, we have compiled some of the most common questions people with ASD may have about life insurance, to help them make informed decisions and qualify for the best policy that suits their needs.

By the end of this article, we hope that you will have a better understanding of the options available to you when it comes to life insurance coverage.

Frequently Asked Questions

What is an Atrial Septal Defect (ASD)?

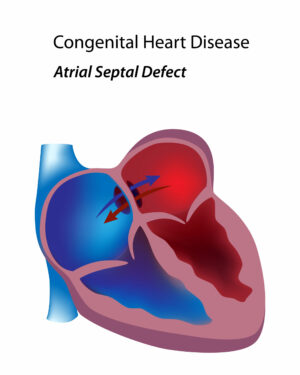

An Atrial Septal Defect (ASD) is a congenital heart defect where there is a hole in the wall (septum) that separates the two upper chambers (atria) of the heart. This hole allows oxygen-rich blood to mix with oxygen-poor blood, causing the heart to work harder than it should. ASDs can range in size and severity, with some small defects causing few or no symptoms, while larger ones may require medical intervention. ASDs are typically diagnosed in childhood, but some people may not discover they have one until later in life.

How does having an ASD affect my ability to qualify for life insurance?

Having an ASD may affect your ability to qualify for life insurance, as it is a pre-existing medical condition that can impact your health and life expectancy. Insurance companies may view individuals with ASD as having a higher risk of developing complications such as heart failure or pulmonary hypertension, which can increase the likelihood of premature death. As a result, insurance companies may require additional medical underwriting or charge higher premiums to offset the risk. However, the impact on your ability to qualify for life insurance will depend on the severity of your ASD, any associated complications or medical history, and other factors such as age and overall health.

What kind of medical underwriting will I have to undergo to get life insurance with ASD?

The medical underwriting process for life insurance with ASD may involve a review of your medical records and a physical exam. Insurance companies may also request additional tests such as an electrocardiogram (ECG), echocardiogram, or stress test to evaluate the severity of your condition and any associated risks. Additionally, you may be asked to provide information about any medications you are taking, previous surgeries or procedures related to your ASD, and any other medical conditions or risk factors that could impact your health and life expectancy. The results of these assessments will be used to determine your insurability and the cost of your premiums.

What types of life insurance policies are available to individuals with ASD?

Individuals with ASD have access to various types of life insurance policies, including term life insurance, whole life insurance, and guaranteed issue life insurance.

Term life insurance policies provide coverage for a specific period and are generally more affordable than other types of life insurance.

Whole life insurance policies offer coverage for your entire life, with premiums that remain the same throughout the policy’s duration. They also accumulate cash value over time, which can be used as a savings vehicle or to pay premiums.

Guaranteed issue life insurance policies are available to individuals with pre-existing medical conditions, including ASD, and typically do not require a medical exam or underwriting. However, premiums for these policies may be higher and coverage amounts may be limited. The type of policy that is best for you will depend on your individual needs and circumstances.

Will the premiums for life insurance policies be higher for me with ASD?

The premiums for life insurance policies may be higher for individuals with ASD, as they are considered to be at higher risk of developing complications such as heart failure or pulmonary hypertension. Insurance companies will take into consideration the severity of your ASD, any associated complications or medical history, and other factors such as age and overall health when determining your premiums. The higher the risk, the higher the premiums are likely to be. However, the actual impact on your premiums will depend on the individual insurance company and policy you are applying for.

How can I lower my premiums for life insurance with ASD?

There are several steps you can take to help lower your premiums for life insurance with ASD:

- Control your ASD: Keep your ASD under control by following your doctor’s recommended treatment plan and medications. Regular check-ups with your cardiologist will help ensure that your condition is managed and that any potential complications are identified and treated early.

- Improve your overall health: Living a healthy lifestyle can help lower your premiums. This includes maintaining a healthy weight, exercising regularly, eating a balanced diet, and avoiding smoking and excessive alcohol consumption.

- Shop around: Different insurance companies may have different underwriting standards and rating structures, which can result in different premiums for the same coverage. Shop around and compare quotes from multiple insurance companies to find the best policy and premiums for you.

- Consider a smaller coverage amount: Opting for a lower coverage amount can help reduce your premiums. Determine the amount of coverage you actually need and adjust accordingly.

- Work with an independent insurance agent: An independent insurance agent can help you navigate the life insurance application process and find the best policy and premiums for your individual needs and circumstances.

How much coverage can I get with ASD?

The amount of coverage you can get with ASD will depend on several factors, including the severity of your ASD, your overall health, and your age. In general, insurance companies will evaluate your risk based on these factors and offer coverage amounts that align with the level of risk.

Individuals with mild ASD and no other significant health issues may be able to obtain coverage amounts similar to those available to individuals without ASD. However, individuals with more severe ASD or other medical complications may be limited in the coverage amounts they can obtain or face higher premiums.

It is important to keep in mind that the amount of coverage you need will depend on your individual circumstances, such as your income, debts, and dependents.

Can I get life insurance with ASD if I have other medical conditions?

Yes, it is possible to obtain life insurance with ASD even if you have other medical conditions. However, the presence of other medical conditions may affect the underwriting process and the premiums you are offered. Insurance companies will evaluate your overall health and assess the risks associated with all of your medical conditions when determining your premiums and coverage amounts.

The severity and impact of your other medical conditions will also be taken into consideration, as well as the potential for complications related to your ASD. It’s important to provide full and accurate information about your medical history when applying for life insurance, so that insurance companies can provide an accurate quote and appropriate coverage.

It’s worth noting that certain medical conditions, such as certain heart or lung conditions, may make it more difficult to obtain coverage or result in higher premiums. Working with an independent insurance agent who has experience working with individuals with ASD and other medical conditions can help you find the best policy and premiums for your unique circumstances.

Can I get life insurance if I have already had surgery to correct my ASD?

Yes, it is possible to obtain life insurance if you have already had surgery to correct your ASD. In fact, insurance companies may view individuals who have had successful ASD surgery more favorably than those with untreated ASD. However, the type of surgery you had and the time elapsed since your surgery may affect the underwriting process and the premiums you are offered.

Insurance companies will want to review your medical records and assess the success of your surgery and any associated complications. The amount of time since your surgery may also be a factor, with some insurance companies requiring a certain amount of time to have passed before offering coverage.

Can I get life insurance with ASD if I am a smoker or have other unhealthy habits?

It is possible to obtain life insurance with ASD even if you are a smoker or have other unhealthy habits, but it may be more difficult and may result in higher premiums. Smoking and other unhealthy habits can increase your risk of developing health complications related to your ASD or other medical conditions, which can make you a higher risk for insurance companies.

Insurance companies will evaluate your overall health and assess the risks associated with your medical conditions and lifestyle habits when determining your premiums and coverage amounts. They may require additional medical exams or tests to evaluate your health and determine your risk.

If you are a smoker or have other unhealthy habits, it’s important to be upfront and honest about these habits when applying for life insurance. Failing to disclose this information could result in a denial of coverage or a claim being denied in the future. Quitting smoking or taking other steps to improve your overall health can help lower your premiums and improve your chances of obtaining coverage.

How can I find the best life insurance policy for my needs as someone with ASD?

As someone with ASD, finding the best life insurance policy for your needs can be challenging, but there are a few steps you can take to make the process easier:

- Work with an independent insurance agent: An independent agent can help you navigate the complex world of life insurance and find policies that are specifically designed for individuals with ASD. They can also help you compare policies from multiple insurance companies to find the one that best meets your needs and budget.

- Be honest and upfront about your medical history: When applying for life insurance, it’s important to be honest and upfront about your medical history, including your ASD and any other medical conditions. Providing accurate information can help insurance companies provide an accurate quote and appropriate coverage.

- Consider your coverage needs: The amount of coverage you need will depend on your individual circumstances, such as your income, debts, and dependents. It’s important to carefully consider your coverage needs and work with your agent to find a policy that provides adequate coverage.

- Compare policies and premiums: It’s important to compare policies and premiums from multiple insurance companies to find the one that best meets your needs and budget. Your independent agent can help you do this and provide guidance on which policy is the best fit for you.

- Don’t give up: Finding the right life insurance policy can take time and patience, especially if you have a medical condition like ASD. Don’t give up and keep working with your agent until you find the policy that’s right for you.

Overall, working with an experienced and knowledgeable independent insurance agent who has experience working with individuals with ASD can be the best way to find the right policy for your unique circumstances.