Life insurance is an essential financial tool that can provide much-needed protection and peace of mind for you and your loved ones. It can help cover expenses and provide financial support for your family in the event of your unexpected death.

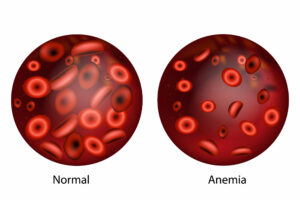

For individuals with aplastic anemia, a rare and serious condition that affects the body’s ability to produce enough blood cells, getting life insurance coverage can be challenging. Many people with aplastic anemia have questions about their eligibility, premium costs, and coverage options.

In this article, we have addressed some of the most common questions and concerns to help those with aplastic anemia make informed decisions about their life insurance coverage. Our hope is that this information will provide a clearer understanding of the life insurance options available, and enable individuals with aplastic anemia to qualify for the best policy possible.

Frequently Asked Questions

Can individuals with aplastic anemia qualify for life insurance?

Individuals with aplastic anemia will have difficulty qualifying for traditional life insurance policies due to their health condition. In fact, most if not all life insurance companies will immediately deny anyone applying for a traditional life insurance policy after they have been diagnosed with aplastic anemia. However, there are still options available for those with aplastic anemia, such as guaranteed issue life insurance policies.

How much life insurance coverage can I get with aplastic anemia?

The specific amount of coverage an individual can receive will also depend on the type of policy they choose. Guaranteed issue life insurance policies, for example, typically offer lower coverage amounts compared to traditional policies, and may not exceed $25,000.

Can I get a guaranteed issue life insurance policy with aplastic anemia?

Yes, individuals with aplastic anemia may be eligible for a guaranteed issue life insurance policy. Guaranteed issue life insurance policies are designed for individuals who have difficulty qualifying for traditional life insurance policies due to their health condition. Unlike traditional policies, guaranteed issue policies do not require a medical exam or health questions to qualify.

While guaranteed issue policies offer a guaranteed acceptance, they often come with lower coverage amounts and higher premium rates compared to traditional policies. Additionally, there may be a waiting period before the policy goes into effect, which could be as long as three years. It’s important to carefully review the terms and conditions of any guaranteed issue policy and to consult with an insurance professional who can help you navigate the process.

What is the waiting period for a guaranteed issue life insurance policy?

The waiting period for a guaranteed issue life insurance policy typically ranges from two to three years, depending on the insurance provider and the specific policy. During this waiting period, the insurance company may limit or exclude coverage for certain medical conditions or causes of death.

The waiting period is designed to protect the insurance company from individuals who may purchase a policy with the intent of using it immediately for a known medical condition or for those who are already in poor health. Once the waiting period is over, the policy becomes fully active, and the coverage amount and benefits become available to the policyholder.

It’s important to carefully review the terms and conditions of any guaranteed issue policy and to consult with an insurance professional who can help you understand the details of the waiting period and the coverage limitations.

Will I have to undergo a medical exam to qualify for a guaranteed issue life insurance coverage?

No, you typically do not have to undergo a medical exam to qualify for a guaranteed issue life insurance policy. Guaranteed issue policies are designed for individuals who have difficulty qualifying for traditional life insurance policies due to their health condition. These policies do not require a medical exam or health questions to qualify, which makes them a popular option for people with serious health conditions such as aplastic anemia.

What kind of documentation do I need to provide to apply for a guaranteed issue life insurance policy?

To apply for a guaranteed issue life insurance policy, you typically need to provide some basic personal information, such as your name, address, and date of birth. Unlike traditional life insurance policies, guaranteed issue policies do not require a medical exam or health questions to qualify. This means that you do not need to provide detailed medical records or undergo any medical tests.

How long does it take to get approved for life insurance coverage with aplastic anemia?

The approval process for a guaranteed issue life insurance policy typically takes much less time than a traditional life insurance policy. In most cases, you can get approved for a guaranteed issue policy within a few days to a week, as long as you meet the eligibility requirements and provide the necessary information.

Since guaranteed issue policies do not require a medical exam or health questions, the approval process is often simpler and faster compared to traditional policies. However, it’s important to note that some insurance providers may have a waiting period before the policy becomes fully active, which could be as long as three years.

What is the maximum age limit for purchasing guaranteed issue life insurance policy with aplastic anemia?

The maximum age limit for purchasing a guaranteed issue life insurance policy with aplastic anemia can vary depending on the insurance provider and the specific policy. However, in general, guaranteed issue policies are designed for older individuals who have difficulty qualifying for traditional life insurance policies due to their age or health condition.

Most insurance providers that offer guaranteed issue policies typically have an age limit for applicants, which can range from 50 to 85 years old. It’s important to check with each insurance provider to see their specific age limits for guaranteed issue policies.

How can I find the best life insurance policy for my situation with aplastic anemia?

Finding the best life insurance policy for your situation with aplastic anemia can be a challenging task. However, there are several steps you can take to help ensure that you find a policy that meets your needs and budget.

- Research different insurance providers: Start by researching different insurance providers that offer life insurance policies for individuals with aplastic anemia. Look for providers that specialize in high-risk life insurance or guaranteed issue policies.

- Compare policy options: Once you have a list of potential insurance providers, compare their policy options, premium rates, and coverage amounts. Make sure to review the specific terms and conditions of each policy to ensure that it meets your needs and budget.

- Consult with an insurance professional: Consider working with an insurance professional who can help guide you through the process and provide expert advice on different policy options. An insurance professional can help you understand the details of each policy and make an informed decision about which policy to choose.

- Be honest about your health history: When applying for a life insurance policy, be honest about your health history and any pre-existing conditions you may have, such as aplastic anemia. Providing accurate information can help ensure that you receive the appropriate coverage and that your policy remains valid.

- Review the policy details: Before signing up for a policy, carefully review the terms and conditions to ensure that you understand the coverage amounts, premium rates, and any exclusions or waiting periods that may apply.

By taking these steps and working with an insurance professional, you can find the best life insurance policy for your situation with aplastic anemia.